Here’s where Australian property prices are going in 2020

Good news for property investors: the Australian housing market is set to perk up in the next two years.

That’s according to the 2019 August CoreLogic Hedonic Home Value Index, which revealed that the Reserve Bank of Australia’s rate cuts and the easing of credit standards would result in a pickup in the property market.

“Our long-held baseline forecast—that the trough in the national housing market has occurred—is evident in improving activity in the Sydney and Melbourne markets, where 60 per cent of activity takes place,” said Moody’s Analytics economist Katrina Ell.

“Improved auction clearance rates in these cities, alongside the return of monthly dwelling value growth, according to CoreLogic data, support the outlook for ongoing improvement.”

Related story: Housing market sprints ahead as buyers urged to get in now

Related story: Property investors flock to Sydney once again

Related story: What if interest rate cuts fuel house prices but nothing else?

The housing market has also been “particularly responsive” to RBA’s rate cuts, which have been closely reflected in the lending rates, Ell added.

“Much of the strength in house prices and construction during the most recent boom was thanks to the decline in interest rates.”

Sydney and Melbourne is predicted to see growth of 7 per cent or more in the next year and the year after, with Brisbane, Adelaide and the ACT also set for positive growth.

Meanwhile, Darwin, Perth and Tasmania and the NT will see some dips either in 2020 or 2021.

Here’s what property values are forecast to like in every Australian state in 2020:

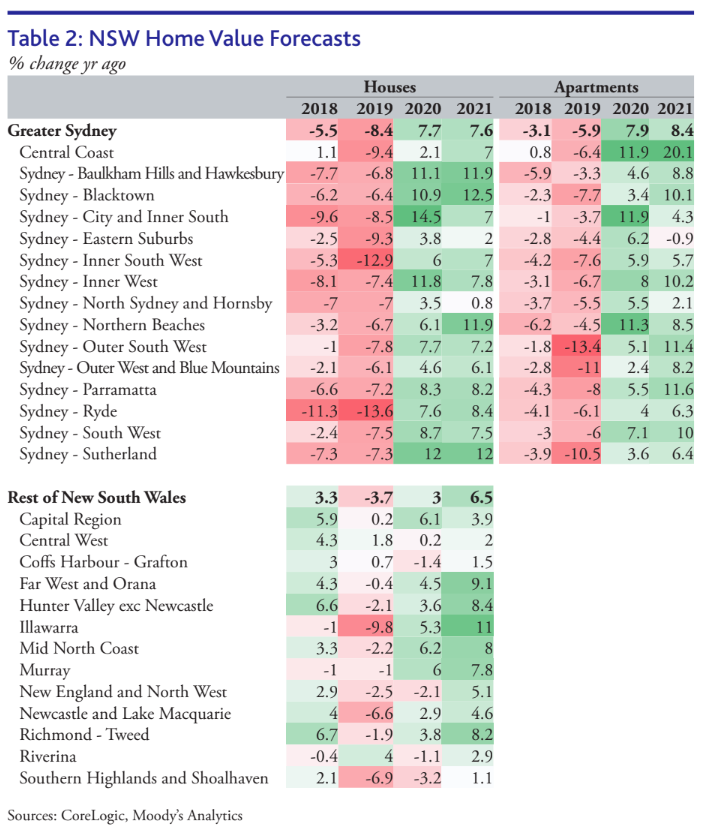

New South Wales

The NSW capital’s recent property market correction has been “the longest and steepest on record for the Sydney market,” Ell said, but is also looking to be emerging from this correction.

House values are set to rise 7.7 per cent next year and 7.6 per cent in 2021, and apartment values to jump 7.9 per cent in 2020 and even further at 8.4 per cent in 2021.

All things considered, house values in Sydney are still high and are up 60 per cent from 2012 levels, Ell pointed out: Demand has risen for more affordable areas outside of Sydney, such as the Hunter Valley, which have become attractive for those who work in Sydney but can’t afford property within the city.

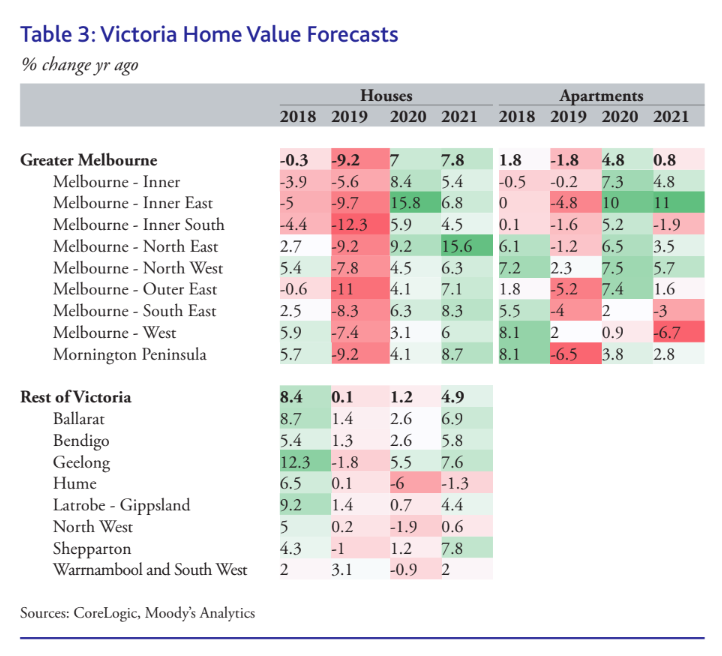

Victoria

The correction in house values will continue for the rest of 2019, with some of the sharpest declines predicted in Melbourne’s Inner South, Outer East and Inner East.

But some of the same areas will see a pick-up come next year.

“A stronger recovery in house values is forecast going into 2020 and 2021, driven by improvements in most suburbs, including a notable pickup in prices in Melbourne-Inner East and North East,” said Ell.

“In 2020, a strong recovery is predicted for most suburbs; unit values in Greater Melbourne are predicted to rise by 4.8 per cent, though values in the West and South East suburbs are likely to grow at a relatively weaker pace.”

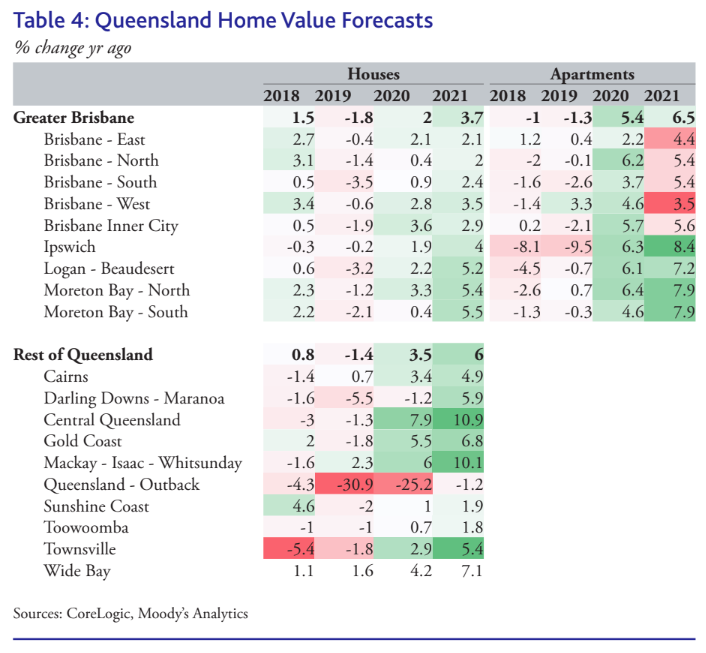

Queensland

Queensland’s property market has done better than other states but hasn’t entirely escaped the downturn. Queensland can be divided into “three distinct groups,” according to Ell:

The first is the bulk of Brisbane, which has seen healthy growth but is now seeing a moderate correction. “The outlook for these housing markets remains either flat or mildly positive over the forecast period.”

The second is ‘lifestyle areas’ such as the Sunshine Coast, Wide Bay, and Cairns, which are expected to perform better in 2020 and 2021.

The third Queensland housing market region consists of “commodity or agriculture-producing areas”, such as Central Queensland, Mackay-Isaac-Whitsunday, and Darling Downs-Maranoa. Property values in these areas have suffered due to the end of the mining boom, and drought conditions will see further declines.

Brisbane is forecast to see growth of 2 per cent in 2020 and a further 3.7 per cent in 2021.

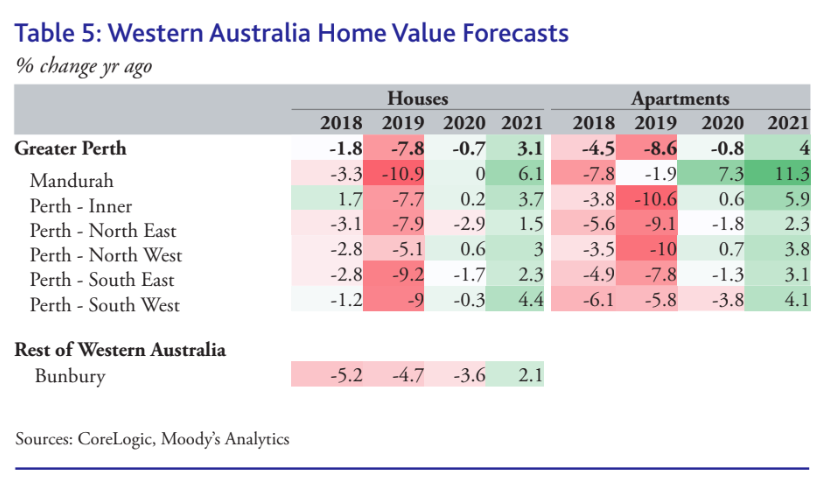

Western Australia

According to Ell, the WA property market took a turn for the worse in the last quarter, and the decline is set to continue into next year.

“Given the subdued conditions, the housing market is expected to continue declining in 2019, with the trough not likely until 2020, after which conditions will begin to pick up before a modest recovery in 2021,” said Ell.

Perth house prices are predicted to drop by -0.7 per cent in 2020 before rising 3.1 per cent in 2021, according to Moody’s Analytics forecasts.

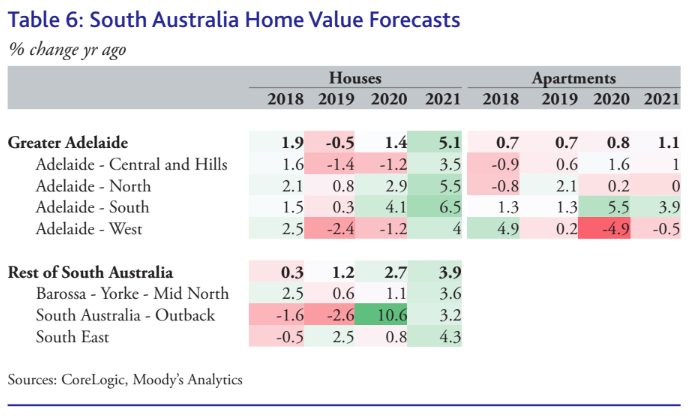

South Australia

The SA housing market remains “relatively stable”, though there will be some divergence in property values.

“In 2020, house values are predicted to rise by 1.4 per cent in Greater Adelaide, supported by a strong pickup in house prices in North and South Adelaide. The weakness in house values in Central and West Adelaide, however, is likely to persist next year, with values projected to decline by 1.2 per cent in both suburbs in 2020,” said Ell.

“In comparison, house values in regional South Australia are expected to record stronger growth of 2.7 per cent in 2020, driven by a significant increase in home values in South Australia-Outback.”

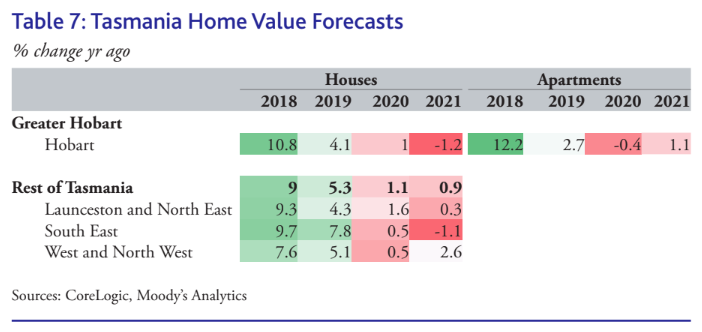

Tasmania

While Tasmania enjoyed a strong performance in its property market when other states dipped, it is set for a correction in the next two years.

“House values are not expected to decline in 2019-2020 but are set for a noticeable deceleration. Apartment values will follow a similar pattern as the strong growth up to 2018 will likely be countered by a significant slowdown from 2019.”

One per cent growth is predicted for Hobart in 2020, but this will drop to -1.2 per cent in 2021.

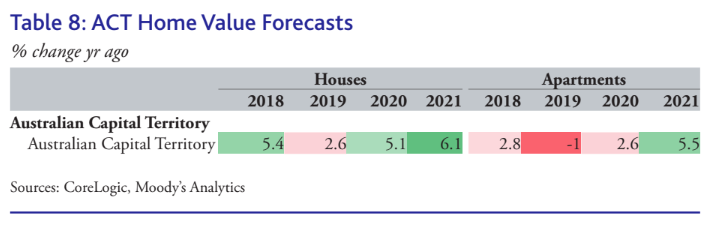

Australian Capital Territory

The ACT’s property market is forecast to see decent growth of 5.1 per cent growth next year and grow a further 6.1 per cent in 2021.

Government consumption expenditure and a healthy unemployment rate has been the drivers behind positive growth so far.

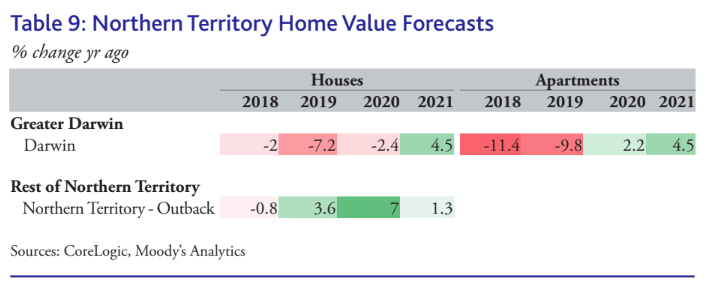

Northern Territory

The NT’s housing market has been declining for the last two years, and this drop is forecast to continue on in 2020. However, a pickup is expected in 2021, though it is lower than previously thought.

“The recovery in 2020 will be less than our prior estimate. Despite the NT housing market being weak while other states enjoyed strong growth until around 2017, particularly in New South Wales and Victoria, house prices in NT have failed to grow from a relatively low base,” said Ell.

“This suggests that the NT housing market has decoupled from the broader national trends and is more driven by local investment and building.

“However, the recent RBA cash rate cuts should help soften the fall and speed up the recovery.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance