Intel Corporation (INTC)

Pre-market:

| Previous close | 31.36 |

| Open | 31.04 |

| Bid | 30.45 x 1300 |

| Ask | 30.50 x 1400 |

| Day's range | 30.42 - 31.17 |

| 52-week range | 26.86 - 51.28 |

| Volume | |

| Avg. volume | 48,981,436 |

| Market cap | 129.707B |

| Beta (5Y monthly) | 1.01 |

| PE ratio (TTM) | 31.41 |

| EPS (TTM) | 0.97 |

| Earnings date | 25 July 2024 - 29 July 2024 |

| Forward dividend & yield | 0.50 (1.64%) |

| Ex-dividend date | 06 May 2024 |

| 1y target est | 40.51 |

Yahoo Finance

Yahoo FinanceAMD beats on Q1 revenue and EPS, stock edges lower on light guidance

Chip giant AMD reported its first quarter earnings on Tuesday beating analysts' expectations on the top and bottom lines, but lighter-than-anticipated guidance for the next quarter sent the stock lower.

- Yahoo Finance Video

April was a losing month for tech stocks. Here's why

Stock market indexes (^DJI, ^IXIC, ^GSPC) cap off the last day of trading in April, closing lower this session and over the past month. The Dow Jones Industrial Average fell off by 570 points in Tuesday's session. Yahoo Finance Senior Markets Reporter Jared Blikre reviews the losses seen across sectors and declines in mega-cap tech market caps in the month of April. For more expert insight and the latest market action, click here to watch this full episode of Market Domination Overtime. This post was written by Luke Carberry Mogan.

Bloomberg

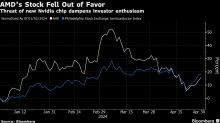

BloombergAMD Slides After AI Chip Forecast Misses Lofty Estimates

(Bloomberg) -- Advanced Micro Devices Inc. shares declined as much as 9.1% in extended trading after the chipmaker gave a disappointing forecast for artificial intelligence processors, a lucrative market now dominated by Nvidia Corp.Most Read from BloombergTesla Axes Most of Supercharger Team in Blow to Other AutomakersTraders Expect Biggest Fed-Day Move in S&P Since 2023, Citi SaysWall Street Hit by Fed Jitters to Close Wild April: Markets WrapPot Stocks Surge on Report DEA Set to Reclassify Ma