You could lose $140,000 by trying to time the property market

Spring has hit, and the property market is finally looking up.

But if you wait too long to step on the property ladder, you’ll not only miss out, but you’ll be out of pocket – by thousands of dollars.

According to analysis by the Property investment Professionals of Australia (PIPA), investors who attempted to time the market could potentially lose $140,000 over the next 15 years.

Related story: Australian property markets roar back to life after 22 months of falls

Related story: Best and worst-performing suburbs in the last 5 years

Related story: The one property market showing no signs of recovery

Normal investors simply don’t have enough of the skills or knowledge to expertly pick the best markets to invest in in the short-term, said PIPA chairman Peter Koulizos.

“Trying to time the market is not only extremely difficult for most investors, the transactional costs of buying and selling multiple times, including stamp duty and Capital Gains Tax, eat up a significant chunk of your potential profit,” he said.

“Most people are only thinking of the potential price uplifts when they try to time a market and naively don’t consider the inherent risks involved in such a market gamble.”

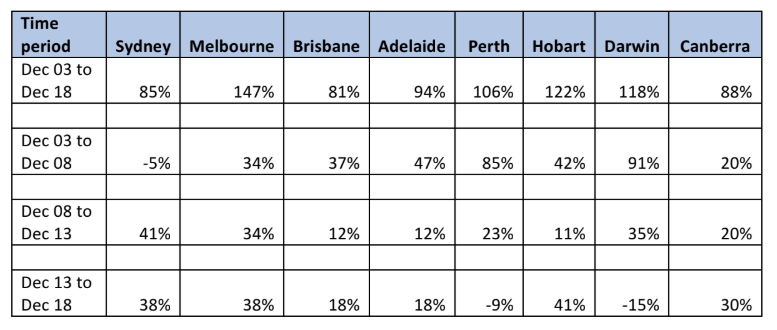

PIPA analysis calculated the median house price changes in every Australian capital city in the last 15 years, broken up into three five-year periods.

The top performing cities were Melbourne, Hobart and Darwin, with Melbourne experiencing 147 per cent growth over a decade and a half.

But if an investor had tried to time the market but chose the worst-performing capital cities in every five-year period, they would be $137,701 out of pocket, according to Koulizos.

For instance, buying a $400,000 house in Sydney in 2003 and holding it for five years would see the investor left with $380,165 at the end of it after the tax refund is added.

After the sale of this Sydney property, let’s say the investor snapped up a house in Hobart in 2008.

“But by the time you allow for a deposit, purchase costs, buyer agent fees and LMI on this property, you can only afford a house that is worth $318,000,” Koulizos explained.

“In this five year period, Hobart property prices increased by 11 per cent so the house is now worth $352,980. If you take away the selling costs and Capital Gains Tax (CGT), you are left with $340,480.”

Say the investor made another bad move and bought a house in Perth in 2013. Where you had $340,480 after selling the Hobart property, you can only afford a house worth $285,000 after the deposit, purchase costs, buyer agent fees and LMI have been factored in.

“In the period between 2013 and 2018, Perth property prices decreased by 9 per cent so the house is now only worth $259,350. If you take away the selling costs but add the tax refund (because you made a capital loss), you will finish up with $262,298.”

All up, making all the wrong moves – picking the wrong cities in each five-year period, where lots of buying and selling costs were involved – you would end up with just $262,298 and lose $137,702 all up.

If an investor picked the best locations each time, they would be up by $386,000 by the end of it all, but simply buying and holding in other locations would have been better, said Koulizos.

“On top of that, there is the stress of buying and selling three times in a 15-year period during which time market sentiment and conditions can change dramatically as well,” he added.

“The moral of the story is rather than trying to “Chase the Ace” and look for a new hotspot every five years, do your research and look for properties that will do well in the longer term,” Koulizos told Yahoo Finance.

The Yahoo Finance’s All Markets Summit will take place on the 26th September 2019 at the Shangri-La Hotel, Sydney. Check out the full line-up of speakers and agenda here.

Yahoo Finance

Yahoo Finance