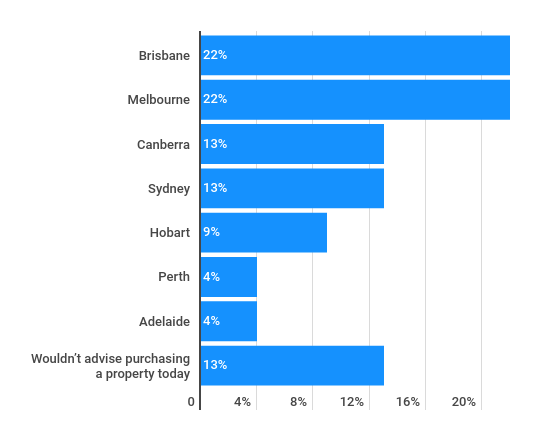

Best two cities for buying real estate right now

Experts have chosen Melbourne and Brisbane as the best cities to invest in property at the moment, on the back of the Reserve Bank's decision on Tuesday to hold rates.

Comparison site Finder's survey of real estate experts and economists showed the two cities got the thumbs up from 22 per cent of respondents each.

Sydney, the experts think, is overpriced.

"While Melbourne and Brisbane are strong candidates for the most promising property market in Australia, it is a bit stunning to see Sydney perform relatively poorly," said Finder insights manager Graham Cooke.

"The state you live doesn’t need to be the state where you buy. With many Sydneysiders grappling with housing affordability, 'rent-vesting' could be the way to go."

Rent-vesting is the concept of renting the home one lives in while owning an investment property that is rented out for income.

First home buyer scheme won't make a difference

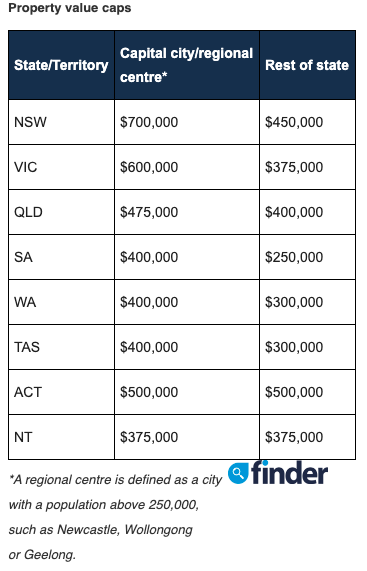

The surveyed experts thought the federal government's first home buyer scheme, to start on January 1, would not make any significant difference to the market.

"The government's scheme limits the purchase price of Sydney properties to $700,000, which to be honest, is a joke," said Cooke.

"Not many properties will qualify for this scheme – some apartment buyers may qualify, but not many houses are available for below that price."

Even the $350,000 eligibility cap for regional Australia was inadequate, according to Cooke.

"Additionally, borrowing with a 5 per cent deposit can end up being a lot more expensive in the long run. This could cost you over $90,000 in extra interest over the full term of a home loan at the big four’s standard variable rate."

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance