Aussie dollar sinks to 17-year low: What this means for you

UPDATE MARCH 19: The Australian dollar was buying 57.18 US cents at noon today, down again from 59.98 US cents on Wednesday.

This comes as the stock market slid marginally lower at noon, dragged down by banks and energy stocks.

The volatile benchmark S&P/ASX200 jumped as high as three per cent in early trade but was down 32.3 points, or 0.65 per cent, at noon on Thursday.

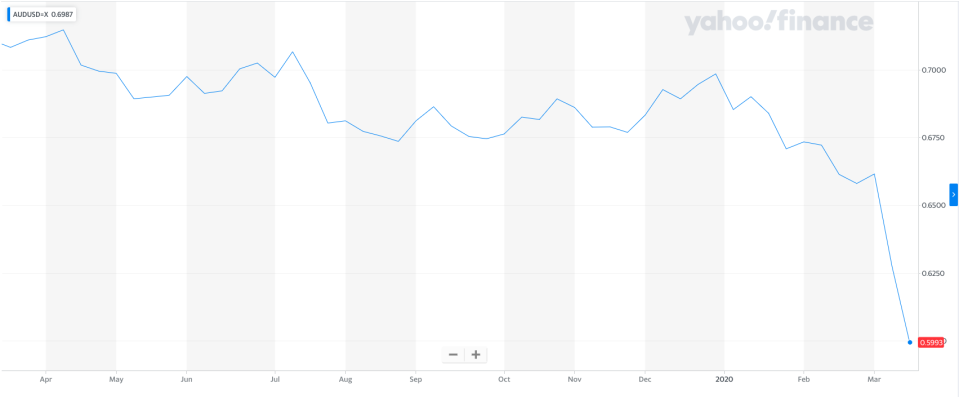

MARCH 18: If you have money sitting overseas, now might be the best time to bring it home as the Australian dollar has sunk to a 17-year low, buying just 59.94 US cents on Wednesday - back to where it was in early 2003.

In February this year, the Aussie dollar dropped to levels not seen since the global financial crisis, but has continued to drop dramatically as the coronavirus outbreak takes its toll on the economy.

This is despite the benchmark S&P/ASX200 index finishing 5.83 per cent higher - marking the highest gains in 23 years yesterday - reversing Monday’s disastrous trading session.

Converting $10,000 to USD today would earn you just $5,983 - over US$2,000 less than what it could have earned you back in 2018, when the AUD hit 81 cents.

Also read: Aussie stocks roar 5.83% higher in best day since 1997

Also read: Airlines to get $715m bailout package

It also means imported goods, like fuel and electronics, will face price pressures.

However, when the Australian dollar sinks, exporting industries like our farmers and education rejoice – as the prices for their products and services become more globally competitive.

How much will my holiday cost me now?

Though the Prime Minister announced a nation-wide overseas travel ban, if you converted cash for future travel plans today, you’d be way out of pocket.

Converting $10,000 to USD today would only get you US$5,989, €5,430, or £4,942.

This time last year, the AUD was worth around 70 US cents, and hit highs of 81 US cents in January 2018.

The Aussie dollar traded at its highest on 27 July 2011, with $1 AUD buying US$1.108. That would see you gain cash on conversion.

Converting your AUD to USD in 2011 would have earned you US$11,000 - more than twice what the dollar is worth today.

Stocks volatile

The stock market has been increasingly volatile, hitting record-lows and record-highs in a matter of days.

The Aussie stock market posted its highest gains on record on Tuesday, after suffering its worst one-day fall in history on Monday.

This morning, the ASX slid 3 per cent, despite Wall Street rallying overnight.

Over in the US, stocks rose 6 per cent, clawing back a huge portion of Monday’s steep losses after the Federal Reserve and the White House announced they would purchase short-term corporate debt, much like during the financial crisis, to stem damage from the coronavirus outbreak.

Prime Minister to announce stimulus

On Tuesday, Finance Minister Mathias Cormann shared details of a new stimulus package, after the government’s first $17.6 billion package was deemed inadequate by experts.

Today, Prime Minister Scott Morrison stated the government was working quickly to form the second stimulus, to “cushion” the blow to the economy caused by coronavirus.

This is likely to be announced in the coming days.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance