Your 5-minute guide to trading stocks online

Are you up for learning how to become a stock market player, albeit one on training wheels?

I was recently challenged by a TV producer to explain this in five minutes. So here goes.

One of the big steps to turbo charge your wealth is to be a buyer of stocks but most normal people think it’s too hard. My book, Join the Rich Club, shows how you can set up an online trading account in 10 minutes.

And then you can buy the best 200 stocks in Australia in one ‘stock’ called an exchange traded fund, which all would-be new stock market players should be able to understand, after I explain it. I call this trade play, “investing in Australia”.

More from Peter Switzer: With interest rates so low, how do first home buyers save for a deposit?

More from Peter Switzer: The 9-question ‘Are you a money dummy?’ test

More from Peter Switzer: You won't get rich by splurging, or by being cheap

By the way, over a10-year period, the overall stock market goes up 10 per cent a year. That’s how you get richer.

So how can a normal person gain the confidence to buy stocks?

Here’s my answer.

Sign up for an online stockbroking account

First up, you need to sign up for an online stockbroking account. I encouraged a young guy in my office, who’d never bought a stock in his life, to do this. He signed up in 10 minutes with Nabtrade. CommSec would be the same. You could also look up real life stockbrokers and arrange an account over the phone and using email. But these brokers are dearer than their online rivals.

What does it cost to buy stocks online?

Nabtrade’s brokerage fee starts at $14.95. And for trades over $5,000 and below $20,000, rises to $19.95.

What’s the minimum amount you can use to buy stocks?

$500-$1,000 is the usual starting point.

But here’s the hard bit: what can a novice buy?

You can buy the biggest 200 companies in Australia on the stock market in one trade by buying an exchange traded fund or ETF. These can be bought just as you’d buy BHP or CBA but you get 200 stocks in one trade.

It means when you’re driving home listening to the radio and you hear the finance guy say the stock market was up 3 per cent today, you’re 3 per cent richer.

What is that stock?

All stocks have a ticker code like BHP, CBA and so on and the ticker code for this stock is IOZ. (There are others like it but I don’t want to confuse you.)

What is an exchange traded fund or ETF?

It’s a fund you can buy and sell on the stock exchange, just like a stock. That’s why they call it an exchange traded fund.

But stock markets can collapse and you could lose your money, couldn’t you?

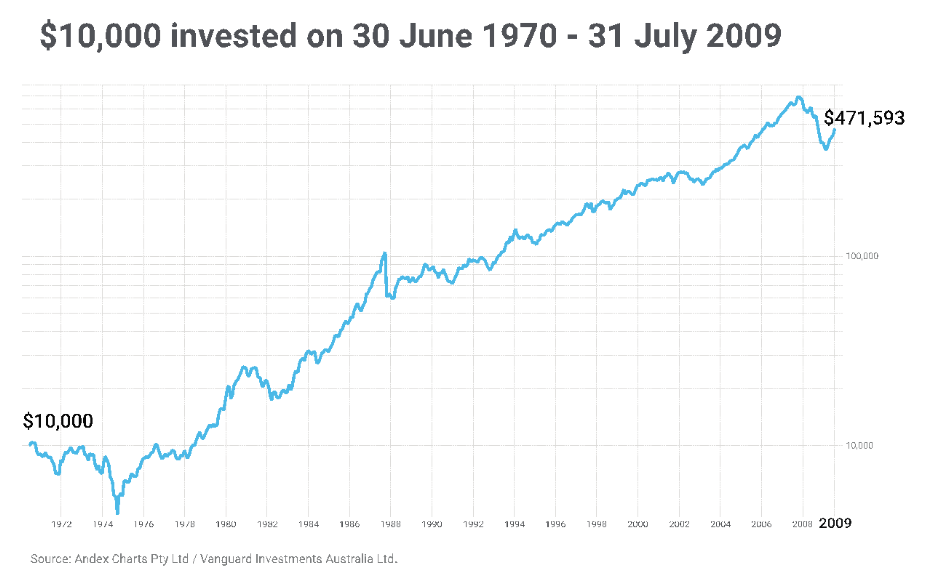

This chart shows you what a stock like IOZ has done.

Between 1970 and 2009 (one year after the GFC crash), $10,000 grew and grew to $471,593. If you stay the course and don’t panic, the stock market returns about 10 per cent a year over a decade.

Sure, your money can go up and down in the stock market in the short term but in the long run, a ‘stock’ like IOZ rises, historically delivering 10 per cent per annum over 10 years – and half of that would be dividends, which don’t disappear unless you spend them!

The blue line has big falls, which are stock market crashes. But see how it resumes and goes higher. Provided you’re patient, a stock market can make you richer.

And that was all readable in five minutes!

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance