8 Australian property regions to avoid in 2020

The property market registered an uptick in the second half of the year, but that doesn’t mean all of Australia enjoyed the good news.

According to the experts, there are some hotspots (and some in regional areas) that buyers should be keeping an eye on in 2020 – but also some that Australians should black-list.

“In terms of sales volumes, most regions of Australia have generally seen a much lower number of transactional activity this year relative to last with confidence clearly weighing down on market participation, even the regions with the highest change in sales activity recorded less than a 1 per cent change annually,” stated CoreLogic’s Regional Market Update October 2019 report.

September 2019: Australian property markets roar back to life after 22 months of falls

November 2019: RAPID RECOVERY: House prices gains largest in 16 years

Looking ahead: Here’s where Australian property prices are going in 2020

If you’re house-hunting, data from CoreLogic has revealed there are nine suburbs that you should avoid, with these areas registering the greatest falls in property values in 2019.

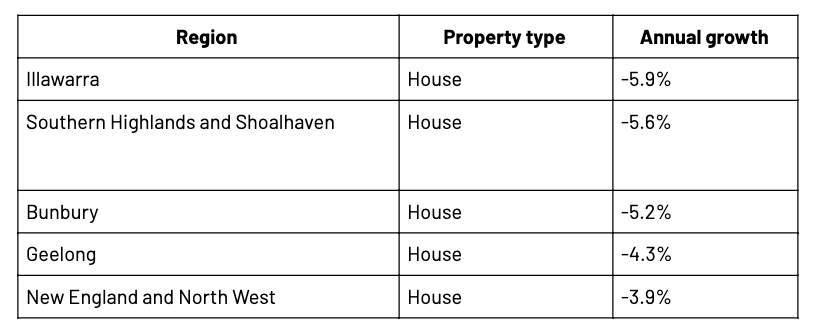

House price growth in NSW’s Illawarra region dropped by 5.9 per cent this year, closely followed by Southern Highlands and Shoalhaven at 5.6 per cent.

“Houses are sitting on the market for over 100 days across the Southern Highlands & Shoalhaven region of NSW,” the report said.

Worst-performing regional areas in 2019: Houses

Bunbury property values dropped by 5.2 per cent, while Melbourne’s neighbour Geelong fell 4.3 per cent and Upper NSW’s New England and North West region fell by 3.9 per cent.

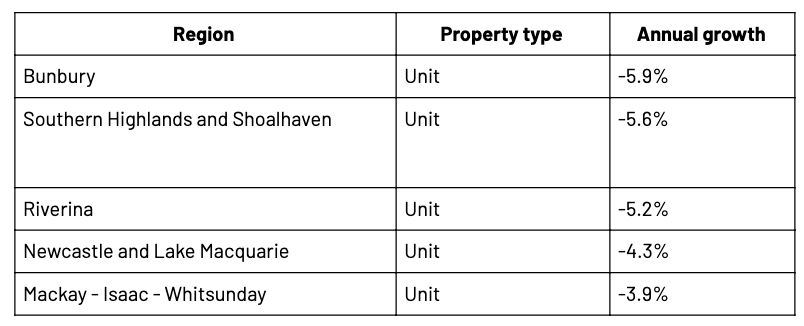

Worst-performing regional areas in 2019: Units

If you’re in the market for a unit or apartment, be sure to steer clear of Bunbury as well as Southern Highlands and Shoalhaven, which have registered an eye-watering 17.2 and 13.1 per cent drop in property value growth respectively.

Growth in unit prices in Riverina has dropped by 10.9 per cent. Newcastle and Lake Macquarie as well as Mackay, Isaac and Whitsunday are also performing poorly, falling by 6.8 per cent and 4.7 per cent respectively.

“The unit market recorded fewer regions with positive annual growth in October,” the report said.

“In New England & North West NSW, selling conditions are much more challenging with units taking around 112 days to sell. The largest discounts were seen across Mackay- Isaac- Whitsunday in Queensland, where vendors are discounting units by -8.8 per cent.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance