GBP/USD Revisits 1.2100 Support Ahead of BoE Testimony

DailyFX.com -

Talking Points:

- USD/JPY Bull-Flag Formation Takes Shape Ahead of Fed Rhetoric.

- GBP/USD Revisits 1.2100 Support Ahead of BoE Governor Carney’s Testimony.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

USD/JPY | 115.85 | 116.34 | 115.20 | 18 | 114 |

USD/JPY Daily

Chart - Created Using Trading View

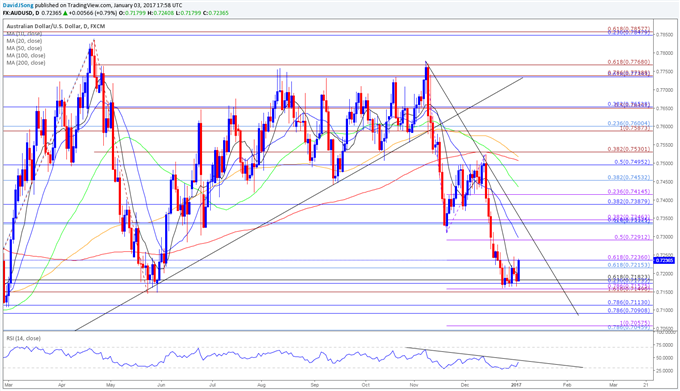

USD/JPY may continue to consolidate over the coming days as a bull-flag formation takes shape, with the pair at risk of extending the decline from earlier this week especially as the Relative Strength Index (RSI) appears to be testing the upward trend carried over from the summer months; will keep a close eye on risk sentiment as global benchmark equity indices highlight a similar dynamic and pullback from recent highs.

With Fed Funds Futures still highlighting a greater than 60% probability for a June rate-hike, fresh comments from Janet Yellen and Co. may continue to foster a long-term bullish outlook for the dollar-yen amid the deviating paths for monetary policy, but the marked deprecation in the Japanese Yen may push the Bank of Japan (BoJ) to soften its dovish tone as it boosts the outlook for inflation.

Downside targets are in focus for the days ahead, with the first area of interest coming in around 114.60 (23.6% expansion) followed by the 114.00 (23.6% retracement) hurdle.

Currency | Last | High | Low | Daily Change (pip) | Daily Range (pip) |

GBP/USD | 1.2165 | 1.2190 | 1.2108 | 2 | 82 |

GBP/USD Daily

Chart - Created Using Trading View

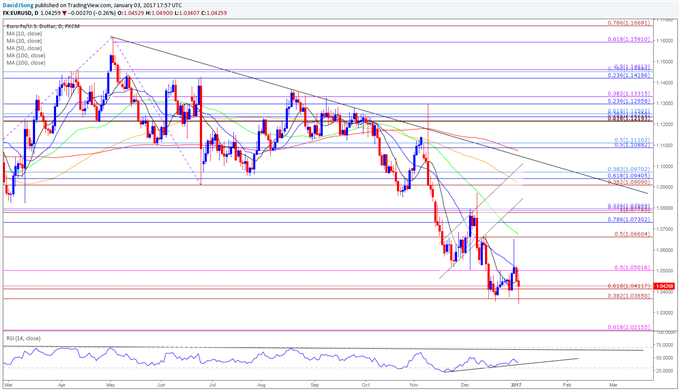

With Bank of England (BoE) Governor Mark Carney scheduled to testify in front the U.K. Parliament’s Treasury Select Committee on Wednesday, GBP/USD stands at risk of making another failed attempt to close below the 1.2100 (61.8% expansion) handle as the central bank changes its tune for monetary policy and persistently warns inflation is ‘likely to overshoot the target later in 2017 and through 2018;’ broader outlook for Cable remains tilted to the downside, but the pound-dollar may face range-bound conditions ahead of the ‘Brexit’ deadline scheduled for the end of March as data prints coming out of the region encourage an improved outlook for the region.

A rebound in U.K. Industrial and Manufacturing Production may also help to mitigate the bearish sentiment surrounding the British Pound as it instills an outlook for growth, and BoE officials may show a greater willingness to move away from the easing-cycle as they argue ‘monetary policy can respond, in either direction, to changes to the economic outlook as they unfold to ensure a sustainable return of inflation to the 2% target.’

String of failed attempts to close below 1.2100 (61.8% expansion) may encourage a larger rebound over the coming days, with the first topside target coming in around 1.2270 (23.6% retracement) followed by 1.2370 (50% expansion).

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

Click HERE for the Entire DailyFX Webinar schedule.

Click Here for the DailyFX Calendar

If you’re looking for trading ideas, check out our Trading Guides.

Read More:

DAX: Bull-flag Consolidation Taking Shape

Yen Looks To Yield Spread For Direction, Trump Calls Out Toyota

USD/JPY Technical Analysis: Short-Term Look At Recent Pull-Back

January Forex Seasonality Sees Further US Dollar Strength to Start the Year

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance