In a snapshot: These are the worrying stats about housing in Australia

Australians are renting more, spending more money on housing costs, and more stressed than ever about it.

They’re the latest findings from the Australia’s Welfare 2019 report released today by the Australian Institute of Health and Welfare (AIHW).

Related story: The one thing to fix the Australian economy: 4 experts give their view

Related story: Global recession storm clouds are now overhead: Here's how it affects you

In a snapshot, what does housing in Australia look like?

Aussies are renting more

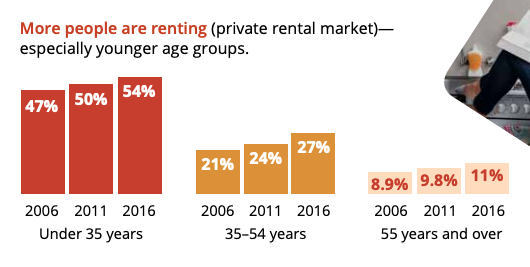

The number of Australians owning their own home is dwindling, particularly among younger people: where one in two 25-29 year olds owned a home in 1971, only 37 per cent of people could say the same in 2016.

And 64 per cent of 30-34 year old Aussies owned a home in 1971, but that dropped down to 50 per cent by 2016.

Aussies are spending more on housing

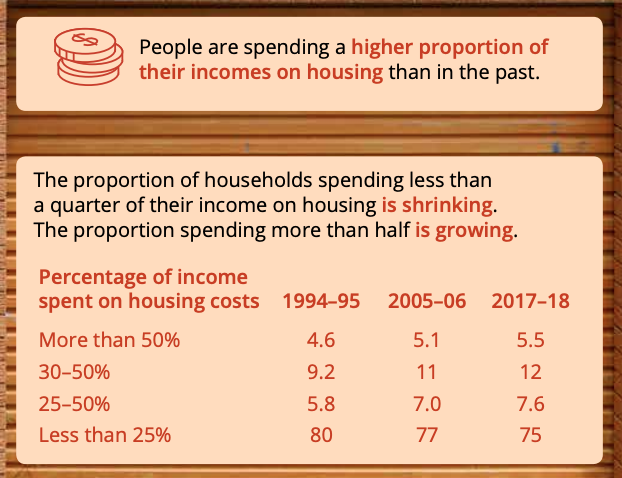

We’re also spending more of our incomes on housing than we used to, the AIHW report revealed.

“The proportion of households spending less than a quarter of their income on housing is shrinking. The proportion spending more than half is growing,” it said.

In 1994-95, 4.6 per cent of Aussies spent more than half their income on housing costs – but that figure rose to 5.5 per cent in 2017-18.

And there are less people in the sweet spot: there are now fewer people who can comfortably afford housing costs.

Four in five households (80 per cent) spent less than a quarter of their pay on housing costs in 1994-95, but this proportion dropped down to 75 per cent in 2017-18.

Aussies are more stressed about housing costs

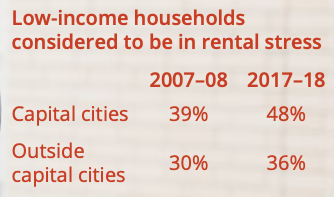

Low-income households are considered to be in housing stress when they spend more than a third of their income on rent or mortgage repayments.

In 2017-18, more than a million low-income households were in housing stress, with renters hit particularly hard.

Among low-income households that rent, nearly a third (32 per cent) feel household stress.

In contrast, only 6 per cent of low-income home owners without a mortgage feel the same stress.

And if you live in a capital city, you’re more likely to feel stressed, though low-income households in rental stress has increased outside capital cities, too.

Related story: You could lose $140,000 by trying to time the property market

Related story: Best and worst-performing suburbs in the last 5 years

Vulnerable Australians live in social housing

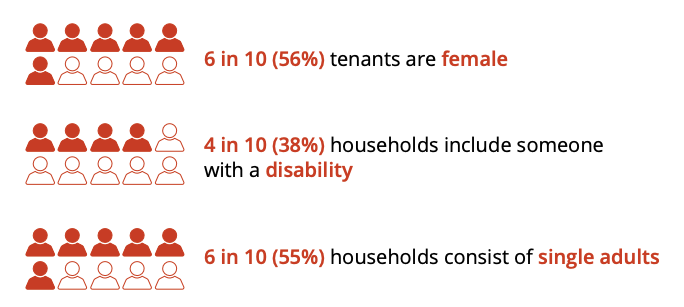

Some of Australia’s most vulnerable groups are social housing tenants.

“Social housing tenants are more likely to be female, and it is common for tenants to have a disability or be single adults,” the AIHW report said.

The Yahoo Finance’s All Markets Summit will take place on the 26th September 2019 at the Shangri-La Hotel, Sydney. Check out the full line-up of speakers and agenda here.

Yahoo Finance

Yahoo Finance