First Hawaiian Inc (FHB) Q1 2024 Earnings: Consistent with Analyst Projections

Net Income: Reported at $54.22 million, slightly above estimates of $53.89 million.

Revenue: Net interest income for Q1 2024 reached $154.4 million, surpassing the previous quarter's $151.8 million and exceeding estimated revenue of $203.73 million.

Earnings Per Share (EPS): Achieved $0.42, meeting the estimated EPS of $0.42.

Dividend: Declared a quarterly cash dividend of $0.26 per share, consistent with the previous quarter.

Asset Quality: Non-performing assets remained stable at 0.13% of total loans and leases, showing strong credit quality.

Capital Ratios: Common Equity Tier 1 Capital Ratio improved to 12.55% from 12.39% at the end of the previous quarter.

Operational Efficiency: Efficiency ratio improved to 62.2% in Q1 2024 from 67.3% in the prior quarter, indicating better cost management.

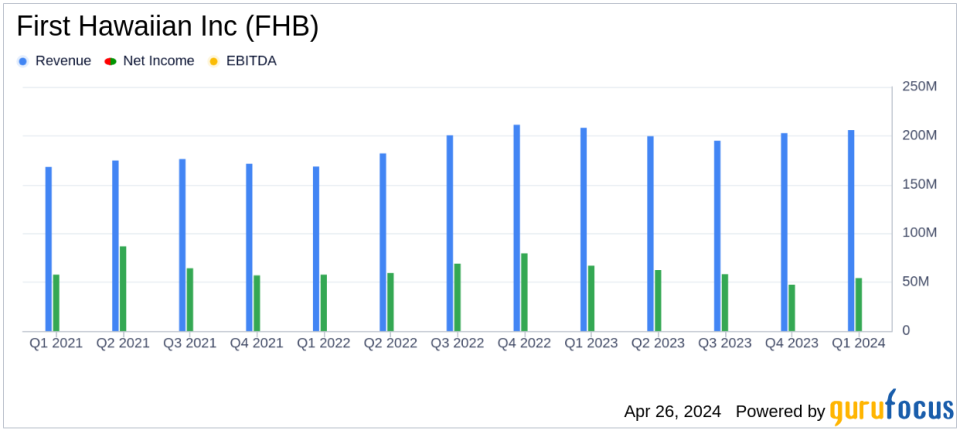

On April 26, 2024, First Hawaiian Inc (NASDAQ:FHB) released its 8-K filing, detailing the financial outcomes for the first quarter ended March 31, 2024. The bank reported a net income of $54.22 million and earnings per share (EPS) of $0.42, aligning closely with analyst expectations of $53.89 million in net income and an EPS of $0.42. Revenue for the quarter stood at $203.73 million, precisely meeting the forecasts.

First Hawaiian Inc, headquartered in Honolulu, Hawaii, is the state's oldest and largest financial institution. The company offers a broad range of banking services to both consumer and commercial customers, including deposit products, lending services, and wealth management. With a history dating back to 1858, First Hawaiian Bank operates branches throughout Hawaii, Guam, and Saipan.

Quarterly Financial Highlights

The first quarter of 2024 saw First Hawaiian managing a slight decrease in total assets, which stood at $24.3 billion, down by 2.6% from the previous quarter. The bank's net interest income showed a modest increase to $154.4 million, up by 1.7% from the prior quarter, benefiting from a net interest margin improvement to 2.91%. Despite a decrease in noninterest income to $51.4 million, the bank's efficiency ratio improved significantly to 62.2%, reflecting better cost management.

The bank's asset quality remained robust with non-performing assets making up only 0.13% of total loans and leases. The allowance for credit losses was $159.8 million, approximately 1.12% of total loans and leases, indicating a cautious approach to potential credit losses. Furthermore, First Hawaiian did not engage in share repurchases during the quarter, reflecting a strategic choice to possibly conserve capital amidst economic uncertainties.

Operational and Strategic Developments

First Hawaiian's operational strategy in the quarter included maintaining a strong capital position, as evidenced by a Tier 1 leverage ratio of 8.80% and a total capital ratio of 13.75%. The bank also declared a quarterly cash dividend of $0.26 per share, consistent with its previous dividend, underscoring its commitment to returning value to shareholders.

CEO Bob Harrison commented on the quarter's performance, stating,

Im pleased to report that we started 2024 with a solid first quarter. We had strong earnings, continued excellent credit quality and continued to grow our capital levels."

This statement highlights the bank's focus on sustaining financial health and shareholder value.

Looking Ahead

While First Hawaiian has demonstrated resilience in its quarterly performance, the bank continues to navigate a challenging interest rate environment and geopolitical uncertainties that could impact the financial sector. The steady results align with analyst expectations and reflect a stable financial footing, which may reassure investors about the bank's capacity to manage through economic fluctuations.

For more detailed information about First Hawaiian Inc's financial performance, you can access the full earnings report and join the upcoming conference call through the links provided in their official announcement.

In conclusion, First Hawaiian Inc's first quarter of 2024 reflects a consistent and stable performance, aligning with market expectations and demonstrating prudent financial management amidst ongoing economic challenges.

Explore the complete 8-K earnings release (here) from First Hawaiian Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance