Watch out – here come the first home buyers

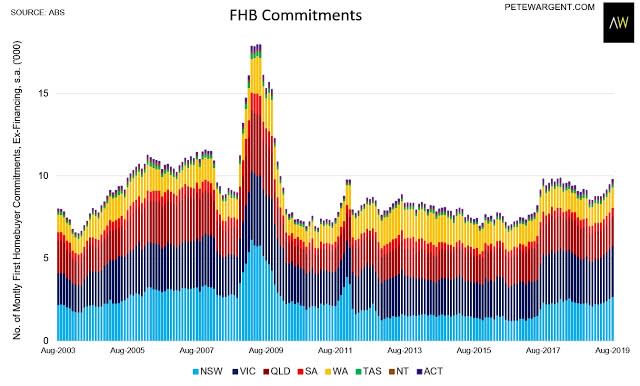

It's quite likely that the number of first home buyers (FHB) in the market will soon reach the highest level since the Rudd stimulus over a decade ago.

At that time, it was part of the Government’s package to stave off a recession in Australia during the GFC.

This time round the FHB incentive was a political promise made during the election when the market was property was very different.

More from Michael Yarndey: What if interest rate cuts fuel house prices but nothing else?

More from Michael Yardney: 4 things property investors need to know about the market

More from Michael Yardney: The secret to getting your property valuer to up your house price

First home buyer numbers had already increased significantly over the last few months and when the Federal Government’s First Home Loan Deposit Scheme comes in to play in January it will be a game of Lotto restricted to the 10,000 lucky families.

If history repeats itself, these FHB’s will push up values in certain locations creating an Established Homeowner Bonus for lucky vendors.

Then there are those who suggest that this election promise to rescue FHBs will just commit them to long term financial imprisonment as the Government props up the Australian property Ponzi scheme.

To get a better understanding of what’s going on let’s have a chat with Dr. Andrew Wilson, chief economist of MyHousingMarket.com.au.

Home buyers rush to market fearful of higher prices

First home buyers are currently rushing Melbourne and Sydney housing markets taking advantage of sharply lower interest rates and fearful of being sidelined by currently strongly rising prices where property values are growing faster than their capacity to save a deposit.

NSW first home buyers’ loans surged over August with 2803 loan approvals according to the ABS, the highest monthly total since December 2011when first home buyers rushed the market to take advantage of changes to state stamp duty.

The average NSW first home buyer loan has also soared over the past year increasing by 11.3 per cent to $425,832.

NSW now accounts for 32.4 per cent of all national first home buyer lending – again its highest market share since the December 2011 surge.

NSW first home buyers also account for 17.4 per cent of all residential lending in NSW – again an 8-year high.

Strong first home buyer activity is also being recorded in Victoria with loans up by 4.9 per cent over the year to August and the value of the average loan rising by 3.5 per cent to $375,835.

NSW and VIC combined now account for 64.9 per cent of all first home buyer lending nationally – well ahead of their long-term average 56.4 per cent.

Around 10,064 first home buyer loans were approved national over August.

The NSW government reports that Liverpool was the top Sydney suburb for the number of first home buyer stamp duty exemptions (prices up to $650,000) and concessions (prices up to $800,000) approved over September followed by Campbelltown, Spring Farm, Westmead and Riverstone.

Other states by contrast have recorded lower levels of first home buyer growth over the past year with QLD down 6.5 per cent and SA down 3.8 per cent.

The First Home Loan Deposit Scheme

The Morrison government’s election promise was to give first-home buyers a leg up into the property market.

This was a political decision at a time of falling property values and tougher lending conditions.

Our property markets are very different today, however from 1 January 2020 the First Home Loan Deposit Scheme would allow first-home buyers to put up a 5 per cent deposit, rather than the usual a 10 or 20 per cent deposit,

We knew that this will only be available for 10,000 eligible first-home buyers each year, but now some further restrictions have been announced.

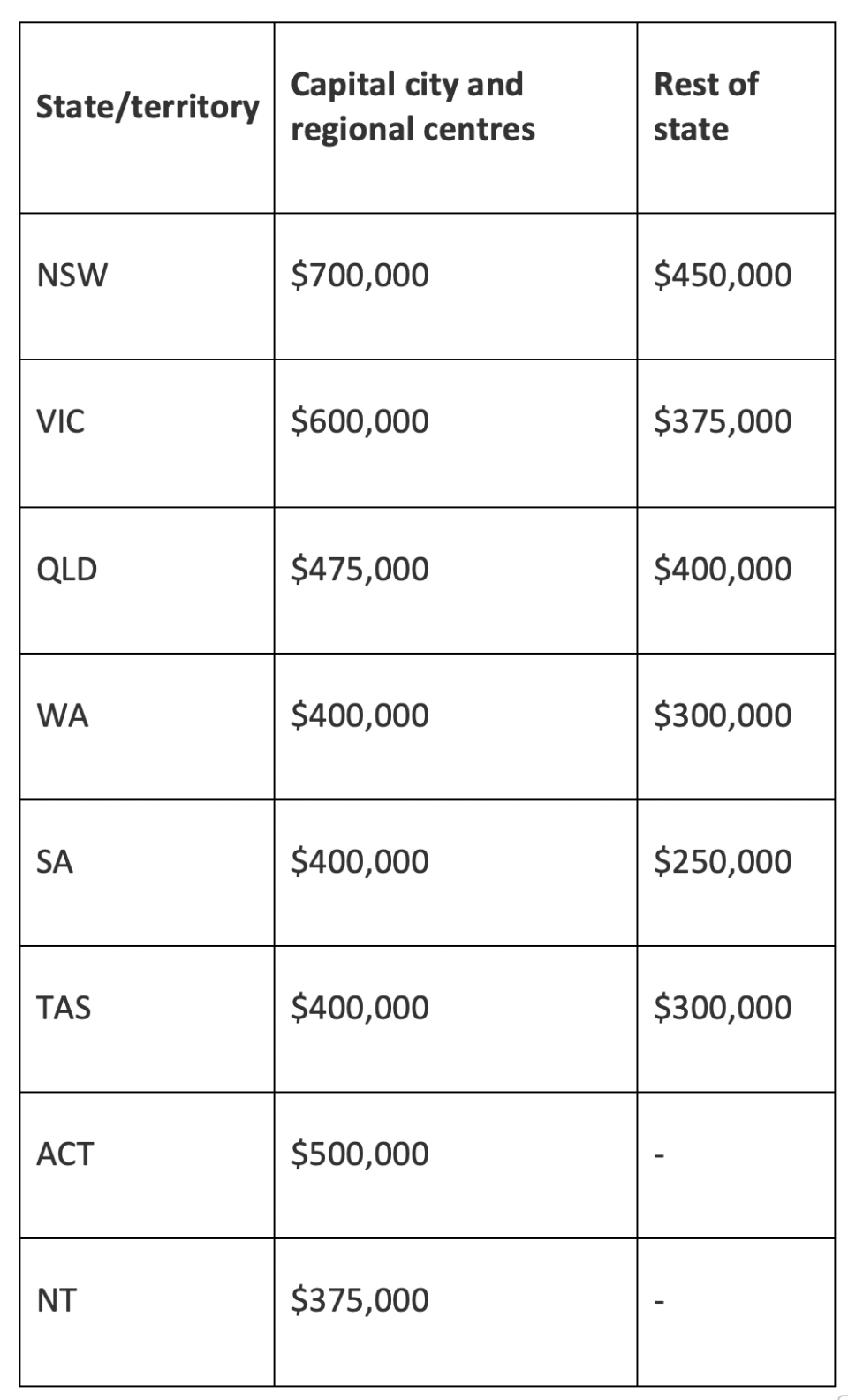

First-home buyers wanting to use the scheme will be limited to properties sold for less than $700,000 in Sydney, $600,000 in Melbourne up to $475,000 in Brisbane and it will apply to owner-occupied loans on a principal and interest basis.

Price caps for large regional centres (Gold Coast, Newcastle and Geelong) are the same as those for the capital city in their state.

It removes the cost of lenders mortgage insurance for FHBs with an annual income of up to $125,000 or couples with a combined $200,000 per year who haven't saved the standard 20 per cent deposit typically required by banks.

And there are still some unknowns. Housing Minister Michael Sukkar said only two of the four big banks will be chosen to take part in the Scheme, with 50 per cent of all guarantees set aside for smaller lenders. The participating big banks have yet to be announced.

My concerns

While I’m sympathetic to the challenges first home buyers face, I’m not convinced the scheme will be a good thing for them.

Currently there are around 10,000 FHB purchases in Australia each month.

It’s possible that in the early months of 2020 this number could double as this is a “first in best dressed” policy.

This means a swag of FHB’s emboldened by the home loans the obtained with their low deposits will be chasing a similar range of properties and the old supply and demand ratio will kick in pushing up property prices.

Of course those FHB’s who miss out the lottery could end up paying more for their properties or have to wait another year for the next round of grants, by which time property values will be even higher.

Then with a new home comes a lot of extra expenses and those who haven’t developed a savings discipline could find themselves in financial strife.

Firstly, they’ll have to pay interest on a larger mortgage, but then they’re likely to go out and buy furniture and appliances on those special no payments, interest free for 3 years packages and down the road find them selves with a hefty debt and paying double digit interest rates.

This reminds me that the Government should be careful of the unintended consequences of hastily though out policies.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia's leading experts in wealth creation through property and writes the Property Update blog.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance