Here's Why You Should Buy Northern Oil Stock

On Jun 22, Northern Oil and Gas, Inc. NOG was upgraded to a Zacks Rank #1 (Strong Buy).

Factors of the Upgrade

The Zacks Consensus Estimate for 2018 earnings per share has been revised upward from 22 cents to 35 cents over the last 60 days. The Zacks Consensus Estimate for 2019 earnings rose to 34 cents from 24 cents This adds to the company’s already impressive earnings profile. Northern Oil has surpassed the Zacks Consensus Estimate in three of the last four quarters, the average positive earnings surprise being 160.4%.

The company has exposure to the Williston Basin, which is considered among the prolific oil plays in the United States. The broader Williston comprises Bakken and Three Forks oil resources. The company has extensive footprint in the core areas of Bakken and Three Forks, spread over 165,000 net mineral acres.

In the Williston Basin, Northern Oil has operating interests in roughly 2,600 gross wells, which indicates large oil production possibilities. These vast resources are likely to be a boon for the company as the prices of the commodity have bounced back from less than $27 per barrel in February 2016 to $65.

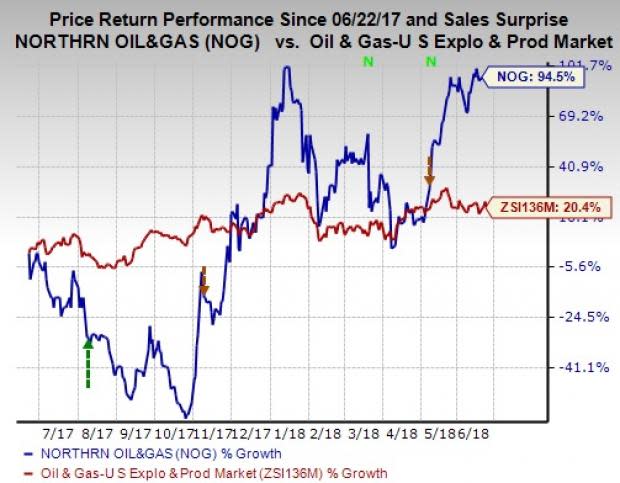

These fundamentals are reflected in the company’s impressive pricing chart. Over the past year, the stock has surged 94.5%, outperforming the 20.4% collective gain of the industry. On top of that, we are expecting the company to record earnings growth of 150% in 2018.

Other Stocks

Other top-ranked prospective players in the energy space are Anadarko Petroleum Corp. APC, Eclipse Resources Corp. ECR and Wildhorse Resource Development Corp. WRD. All the stocks sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

We expect Anadarko Petroleum to witness year-over-year earnings growth of 229.6% in 2018.

Eclipse is expected to record revenue growth of 13.5% through 2018.

Wildhorse will likely see year-over-year earnings growth of 309.3% in 2018.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Anadarko Petroleum Corporation (APC) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

Eclipse Resources Corporation (ECR) : Free Stock Analysis Report

Wildhorse Resource Development Corporation (WRD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance