10 worst off-the-plan Aussie suburbs in 2018 revealed

We’re living in a post-property-boom era, in a time when the term ‘off-the-plan’ starts ringing alarm bells, especially given almost all capital cities in Australia are suffering from potential unit oversupply.

With that in mind, RiskWise has compiled a list of the most risky suburbs across the country.

Also read: Are investors making a permanent retreat from Aussie property?

The widespread oversupply issue is universally acknowledged by banks, including the Reserve Bank of Australia, who have all compiled ‘blacklists’ for postcodes that are suffering from potential unit saturation.

Lenders will either require a much higher deposit as security on their loan, or they may turn down a loan application entirely.

Lenders understand that oversupplied suburbs carry a greater degree of risk – and those risks are just as real for the investors who buy in those suburbs. In fact, they are one more risk on top of a number of unique dangers inherent in off-the-plan builds.

Also read: Why these ‘superstar’ cities have broken away from the Aussie property market

Unlike a straightforward property handover, off-the-plan investors must be able to attain finance approval after construction is complete, and if the market has sunk during the build period, they are fronting the mortgage on an over-valued property.

Additionally, off-the-plan dwellings are typically marketed to investors, and when many – sometimes hundreds – of identical dwellings come online simultaneously, it can be a race to the bottom as investors drop rents to lure in a tenant. Squashed property values and high vacancy rates are hallmarks of the new oversupply issue.

Despite the concerns, the unit market continues to grow. More than 315,000 units have been approved for construction across Australia over the next two years.

Also read: The Australian economy – where the bloody hell are we?

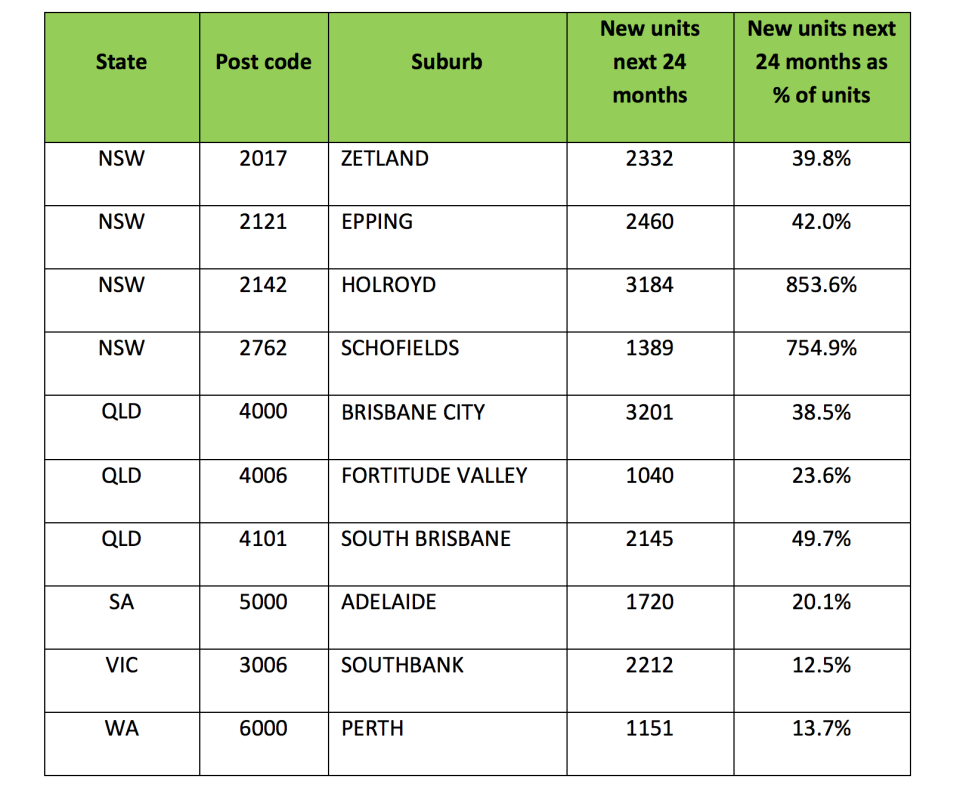

If we look at the top 10 suburbs on the list, it’s no surprise to see several city centres make an appearance – particularly Brisbane, which features prominently on lenders’ blacklists.

In 2017, more than 5300 units were completed in Brisbane, with another 11,000 in construction. What we’re currently seeing on the market is a lot of incentivised advertising, from offers of full furnishings included to a free car on settlement.

But taking out number one spot is Zetland, a former industrial zone 4km south of Sydney’s CBD. Now in an advanced stage of gentrification as part of an urban renewal project, the residential development of choice has been high-density units and apartments, with more than 5000 new units in the pipeline across Zetland and neighbouring Waterloo since 2016.

Also read: Forget Sydney, here’s Australia’s boom property markets in 2018

“We would advise any investors looking at off-the-plan purchases to know what to look for and the degree of risk involved. Buyers should arm themselves with an in-depth analysis on the suburb’s ability to absorb the new unit supply, and the potential impact on future capital gains,” RiskWise said.

Top 10 Danger Zone suburbs

Using its advanced algorithm and analysis tools, RiskWise has also pinpointed five key factors that create poor off-the-plan investment environments.

1. Poor economic growth

Undoubtedly, the number one failure factor for both houses and units is poor economic growth. Our research has shown that areas with weak economic growth underperformed the national benchmark, delivering an average five-year uplift of 10.4%.

This is compared to suburbs with strong and sustainable economic outlooks which outperformed the national benchmark in 90% of cases, delivering an average five-year growth of 48%.

2. Oversupply and high proportions of new units

Even in areas that enjoy a strong, sustainable economic growth, the dampening effect of off-the-plan oversupply on the market is clear. A high proportion of new units in a relatively small area shows a strong correlation with poor capital growth.

For example, although Melbourne has one of the country’s strongest economic growth outlooks and held a very strong housing market for several years, Box Hill experienced a negative capital growth of 8% in the last 12 months, due to oversupply. Around 1800 units were in the pipeline in 2017, an addition of more than 30% to the existing stock.

3. Houses versus units

Off-the-plan units are weaker investments than new house builds in the same suburb. For example, houses in Queensland’s suburb of Chermside achieved a five-year growth of 32%, versus unit growth of just 2%.

4. Middle-ring units vs. inner-ring units

Inner-ring demand doesn’t extend to units, with CBD units delivering poorer capital growth than units in the middle ring. Prime examples of poor growth are Melbourne’s Southbank, and Fortitude Valley in Brisbane, with negative growths of -1% and 4.8%, respectively.

5. Renter ratio

The higher the renter ratio, the poorer the capital growth performance of off-the-plan dwellings. Houses and units purchased in suburbs with a renter ratio lower than 50% delivered five-year growth of 41.6%. Where the renter ratio was higher than 70%, we saw an average 22.3% growth in the same timeframe.

Yahoo Finance

Yahoo Finance