Interest rate decision: Reserve Bank of Australia delivers verdict

The Reserve Bank of Australia (RBA) has decided to keep the official interest rate at its record low of 0.75 per cent, after pulling the trigger in October.

The bank has cut rates three times since June, sending house prices soaring as mortgage interest rates also fell.

Related story: The safe haven suburbs for property investors

Related story: Google searches for 'Australia recession' have hit GFC levels

Related story: Here’s where Australian property prices are going in 2020

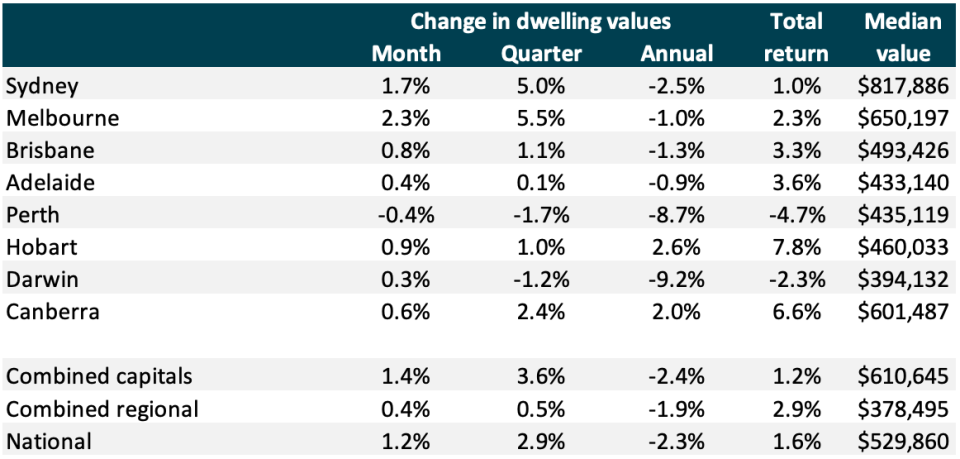

In October, national house values rose 1.2 per cent while values in Sydney and Melbourne surged 1.7 per cent and 2.3 per cent respectively.

According to CoreLogic research director Tim Lawless, today’s outcome is unsurprising.

“Considering the RBA is running out of conventional monetary policy ammunition, the decision to hold the cash rate at the historic low of 0.75 per cent was widely anticipated,” he said.

He noted that unemployment has shifted lower while inflation also edged 1.7 per cent higher in the September quarter, supporting an RBA decision to hold.

“Additionally, a rebound in housing values and a rise in buyer activity will hopefully begin to flow through to a gradual improvement in household wealth and spending,” Lawless said.

“While several of the key economic indicators have stabilised, no doubt the RBA will be carefully monitoring other indicators which have continued to lose momentum such as consumer confidence, residential construction activity and retail spending.”

All 37 experts and economists on Finder’s RBA rate decision panel agreed the bank would hold rates steady.

Mortgage Choice’s Susan Mitchell said the decision was supported by the latest economic data.

“ABS data revealed that the unemployment rate declined in September and even though it is far off the Bank's target, the latest figures provide some breathing room for policy makers.”

Realestate.com.au’s chief economist Nerida Conisbee agreed, noting that all three cuts have come within five months of each other.

“At this stage, it is likely the RBA will take a wait and see approach,” she said.

“With monetary policy not as effective as it has been historically, we should expect to see a greater focus by government on other ways to boost economic growth, including tax cuts and government spending.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance