The science behind goal-setting (and how to use it to your advantage)

When mapping out goals, we’re often told to make sure they’re realistic.

But removing reality, and even money, from the equation can help us get a truer sense of who we are, what we need and what we want. And then we can delve back into reality with a bit of inspiration in our back pocket.

It may seem wooly, but the truth is there’s science behind the power of goals.

A Cornell University study found that when we set goals, we trick our brains into thinking we own it, or into believing that the goal is an extension of ourselves.

Stanford University psychologist, Kelly McGonigal also says a crucial element in achieving your goals is to frame them positively – focus on what you want, not what you don’t want.

And a Harvard Business Study found that of those who graduated from their MBA, the 3 per cent who wrote their goals down ended up earning 10 times as much as the other 97 per cent put together within 10 years of graduation.

Here’s how you can use this to your advantage:

Step one: focus on what you want

When it comes to financial goals, the best place to start is by focusing on what you want.

The “how” of getting there comes after, and that’s the way it should be, argues AMP Goals Coach, Tanner Tupou.

Money is an incredibly personal topic – opening up to a financial adviser can be difficult.

In fact, most of us are more comfortable talking about our weight, politics or even sex than money. This discomfort doesn’t just disappear when we’re talking to a financial adviser.

But as soon as the conversation is reframed to discuss wants, not haves, it becomes a lot easier and even fun.

That’s the concept behind the AMP Goals Centres.

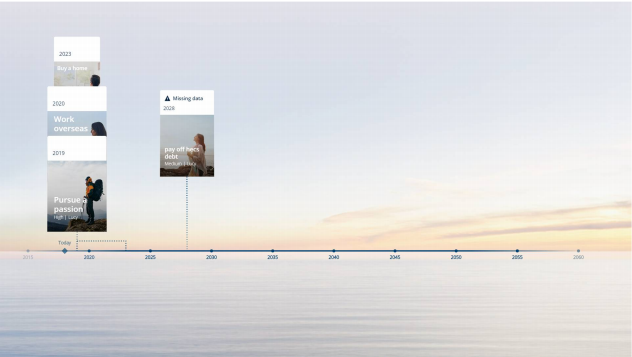

The free service is designed around encouraging conversations. Users pick out their goals from a wall of goals and then discuss their priorities and the time frames.

And then it’s written down and printed out.

Step two: write it down

Writing it down makes it real, explains Tupou, and “you don’t worry about things until it’s real”.

Science backs it up: you’re 42 per cent more likely to achieve your goals just by writing them down, found the Dominican University in California’s Dr. Gail Matthews.

Putting pen to paper forces you to be clear about what you want to accomplish, and also motivates you to actually do it.

And as financial goals like raising a family, buying a home or saving for retirement are often shared by a partner, writing it down forces you to have the tough conversations.

Step three: be prepared

Visualising your success is critical, but it’s also important to be realistic. Psychotherapist Amy Morin, warns that vision boards can be destructive without the legwork required to achieve the goal.

“Rather than get out there and work toward their goals, people who created vision boards seemed to be waiting for the universe to grant their wishes,” she told online workplace publication Inc.

One man with a vision board which including a mansion, sports car and attractive girlfriend was convinced all he had to do was visualise the goals and the universe would grant his wish.

“He was barely making ends meet, and he hadn’t been on a date in years, but he was convinced that the law of attraction would magically make his dreams come true. Rather than get a new job or put himself out there socially, he passively waited for his life to change.”

The better option is to visualise yourself putting in the effort to achieve the goals. So if you want to smash an exam, you should visualise yourself studying, rather than scoring an A+. Similarly, if you’re saving for a home, you should visualise yourself saving, just as much as you visualise yourself crossing the threshold.

Step four: be honest

Tanner related the story of a couple who came into the Goals Centre believing they were on the same page when it came to their children’s education – give them a good education.

But they swiftly realised they weren’t aligned.

“Conceptually they agreed on the goal, they wanted to provide the best education for their child. But it’s the details around it,” Tupou said.

One partner wanted to send the child to a private school. The other argued that private education is expensive, their child should go to a state school and they could save that money for university.

“They had spoken about it before but it was only when it came to writing it down that it became more real and this is where the disagreements came from.”

Understanding what you’re willing to sacrifice and do will make it easier to achieve your goals. If you have a goal of running a marathon, it’s important to understand that you might need to sacrifice a few social outings and sleep-ins.

But if you enter the process understanding this, you’re less likely to consider these as hurdles to success.

The same goes for finance. If you understand that sending your child to private school may incur costs or require you to save, you’ll either reassess or at the very least be prepared to do what it takes.

Having too many big-ticket goals can also be counterproductive, so it’s critical to be honest about your priorities. AMP’s Goal Centres encourage users class their goals as low priority, medium or high priority.

Then they ask you for your timeline and to consider why the goal is important. Users then have a choice to proceed to a financial adviser, or just mull over their goals on their own.

Step five: work at it

You’ll need an action plan and a timeline to keep yourself accountable. And you’ll also need to monitor your progress and be prepared to adjust to setbacks.

It’s about being “goals-centric”, Tupou says, not just “goals aware”.

And it’s about making ourselves liable.

After all, we really are the only ones who can make them happen.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: 7 tips to choose the perfect candidate for the job

Now read: Why Aussies are leaving their telcos in droves

Now read: Six most bizarre insurance claims Aussies made in 2018

Yahoo Finance

Yahoo Finance