Aussie markets hurtle 6.4% lower on travel news

The benchmark S&P/ASX200 closed 6.43 per cent lower on Wednesday as the Australian government lifts the official travel advice to its strongest warning in history.

The broader All Ordinaries index finished 6.26 per cent lower, while the Australian dollar sunk to its lowest level in 17 years.

Don’t have shares? Here’s how the stock market movements affect you

Australians travelling abroad have been urged to come home as soon as possible, while those planning international travel have been told not to travel anywhere internationally. This is the strongest travel warning Australians have ever received.

What happened in markets earlier today?

The S&P/ASX200 fell 3 per cent at the open on Wednesday, despite a rally on Wall Street overnight.

Wall Street surged 6 per cent overnight after the Trump administration suggested a third stimulus package could be in the trillions, a larger injection than the 2008 bank bailout.

The falls come after the ASX200 saw its best day since 1997, finishing up 5.83 per cent and nearly halving the dramatic losses seen on Monday.

Airline bailout

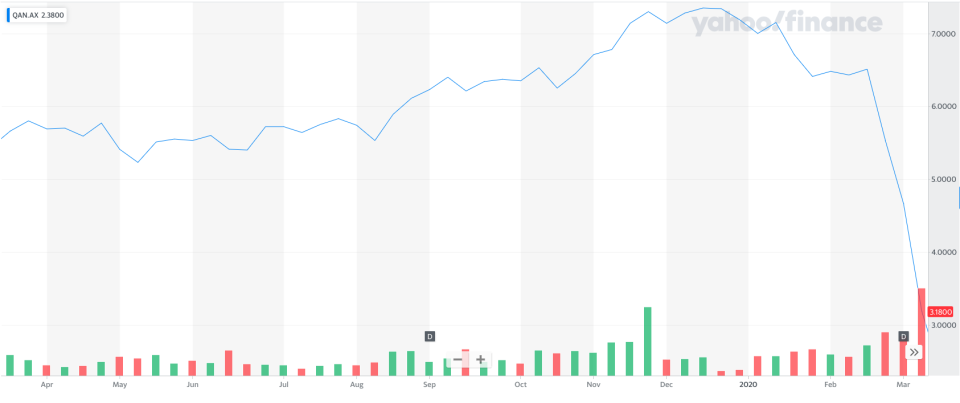

Qantas (QAN.AX) shares dropped 16.78 per cent by 1059AEDT, and were sitting around $2.38 despite Prime Minister Scott Morrison’s announcement that the government will provide $715 million in aid to the country’s ailing airlines.

Qantas announced on Tuesday that it would be forced to suspend 90 per cent of its international flights, and Virgin (VAH.AX) today announced it would suspend all international flights.

Morrison today also upped the travel advice warning level to a level four, the highest it has ever been. That level of travel advice warns Australians against all international travel, and comes as the Department of Foreign Affairs and Trade urges all Australians abroad to return home as soon as possible, as international border closures make return travel difficult.

The Reserve Bank of Australia is expected to announce further measures to support the economy on Thursday, while the Federal Government will provide details of its second “cushioning” financial package later this week.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance