Analyzing 3 SGX Dividend Stocks With Yields Ranging From 4.7% To 5.4%

In recent developments, the global financial landscape is witnessing significant technological advancements, as illustrated by major banks like Santander rolling out sophisticated cloud-based platforms. This trend underscores the importance of innovation and adaptability in today's dynamic market environment. In this context, selecting dividend stocks that not only offer attractive yields but also demonstrate resilience and strategic foresight in adapting to new technologies is crucial for investors looking at opportunities on the Singapore Exchange (SGX).

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.05% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.53% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.78% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.66% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.93% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.09% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Oversea-Chinese Banking (SGX:O39) | 5.87% | ★★★★☆☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

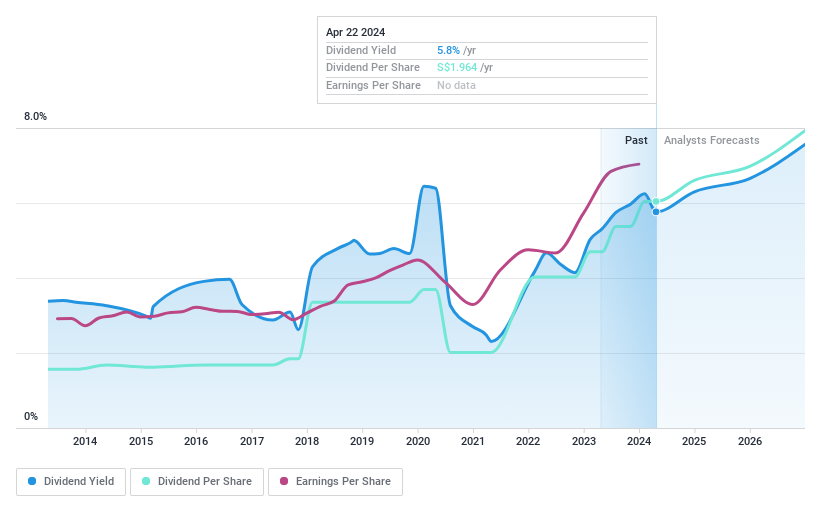

DBS Group Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd operates as a commercial bank offering financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market capitalization of approximately SGD 101.93 billion.

Operations: DBS Group Holdings Ltd generates its revenue through commercial banking and financial services across various regions including Singapore, Hong Kong, Greater China, South and Southeast Asia.

Dividend Yield: 5.5%

DBS Group Holdings has experienced a 16.7% growth in earnings over the past year, indicating robust financial health. However, its dividend yield of 5.48% is below the top tier in Singapore's market, and its dividend track record has been marked by volatility and unreliability over the last decade. On a positive note, dividends are currently covered by earnings at a 50.8% payout ratio, with future coverage also looking sustainable at an expected 66.4%. Recent executive changes aim to enhance technological resilience following operational disruptions.

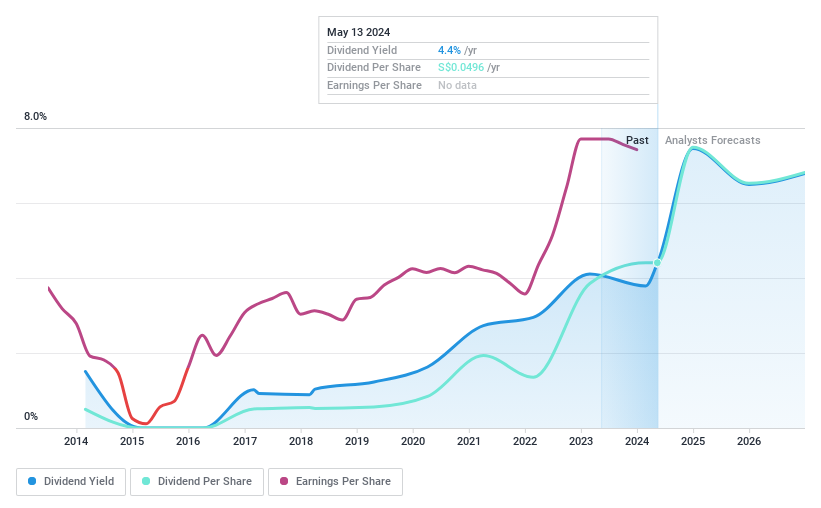

Food Empire Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Food Empire Holdings Limited, an investment holding company, specializes in the manufacturing and distribution of food and beverage products across markets in Russia, Ukraine, Kazakhstan, CIS regions, Southeast Asia, South Asia, and globally with a market capitalization of SGD 542.78 million.

Operations: Food Empire Holdings generates revenue primarily from South-East Asia (SGD 239.74 million), Russia (SGD 152.42 million), South Asia (SGD 68.36 million), and Ukraine, Kazakhstan, and other CIS countries (SGD 110.74 million).

Dividend Yield: 4.8%

Food Empire Holdings has announced a special dividend of SGD 0.05 and approved the same amount as its final dividend for FY 2023, reflecting a commitment to shareholder returns despite past volatility in dividends. The firm's recent acquisition of land in Kazakhstan for USD 30 million signals expansion, promising future revenue growth but also entails significant investment risks. Trading at a value deemed favorable relative to peers, the company's dividends are well-covered by earnings with a payout ratio of 35.2% and cash flows with a cash payout ratio of 50.7%. However, analysts predict only modest annual earnings growth at 3.91%, and its dividend yield remains lower than top market payers in Singapore.

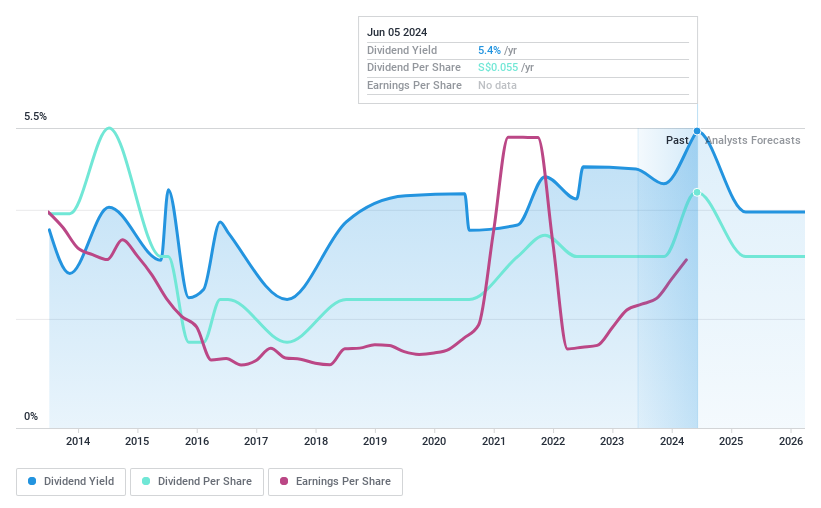

Boustead Singapore

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited is an investment holding company that offers energy engineering, real estate, geospatial, and healthcare technology solutions across multiple regions including Singapore, Australia, Malaysia, the US, Europe, and more; it has a market capitalization of approximately SGD 487.02 million.

Operations: Boustead Singapore Limited generates revenue from several key segments: geospatial solutions contributing SGD 212.67 million, healthcare technology with SGD 10.58 million, energy engineering at SGD 174.41 million, and real estate solutions totaling SGD 369.46 million.

Dividend Yield: 5.4%

Boustead Singapore Limited's dividend history shows instability, with payments fluctuating significantly over the past decade. Despite this, its dividends are well-supported by both earnings and cash flows, evidenced by payout ratios of 40.9% and 28.6% respectively. The company's recent performance indicates robust growth with a significant increase in sales to SGD 767.57 million and net income rising to SGD 64.19 million for FY 2024, outpacing previous years' figures substantially. However, future earnings are projected to decline annually by 9.9% over the next three years, potentially impacting dividend sustainability unless offset by operational efficiencies or new revenue streams from strategic appointments such as Mr Wong Yu Wei as Group COO.

Summing It All Up

Explore the 19 names from our Top SGX Dividend Stocks screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:D05 SGX:F03 and SGX:F9D.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance