Here’s how to check if you’re in the best super fund

One of the great complaints younger Australians have is about the price of properties and how hard it is for these Aussies to get on the property ladder.

That’s a genuine reason for hip pocket annoyance. But on the other hand, superannuation is a fantastic asset that will leave most younger Australians effectively millionaires when they eventually stop work.

Of course, because super takes 9.5 per cent out of an employee’s salary, it makes buying a home a lot harder but the offset is the super pay off down the track.

More from Peter Switzer: Here's how much your super fund should cost you

More from Peter Switzer: How the coronavirus will wreck your finances

More from Peter Switzer: Your 5-minute guide to trading stocks online

However, because super is so important, it’s really important that your super fund delivers and doesn’t overcharge!

You also have to be in the right type of fund. Younger people should be in a growth or a balanced fund, while the older you get, the more conservative you could become.

In a growth option, your super will surge in good times and drop dramatically in bad market crashes. But, over time, your super money balance will grow at a rate of around 10 per cent per annum over a 10-year period.

So there will be ups and downs, but on a rising trend.

I love this example of $10,000 invested in 1970 in a growth portfolio, where the money is kept in the market and reinvested, snowballed to over $450,000 by 2009, which was one year after the GFC stock market crash!

Once you know what option you should be in – growth, balanced or conservative — next make sure your fund is charging you less than 1 per cent. If you are overcharged for 45 years of work, it could cost you hundreds of thousands of dollars when you retire.

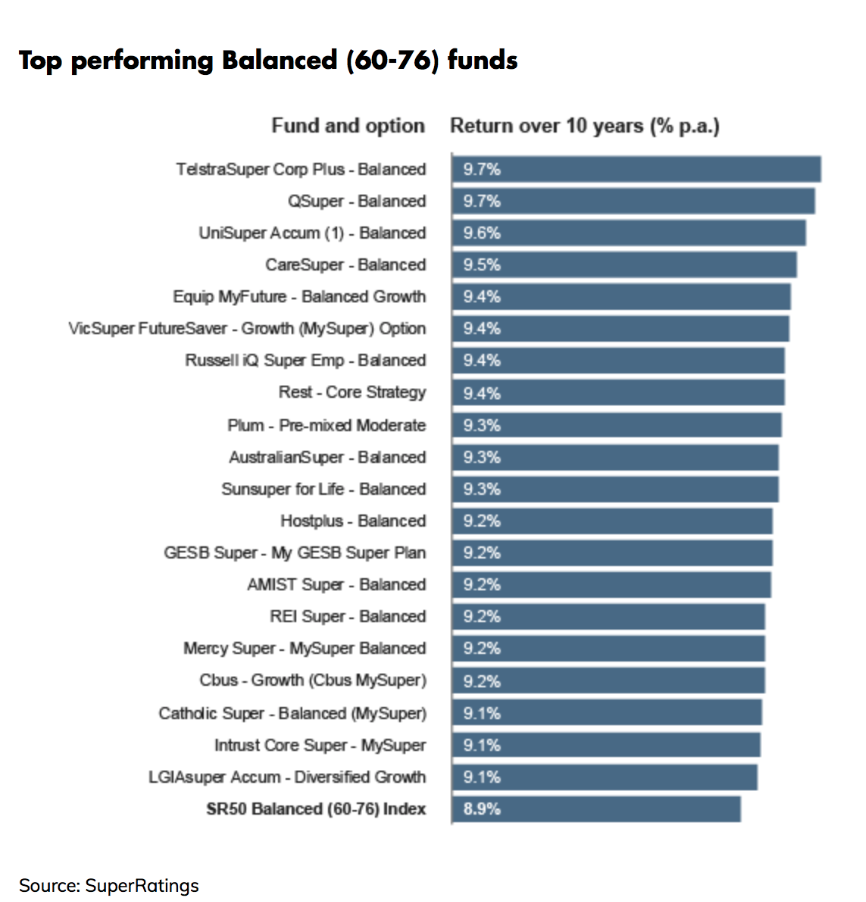

Finally, make sure you know how your fund performs and compares to the best super funds available. Here is the latest performance results for the top super funds and you can use this to stress test your fund’s showing.

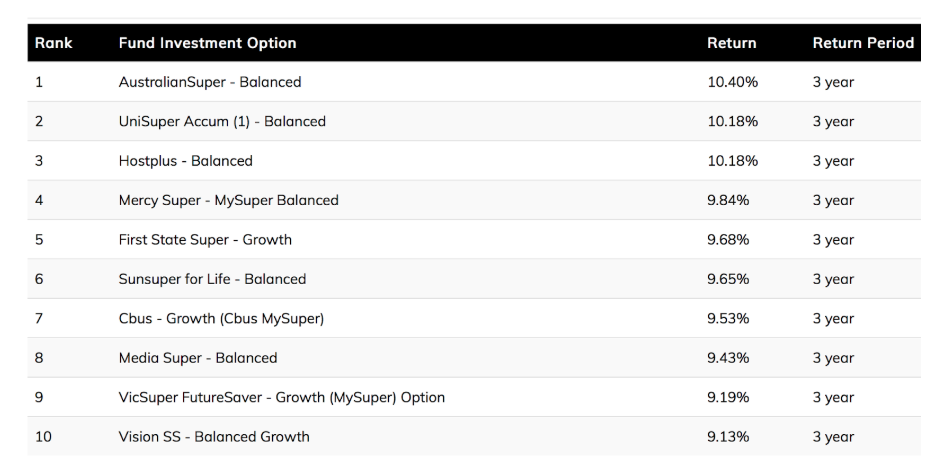

The above shows the 10-year performance, which is a good test of a fund and here’s the three-year showing.

You could request your fund to tell you its performance over these time periods.

This could help you decide whether you’re in a super superannuation fund!

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance