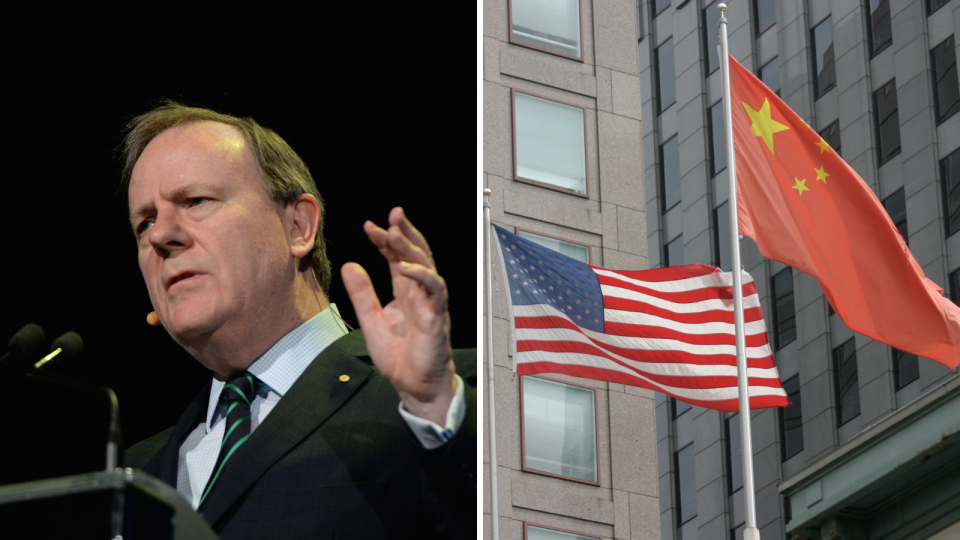

Aussies will be hit by US-China trade war, warns Peter Costello

Amanda Stevens will speak about the US-China trade war, productivity and monetary policy at Yahoo Finance’s All Markets Summit. Buy tickets here.

The US-China trade war has sent multiple shockwaves through the Australian stock market over the last few weeks: just last week (26 August), $30 billion was wiped off the ASX at the open.

But it isn’t just investors who are losing money. If trade tensions continue to escalate, Australians will feel the ramifications in a number of ways.

15 August: $50bn wiped from ASX amid US recession fears: What it means for Australia

6 August: Bloodbath for share markets: Here’s how it affects you

AUD: Aussie dollar faces a bleak outlook as markets take a beating

Australia’s longest-serving treasurer and Future Fund chairman Peter Costello, who will be speaking at Yahoo Finance’s All Markets Summit in Sydney on September 26, said the trade war meant shock market volatility was up, the flow-on effects of which would have consequences for Australia.

“A growing Chinese economy is good for Australia,” he told Yahoo Finance.

“If it would turn down as a result of trade tensions or any other cause, that would affect our national income. So in a sense, we would all become poorer if the Chinese economy were to falter, and if we were to cease growing strongly.”

3 ways Australians will be hit by the US-China trade war

And what would it mean if stock markets turned sour?

“It just means their superannuation will be less, it means that the income for retirees many of whom live off dividends, frank dividends, in particular, will be less,” Costello said.

“It will, through financial markets, have an effect on family budgets for retirees and savers.”

Related story: This Australian just made $1,220 while stock markets crashed

1. The trade war will hit your superannuation

All working Australians are investors: your superannuation money gets pooled then invested on your behalf by professional investment managers. Most superannuation accounts are at least partially invested in the stock market.

And when US-China tensions escalate, share prices plunge, explained the Australia Institute’s Centre for Future Work director and economist Jim Stanford.

“That will put a dent, at least temporarily, in Australians’ financial investments – including their super accounts.”

Related story: Former Treasurer Peter Costello tackles Australia’s economic future

Related story: ‘We have to do more’: Peter Costello to tackle productivity at Yahoo Finance Summit

2. The trade war will hit franking dividends

“In the event of a worldwide downturn, dividend payments from Australian corporations are likely to decline – especially in the resource sector, which is vulnerable to big swings in global commodity prices,” Stanford told Yahoo Finance.

But very few Aussies live off franking dividends, so this will have little impact on real economic activity.

A few well-off investors will see smaller dividends, but that won’t be a big deal compared to other aspects of Australia’s economy that would be hit harder, he said.

3. The trade war will make people stash money

When the economy is weak, people are tempted to stash away money for a rainy day – but this isn’t good for the economy.

“That act of increasing saving will actually make things worse – and could actually bring about the recession that everyone had been fearing,” said Stanford.

“It’s better at a time like that for the economy to keep spending, in order to sustain purchasing power and prevent a more serious downturn from taking hold. That’s why we need government to play a leading role, by pumping additional money into the economy to support spending and jobs, and reduce the risk of recession.”

Peter Costello will be speaking at Yahoo Finance’s All Markets Summit in Sydney’s Shangri-La on September 26. Join us for this groundbreaking event.

Yahoo Finance

Yahoo Finance