5 essential rules for post-coronavirus investors

Six months ago, some of the younger team in my office asked if they should start investing in the stock market.

My answer was that they could start small and learn how to buy and sell stocks but the best time for them to start might be after a stock market crash!

I said to them that I thought 2020 would be OK because I suspected Donald Trump would not want a Wall Street crash in a year when he was hoping to be re-elected.

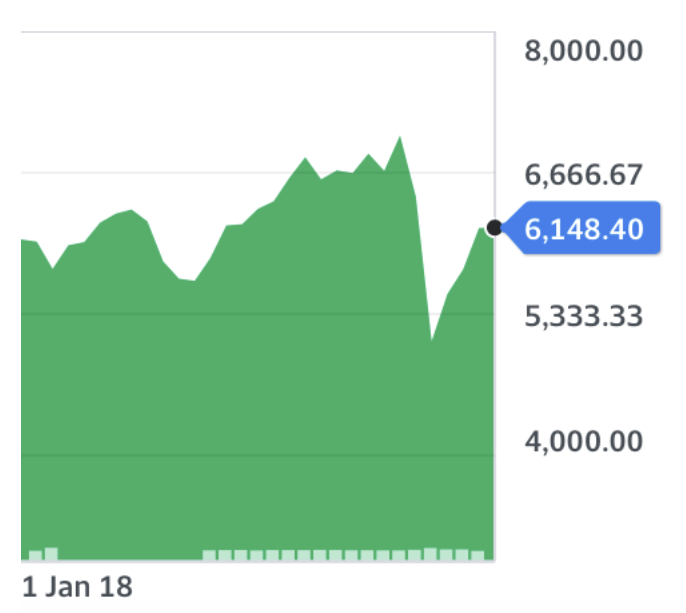

And he had kissed and made up with China on his little trade war, which helped 2019 be a great year for stocks after that trade spat KO’d the market in 2018, as the chart below shows.

S&P/ASX 200 Index

I said 2021 could be a stock market sell-off year or 2022, as these are historically the worst stock market years in a US Presidential cycle.

Also, we hadn’t seen a stock market crash since the 2008-09 GFC, and they tend to happen every 9-10 years. I suggested they might save up and go long great stocks when the crash happened.

More from Peter Switzer: Stock buying lessons all investors need to know

More from Peter Switzer: Don’t forget to invest in the most important business – yourself

More from Peter Switzer: What do Warren Buffett and Kim Kardashian have in common?

I told them that before that GFC crash, CBA was a $60 stock but fell to $27 during that time and is now a $70 stock. And people who bought that then are getting dividend returns of 17% plus because they bought a great company when everyone was really scared.

Macquarie Group saw its share price drop to $16 during the GFC and its now $120 but not long ago it was $151!

5 rules to follow before you invest

With a lot of people making money at the moment as the local stock market rebounds out of the Coronavirus crash, I’m thinking about what many people do wrong when it comes to getting richer.

So here are a few rules I’d like you to think about before you invest or save:

If the returns look better than government guaranteed term deposits, then they are more risky and you could lose your money or see it shrink.

Be diversified. When we create a portfolio of stocks for our financial planning clients, they could be in 20 different shares/companies.

Try to buy when sellers are pushing down the share prices of really good companies and think about where the share price might be in the long term.

Think of a share as your part-ownership in a company, so make sure you like the business and see it as something that has real potential because then its share price should eventually show this potential.

Read as much as you can and do as much research as possible on what you are investing in and remember if it’s a quality business, even if the market crashed again, it’s the quality businesses that either don’t fall too much or rebound the quickest.

Look at how Xero, which is becoming a highly-regarded modern business here in Australia, rebounded out of the Coronavirus crash.

Before the recent crash, it was an $89 stock but it fell to $58.75 on March 23. By June 3 it was an $89 stock again. It dropped back on June 10 but you get my point.

Now that’s a quality act.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance