ASX Growth Leaders With High Insider Ownership In June 2024

Amidst a generally declining Australian market, with the ASX200 hitting a two-week low and most sectors experiencing downturns, certain companies have managed to capture the attention of both analysts and investors. In such an environment, growth companies with high insider ownership can be particularly compelling as these insiders may have a deep commitment to their companies' futures, potentially aligning their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's review some notable picks from our screened stocks.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited operates as a travel retailer serving both leisure and corporate sectors across various regions including Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market cap of A$4.26 billion.

Operations: The company generates A$1.28 billion from its leisure segment and A$1.06 billion from its corporate travel services.

Insider Ownership: 13.3%

Return On Equity Forecast: 22% (2026 estimate)

Flight Centre Travel Group, currently trading at A$21.4% below its estimated fair value, has recently shown promising financial developments. The company became profitable this year and is experiencing robust growth forecasts with earnings expected to increase by 18.98% annually and revenue projected to rise by 9.7% per year—outpacing the Australian market's average of 5.3%. Additionally, Flight Centre's anticipated Return on Equity is high at 21.7%. Despite these positive trends, there hasn't been significant insider buying or selling in the past three months.

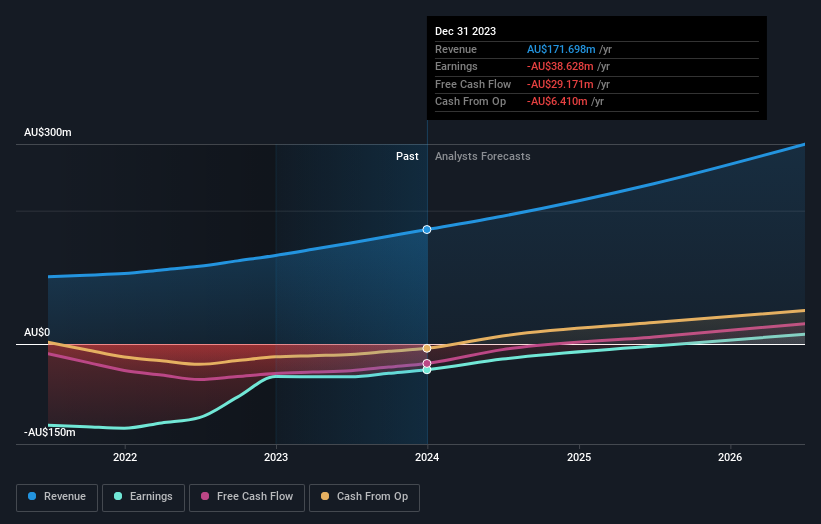

SiteMinder

Simply Wall St Growth Rating: ★★★★★☆

Overview: SiteMinder Limited, with a market cap of A$1.31 billion, is engaged in developing, marketing, and selling online guest acquisition platforms and commerce solutions for accommodation providers both in Australia and globally.

Operations: The company generates its revenue primarily from software and programming services, amounting to A$171.70 million.

Insider Ownership: 11.3%

Return On Equity Forecast: 25% (2026 estimate)

SiteMinder, recently added to the S&P/ASX 200 Index, is poised for significant growth with earnings forecasted to surge by 72.7% annually. Over the past five years, earnings grew at 14.9% per year. Expected to turn profitable within three years, SiteMinder's anticipated return on equity stands impressively at 24.9%. Additionally, its revenue growth rate of 19.7% per year is projected to outstrip the broader Australian market's average of 5.3%. Currently, it trades at A$45.7% below its fair value estimate.

Click here and access our complete growth analysis report to understand the dynamics of SiteMinder.

Our valuation report unveils the possibility SiteMinder's shares may be trading at a premium.

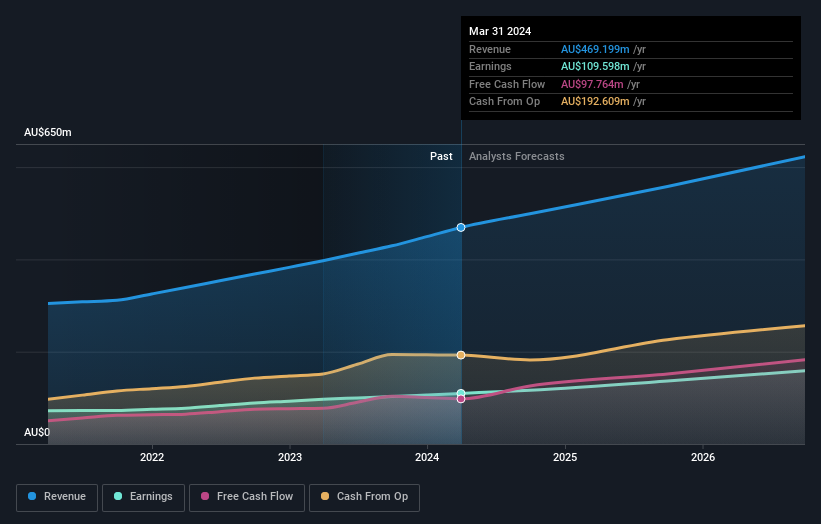

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Technology One Limited is an enterprise software company that offers comprehensive business solutions, operating both in Australia and internationally, with a market cap of approximately A$5.94 billion.

Operations: The company's revenue is primarily derived from three segments: Software (A$317.24 million), Corporate (A$83.83 million), and Consulting (A$68.13 million).

Insider Ownership: 12.3%

Return On Equity Forecast: 33% (2027 estimate)

Technology One, an Australian software company, is expected to see its earnings grow by 14.3% annually, outpacing the general market's 13.8%. Despite a high price-to-earnings ratio of 53.5x compared to the industry average of 60.9x, insider trading activity has been minimal recently. The firm reported a significant increase in half-yearly revenues to A$240.83 million and net income to A$48 million, reflecting a robust financial performance with promising growth prospects in both earnings and revenue forecasted at 11.1% per year.

Key Takeaways

Click this link to deep-dive into the 91 companies within our Fast Growing ASX Companies With High Insider Ownership screener.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:FLTASX:SDR ASX:TNE

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance