RAPID RECOVERY: House prices gains largest in 16 years

Australian property prices have seen the largest monthly gains in 16 years, according to the latest figures from CoreLogic

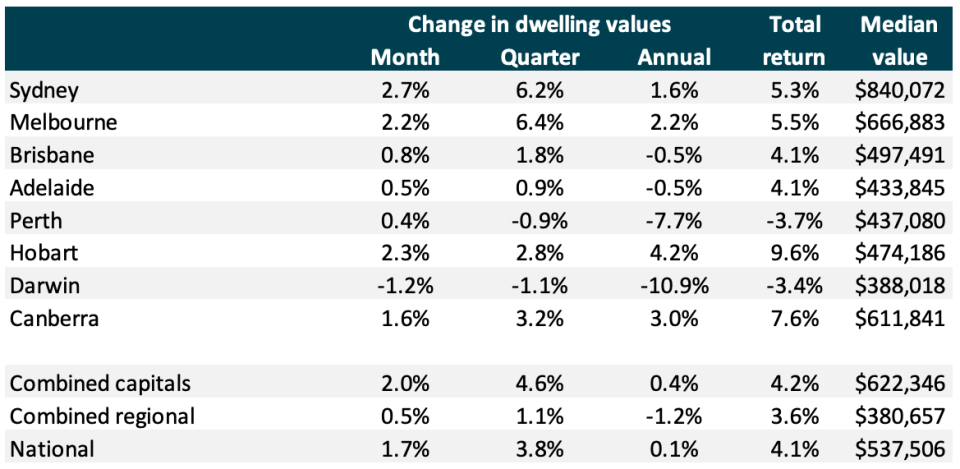

Nationally, house prices etched up 1.7 per cent in November, bringing quarterly growth to 3.8 per cent.

Related story: ‘Act fast’: Home-buyers urged to get in before Christmas

Related story: Are those wild forecasts for property in 2020 realistic?

Related story: House prices to rise 10% next year

Growth was strongest in Sydney, where prices went up 2.7 per cent, while values grew 2.3 per cent in Hobart and 2.2 per cent in Melbourne.

Perth saw price gains of 0.4 per cent, the first month-on-month rise since early 2018.

A series of interest rate cuts, easier home loan rules and the removal of negative gearing change fears all drove the growth.

“Additionally, we’re seeing advertised stock levels persistently low, creating a sense of urgency in the market as buyer demand picks up,” CoreLogic head of research Tim Lawless said.

“There’s also the prospect that interest rates are likely to fall further over the coming months and an improvement in housing affordability following the recent downturn are other factors supporting a lift in values.”

These figures mark the fifth consecutive month of growth, and an “unexpected period of rapid recovery”.

“The question is, how long can such a high pace of capital gains be sustained?”

Canberra saw prices rise 1.6 per cent, while Brisbane saw prices grow 0.8 per cent and Adelaide went up 0.5 per cent.

Darwin was the only city to mark negative growth, down 1.2 per cent.

But Lawless said this rapid recovery can’t last, pointing to the weak economic figures.

“Considering wages and household income growth remains low, economic conditions are losing momentum and housing affordability is once again worsening (from an already high base in the largest cities), there are likely to be some headwinds in maintaining such a fast recovery,” Lawless said.

Lawless also noted that the price growth has begun to take hold in smaller capital cities like Perth, where prices have been cycling lower since 2014.

This is largely due to poorer housing affordability in other cities and slightly higher unemployment in NSW and Victoria.

“Mortgage rates are already at their lowest level since at least the 1950’s which is one of the main factors supporting increasing market activity,” Lawless said.

“If rates do move lower, no doubt policy makers will be watchful for any triggers that could provoke a policy response limiting housing credit.”

The Reserve Bank of Australia will meet on Tuesday to deliver its official interest rate decision for December, with economists and real estate experts tipping rates will be kept on hold at 0.5 per cent.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance