ALBIS Leasing (ETR:ALG) investors are sitting on a loss of 28% if they invested three years ago

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, you risk returning less than the market. Unfortunately, that's been the case for longer term ALBIS Leasing AG (ETR:ALG) shareholders, since the share price is down 28% in the last three years, falling well short of the market decline of around 5.0%.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

See our latest analysis for ALBIS Leasing

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

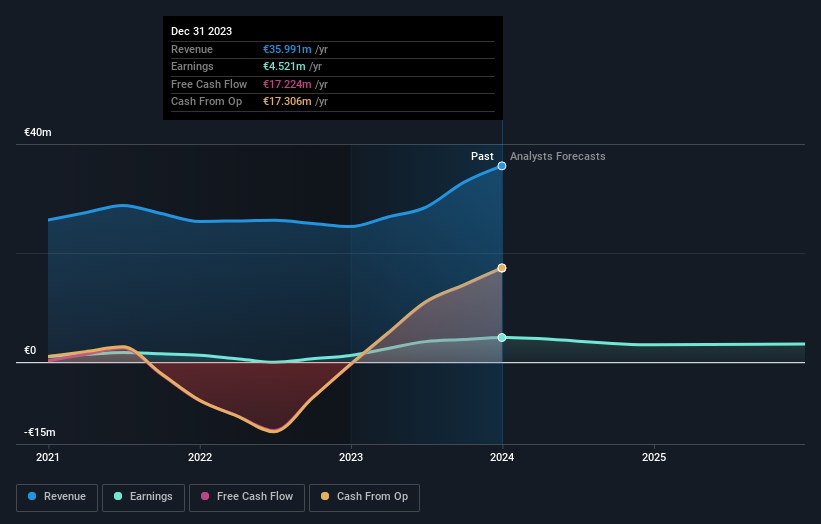

Although the share price is down over three years, ALBIS Leasing actually managed to grow EPS by 59% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that, in three years, revenue has actually grown at a 6.5% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating ALBIS Leasing further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling ALBIS Leasing stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

ALBIS Leasing provided a TSR of 8.7% over the year. That's fairly close to the broader market return. To take a positive view, the gain is pleasing, and it sure beats annualized TSR loss of 3%, which was endured over half a decade. While 'turnarounds seldom turn' there are green shoots for ALBIS Leasing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for ALBIS Leasing (2 are significant) that you should be aware of.

We will like ALBIS Leasing better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance