ASX Growth Companies With At Least 13% Insider Ownership

The Australian stock market faced significant challenges recently, with the ASX200 closing down 1.35% as all sectors struggled and materials taking the hardest hit. Amidst this turbulent environment, certain growth companies with high insider ownership may offer a unique perspective on stability and potential resilience. In times of market volatility, stocks with substantial insider ownership can be appealing as insiders are often perceived to have a better understanding and commitment to the company’s long-term success.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's dive into some prime choices out of from the screener.

Chrysos

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chrysos Corporation Limited is a company involved in the development and supply of mining technology, with a market capitalization of approximately A$595.56 million.

Operations: The firm generates revenue primarily through its Mining Services segment, totaling A$34.24 million.

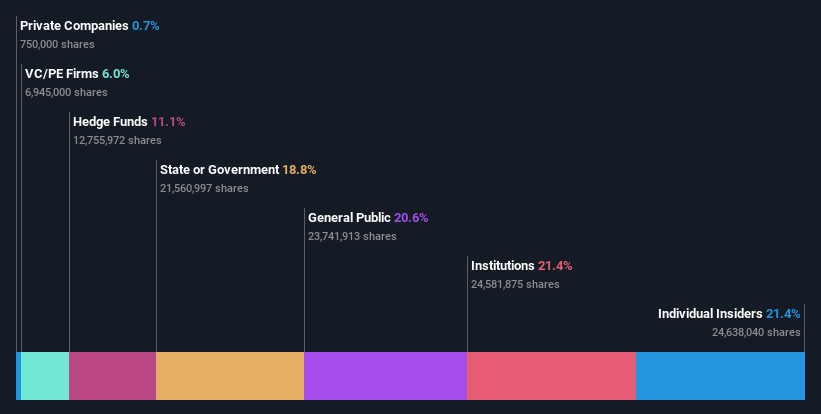

Insider Ownership: 21.4%

Chrysos Corporation Limited, a growth-focused company with high insider ownership in Australia, is navigating a complex landscape. While the company's revenue is projected to increase significantly at 35.3% annually, surpassing the Australian market average of 5.3%, it has experienced some shareholder dilution over the past year. Despite this, Chrysos is expected to become profitable within three years, with earnings potentially growing by 63.48% per year. However, there have been substantial insider sales recently which could raise concerns among potential investors.

Flight Centre Travel Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Flight Centre Travel Group Limited is a global travel services provider operating in sectors including leisure and corporate across regions such as Australia, New Zealand, the Americas, Europe, the Middle East, Africa, and Asia with a market capitalization of approximately A$4.26 billion.

Operations: Flight Centre Travel Group's revenue is primarily derived from its leisure and corporate travel services, generating A$1.28 billion and A$1.06 billion respectively.

Insider Ownership: 13.3%

Flight Centre Travel Group, recently added to the S&P/ASX 100 Index, shows promising growth prospects with its revenue expected to increase by 9.7% annually, outpacing the Australian market's 5.3%. While its earnings growth is less dramatic at around 19% per year, it still exceeds the market average of 13.8%. The company also boasts a strong forecasted return on equity of 21.7% in three years. However, it lacks significant insider buying or selling activity in recent months.

Dive into the specifics of Flight Centre Travel Group here with our thorough growth forecast report.

PWR Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PWR Holdings Limited specializes in the design, production, and sale of cooling products and solutions across various countries including Australia, the US, and parts of Europe, with a market capitalization of approximately A$1.10 billion.

Operations: PWR Holdings Limited generates revenue through two primary segments: PWR C&R, which contributes A$37.35 million, and PWR Performance Products, accounting for A$104.44 million.

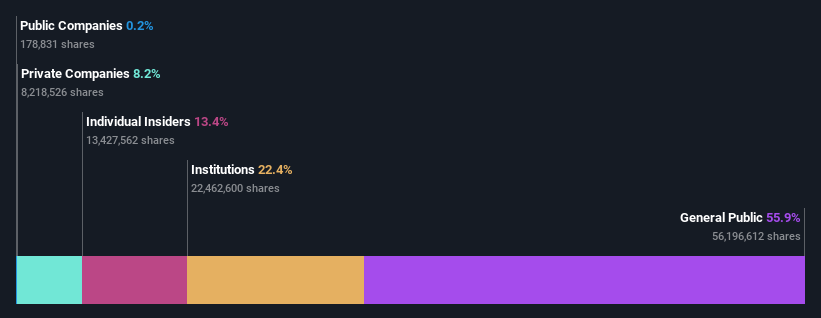

Insider Ownership: 13.4%

PWR Holdings, with recent insider buying, albeit modest, reflects a positive sentiment from those within. The company's revenue and earnings are forecasted to grow at 14.4% and 17% per year respectively, outperforming the Australian market averages. Although its earnings growth isn't exceptionally high, it remains robust compared to sector norms. The addition of Jason Conroy as a non-executive director could further enhance board dynamics given his extensive experience in relevant industries.

Summing It All Up

Discover the full array of 91 Fast Growing ASX Companies With High Insider Ownership right here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:C79 ASX:FLT and ASX:PWH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance