9 hot tips for millennial investors

A word of warning to the millennials: stealing from the rich to give to the poor could make you an economic casualty of this Coronavirus crash and rally.

One of my favourite heroes has always been Robin Hood. The idea of robbing the bad rich to give to the good poor made so much sense when I was young and very biased!

I no longer accept the proposition that the rich of today are bad like Prince John, the Sheriff of Nottingham and the lords and ladies he counted as his supporters.

As the story went, the Norman aristocrats were less friendly to the poor compared to the Saxon nobles, from which Robin of Loxley (aka Robin Hood) came from.

But that’s a history lesson for another time.

I want to give young or new stock market investors a start-up guide so that they don’t end up as an economic casualty of this Coronavirus crash and rally.

For my SwitzerTV: Investing program on Monday, I looked at the claims of professional fund managers that millennial investors were making this Coronavirus crash-turned-rally into an excessive bounce-back.

In the US, many market pros are worried about a ‘Robinhood’ app that allows stock trading for free. It’s thought that young or new investors are buying and selling stocks like punt-drunk gamblers. Right now, the US market is only 8.6% off its pre-virus level of 3386!

We’re still 20 per cent off our pre-crash high of 7162, so our new investors haven’t gone rogue Robin Hood like the young Yanks but all investors need to be wary of a second-wave infection sell off.

More from Peter Switzer: 5 essential rules for post-coronavirus investors

More from Peter Switzer: Stock buying lessons all investors need to know

More from Peter Switzer: Don’t forget to invest in the most important business – yourself

Here are my 9 market-playing tips for novice investors

Buy quality companies.

One-time good companies can fail in crash economies - take HERTZ filing for bankruptcy, for example.

Don’t be afraid to take profit on fast-rising shares.

Some investors will sell gains to get their stake money back, but let their profits run.

Be wary about borrowing using margin loans to buy shares.

If you buy quality companies at historically low prices to hold for a few years, then this should be a rewarding strategy.

Try to have a group of stocks so you are diversified and not over-reliant on one company that could be badly affected by a dumb government, a silly CEO or a pandemic!

Understand you’re taking risks to gain higher returns, so you can’t complain if you endure losses.

That said, your losses today can become great profits in the long term.

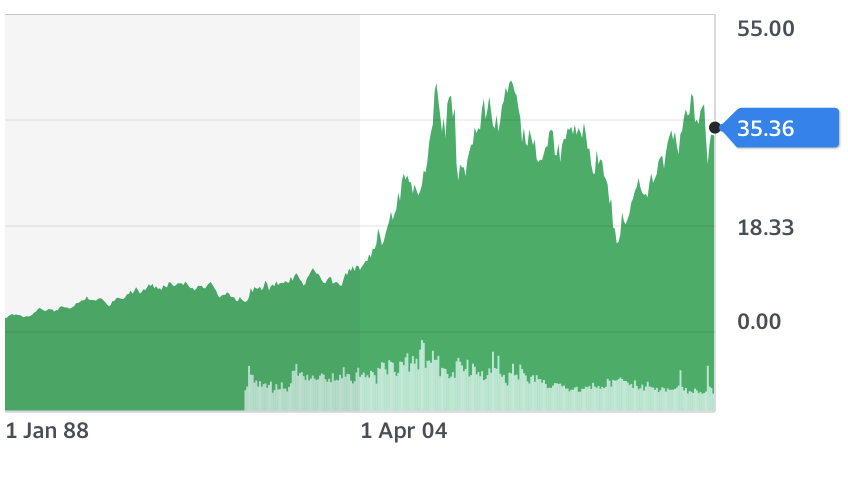

This chart of BHP shows that this now high-flying company had a few problems in 2016, when the mining boom collapsed.

Before February 2016, arguably the best miner in the world was a $43 stock but when things went from bad to worse, the price fell to as low $14.20.

On my old Sky Business TV show, SWITZER, I kept asking experts if this was the time to buy but few were prepared to take a punt until it got into the $15 region.

My argument was if we guess this one $43 stock gets to $20 in three years, we’d make about $6 on $14 and that’s a 71% return or around 23% a year! Plus there are dividends!

BHP

The miner is now a $35 stock but was a $41 stock before the Coronavirus came to town.

So what’s the most important lesson? Buy quality at good prices and be prepared to wait.

Are you a millennial or Gen Z-er interested in joining a community where you can learn how to take control of your money? Join us at The Broke Millennials Club on Facebook!

Yahoo Finance

Yahoo Finance