Do Coles Group's (ASX:COL) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Coles Group (ASX:COL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Coles Group

How Fast Is Coles Group Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Coles Group's EPS soared from AU$0.65 to AU$0.89, over the last year. That's a commendable gain of 36%.

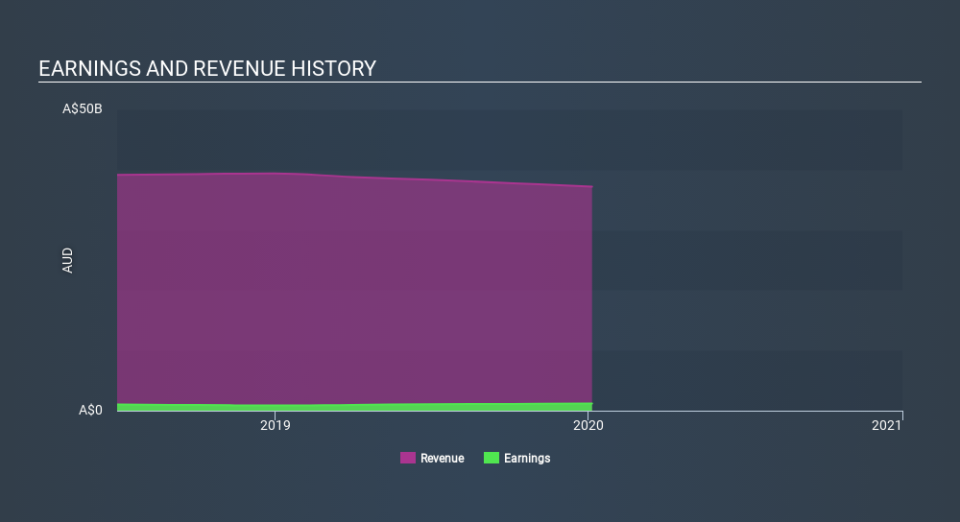

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Coles Group may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Coles Group?

Are Coles Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's a pleasure to note that insiders spent AU$1.2m buying Coles Group shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Independent Chairman James Graham who made the biggest single purchase, worth AU$579k, paying AU$14.48 per share.

The good news, alongside the insider buying, for Coles Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold AU$35m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Coles Group To Your Watchlist?

For growth investors like me, Coles Group's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. Even so, be aware that Coles Group is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Coles Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance