Funko Inc (FNKO) Q1 2024 Earnings: Misses Revenue Estimates and Widens Net Loss

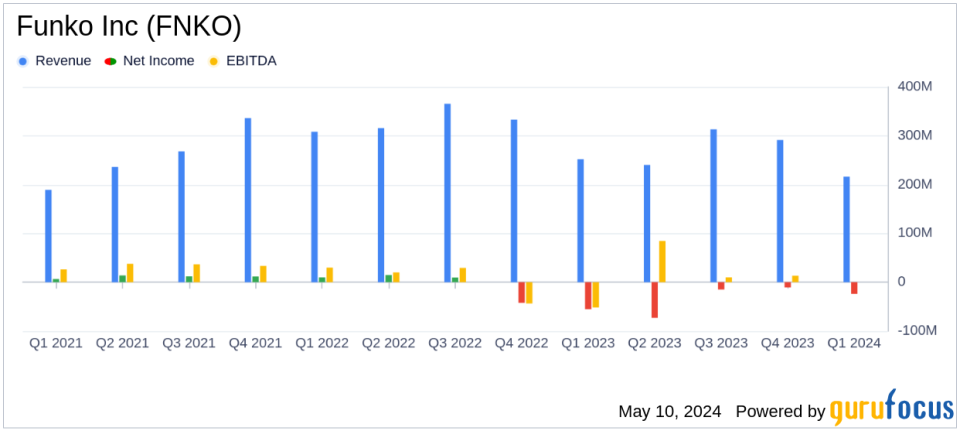

Revenue: Reported $215.7 million, a decrease of 14.4% year-over-year, falling short of estimates of $220.27 million.

Net Loss: Posted a net loss of $23.7 million, higher than the estimated net loss of $18.01 million.

Earnings Per Share (EPS): Recorded a loss of $0.45 per share, higher than the estimated loss per share of $0.30.

Gross Margin: Achieved a gross margin of 40.0%, a significant improvement from the previous year's 19.7%.

Adjusted EBITDA: Reported $9.6 million, a substantial improvement from the negative adjusted EBITDA of $14.0 million in the prior year.

Inventory Management: Reduced inventory levels to $112.3 million from $119.5 million at the end of the previous quarter.

Debt Reduction: Lowered total debt to $246.4 million, down from $273.6 million at the end of the previous quarter.

Funko Inc (NASDAQ:FNKO), a prominent name in the pop culture consumer products sector, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its recent 8-K filing. The Everett, Washington-based company reported a net loss and a decline in revenue, yet highlighted significant improvements in gross margin and adjusted EBITDA.

Financial Performance Overview

For Q1 2024, Funko Inc posted net sales of $215.7 million, a decrease from $251.9 million in the same quarter the previous year, falling short of the analyst estimates of $220.27 million. The net loss deepened to $23.7 million, or $0.45 per share, compared to a loss of $61.1 million, or $1.17 per share in Q1 2023. This performance was below the expected quarterly loss of $18.01 million. Despite the revenue and net income downturn, the company achieved a gross margin of 40.0%, a substantial improvement from 19.7% in the prior year, primarily due to better inventory management and favorable freight costs.

Operational and Segment Highlights

Funko's core collectibles, its largest segment, saw a decline in sales by 14.6% to $157.1 million. The company's geographical sales analysis revealed a 17.4% decrease in the United States and a 7.2% decrease in Europe. Despite these challenges, management remains optimistic about their strategic initiatives which are expected to stabilize the business moving forward.

Balance Sheet and Cash Flow Insights

The balance sheet reflects a decrease in total cash and cash equivalents to $26.1 million from $36.5 million at the end of the previous quarter. Inventory levels showed a modest reduction to $112.3 million from $119.5 million, indicating ongoing efforts to optimize inventory management. Total debt decreased to $246.4 million, down from $273.6 million, showing progress in debt reduction.

Leadership and Future Outlook

Amidst these financial updates, Funko also announced a significant leadership change. Cynthia Williams will assume the role of CEO effective May 20, 2024. Williams brings extensive experience from notable companies such as Hasbro, Microsoft, and Amazon, which could be pivotal in steering Funko towards a more robust path.

Looking ahead, Funko reiterated its full-year 2024 guidance, projecting net sales between $1.047 billion and $1.103 billion and adjusted EBITDA between $65 million and $85 million. For the upcoming second quarter, the company expects net sales in the range of $225 million to $240 million and anticipates an adjusted net loss per share between $0.15 and $0.08.

Conclusion

While Funko's Q1 2024 results reflect ongoing challenges, the improvements in gross margin and adjusted EBITDA highlight underlying potential. With strategic leadership changes and continued focus on operational efficiency, Funko aims to navigate through the current headwinds and deliver on its full-year expectations.

Investors and stakeholders will likely watch closely how the new strategies unfold under the leadership of Cynthia Williams and whether these can significantly impact the company's performance in a competitive market.

For further details, please refer to the full 8-K filing and join the upcoming earnings call to discuss these results and updates in more depth.

Explore the complete 8-K earnings release (here) from Funko Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance