Blue Foundry Bancorp Reports Q1 2024 Earnings: A Closer Look at Financial Metrics and Strategic ...

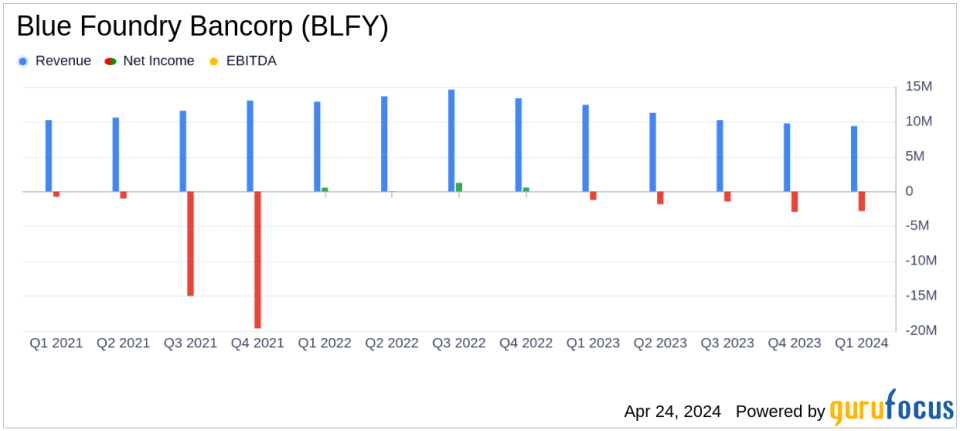

Net Loss: Reported a net loss of $2.8 million for Q1 2024, an improvement from a net loss of $2.9 million in Q4 2023, but widened from a net loss of $1.2 million in Q1 2023.

Earnings Per Share (EPS): Recorded EPS of -$0.13, consistent with the previous quarter and below the estimated EPS of -$0.22.

Revenue: Interest income for the quarter reached $20.8 million, up 2.5% from the previous quarter.

Deposits: Saw an increase of $46.3 million in deposits, marking a 3.7% rise from the previous quarter, driven by a significant increase in time deposits.

Loan Portfolio: Total loans decreased by $6.6 million, with growth in commercial real estate and construction loans offset by reductions in multifamily and residential loans.

Share Repurchase: Repurchased 532,052 shares at an average price of $9.49 per share, reflecting ongoing capital return initiatives.

Asset Quality: Non-performing loans constituted 0.43% of total loans, a slight increase from 0.38% in the previous quarter.

On April 24, 2024, Blue Foundry Bancorp (NASDAQ:BLFY) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a net loss of $2.8 million, or $0.13 per diluted common share, which aligns with the previous quarter's performance but shows a deterioration from a net loss of $1.2 million, or $0.05 per diluted common share, in the first quarter of the previous year.

Company Overview

Blue Foundry Bancorp operates as a full-service bank through its subsidiary, Blue Foundry Bank. The bank engages in originating a variety of loans including residential and commercial real estate loans, and it also offers deposit products and invests in securities. Primarily serving the northern New Jersey area, the bank focuses on attracting retail deposits from the general public and through online channels.

Financial Performance and Strategic Highlights

For Q1 2024, Blue Foundry Bancorp reported significant deposit growth, which President and CEO James D. Nesci noted as a catalyst for margin expansion. The bank's net interest margin improved to 1.92%, up from the previous quarter. This growth in deposits totaled an increase of $46.3 million, or 3.7%, with a notable rise in time deposits by $45.7 million.

The bank also continued its focus on capital stewardship, repurchasing over 532 thousand shares, enhancing shareholder value by increasing the tangible book value per share to $14.60. Despite a decrease in the multifamily and residential loan portfolios, there was growth in commercial real estate, construction, and commercial and industrial loans, indicating a strategic shift towards diversifying the lending portfolio.

Challenges and Operational Metrics

Despite the growth in certain areas, Blue Foundry Bancorp faced challenges including a net loss which, although consistent quarter-over-quarter, showed an increase year-over-year. The bank's strategy to manage and diversify its loan portfolio involves reducing exposure to more volatile markets, which is crucial in maintaining asset quality in uncertain economic conditions.

The bank's asset quality remains robust with non-performing loans comprising only 0.43% of total loans as of March 31, 2024. The allowance for credit losses was $13.7 million, with a net release of provision for credit losses amounting to $535 thousand due to improved forecasts and declining portfolio balances.

Balance Sheet and Income Statement Details

Total assets stood at approximately $2.03 billion as of March 31, 2024, with cash and cash equivalents showing an increase to $53.8 million. The loan portfolio slightly decreased by $6.6 million to $1.55 billion, reflecting the bank's cautious approach in a fluctuating economic environment.

Interest income for the quarter was $20.8 million, a slight increase from the previous quarter, while interest expense also rose to $11.4 million. This resulted in a net interest income of $9.4 million for the quarter. Non-interest expenses rose primarily due to increases in compensation and benefits, highlighting ongoing investments in bank staff and operations.

Conclusion and Outlook

Blue Foundry Bancorp's first quarter of 2024 illustrates a mixed financial landscape. While the bank has effectively managed its capital and seen deposit growth, the continued net losses highlight ongoing challenges. The strategic focus on diversifying the loan portfolio and maintaining strong asset quality positions the bank to navigate future uncertainties in the financial sector.

Investors and stakeholders will likely keep a close watch on how these strategies unfold in subsequent quarters, particularly in terms of profitability and asset quality management.

Explore the complete 8-K earnings release (here) from Blue Foundry Bancorp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance