GME Jun 2024 34.000 put

| Previous close | 9.10 |

| Open | 9.31 |

| Bid | 10.20 |

| Ask | 10.75 |

| Strike | 34.00 |

| Expiry date | 2024-06-28 |

| Day's range | 9.31 - 10.51 |

| Contract range | N/A |

| Volume | |

| Open interest | 43 |

Insider Monkey

Insider MonkeyWhy is Reddit so Great for Research on Stocks?

We recently made a list of 15 Best Websites To Research Stocks. Reddit is one of them. While Reddit is not a finance platform, the threads it has on investing are extremely useful. When it comes to building a strong portfolio, retail investors conduct a great deal of research to learn about the macroeconomic climate, […]

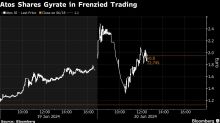

Bloomberg

BloombergParis Gets a Wild Meme Stock as Atos Becomes a Chatroom Favorite

(Bloomberg) -- The logic-defying swings in shares of Atos SE suggest Paris is experiencing a slice of the meme-stock craze seen in the US.Most Read from BloombergCar Dealerships Across US Halt Services After CyberattackCDK Tells Car Dealers Their Systems Likely Offline Several DaysPutin’s Hybrid War Opens a Second Front on NATO’s Eastern BorderHedge Fund Talent Schools Are Looking for the Perfect TraderStocks Show Signs of Buyer Exhaustion After Rally: Markets WrapAnalysts have warned that share

Yahoo Finance

Yahoo FinanceGameStop should ditch retail and become a holding company like Warren Buffett's Berkshire Hathaway

GameStop is a retailer no more. One retail expert makes his case.