Consumer Internet Stocks Q1 Recap: Benchmarking Coupang (NYSE:CPNG)

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Coupang (NYSE:CPNG) and the rest of the consumer internet stocks fared in Q1.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 43 consumer internet stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 2.6%. while next quarter's revenue guidance was in line with consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, and while some of the consumer internet stocks have fared somewhat better than others, they collectively declined, with share prices falling 0.3% on average since the previous earnings results.

Coupang (NYSE:CPNG)

Founded in 2010 by Harvard Business School student Bom Kim, Coupang (NYSE:CPNG) is a South Korean e-commerce giant often referred to as the "Amazon of South Korea".

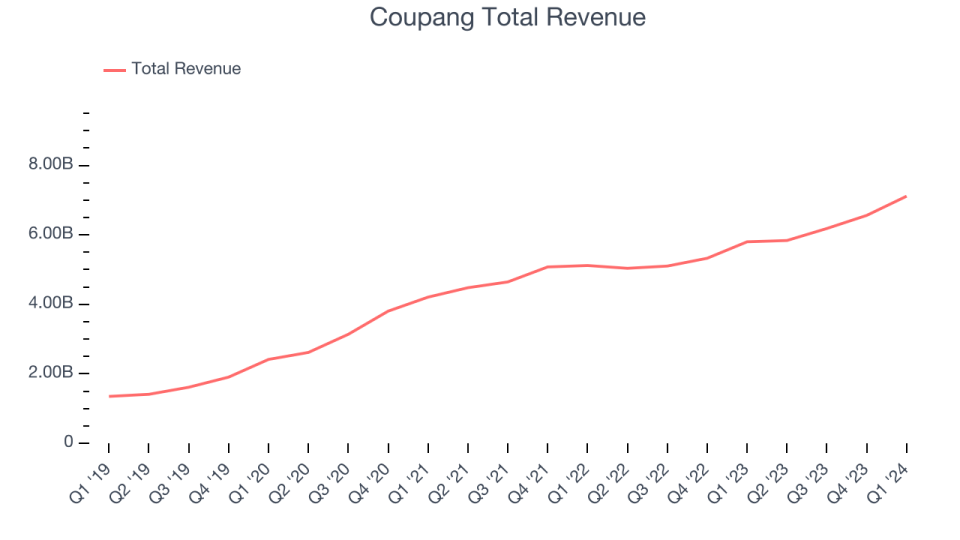

Coupang reported revenues of $7.11 billion, up 22.6% year on year, topping analysts' expectations by 1.5%. It was a mixed quarter for the company: Coupang narrowly top analysts' revenue expectations this quarter as its developing offerings segment, which includes Taiwan and non-e-commerce products, outperformed. On the other hand, its EPS missed.

“Our results are a reflection of our commitment to customer experience and operational excellence,” said Gaurav Anand, CFO of Coupang.

The stock is down 3.2% since the results and currently trades at $22.9.

Is now the time to buy Coupang? Access our full analysis of the earnings results here, it's free.

Best Q1: MercadoLibre (NASDAQ:MELI)

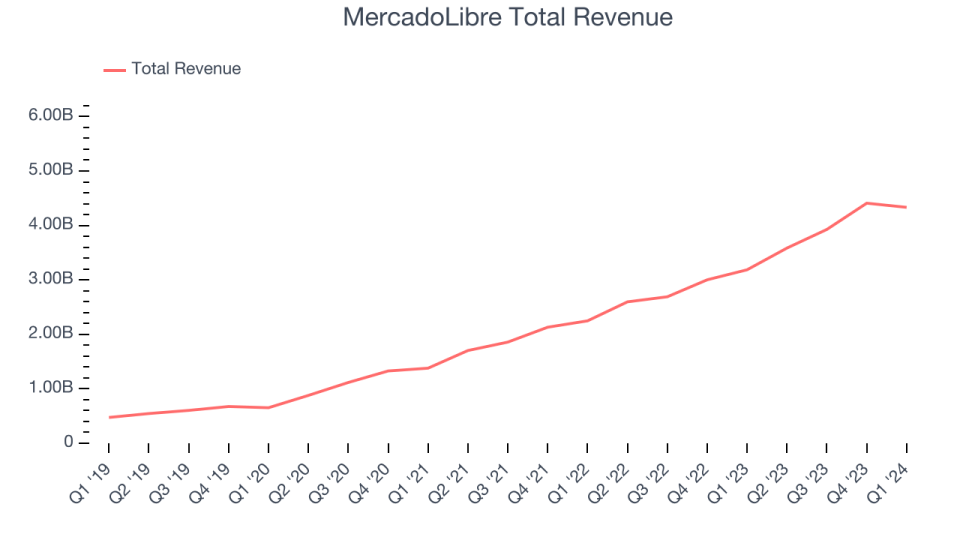

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $4.33 billion, up 36% year on year, outperforming analysts' expectations by 12.1%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue estimates and exceptional revenue growth.

The stock is up 17.7% since the results and currently trades at $1,774.49.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $25.24 million, down 43.1% year on year, falling short of analysts' expectations by 12.6%. It was a weak quarter for the company, with a decline in its users and slow revenue growth.

Skillz had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 121,000 monthly active users, down 43.5% year on year. The stock is up 1.1% since the results and currently trades at $6.48.

Read our full analysis of Skillz's results here.

Roku (NASDAQ:ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $881.5 million, up 19% year on year, surpassing analysts' expectations by 3.7%. It was a decent quarter for the company. Roku beat analysts' revenue expectations and crushed adjusted EBITDA expectations this quarter. Guidance was similar to the results themselves, with Q2 revenue guidance roughly in line while adjusted EBITDA guidance was well ahead.

The company reported 81.6 million monthly active users, up 14% year on year. The stock is down 7.9% since the results and currently trades at $57.89.

Read our full, actionable report on Roku here, it's free.

Duolingo (NASDAQ:DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $167.6 million, up 44.9% year on year, surpassing analysts' expectations by 1.1%. It was a mixed quarter for the company, with exceptional revenue growth but underwhelming revenue guidance for the next quarter.

Duolingo achieved the fastest revenue growth among its peers. The stock is down 25.8% since the results and currently trades at $181.5.

Read our full, actionable report on Duolingo here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance