Biohaven Ltd. (BHVN)

After hours:

| Previous close | 40.24 |

| Open | 41.01 |

| Bid | 41.36 x 800 |

| Ask | 41.37 x 1200 |

| Day's range | 40.76 - 41.84 |

| 52-week range | 16.45 - 62.21 |

| Volume | |

| Avg. volume | 1,234,419 |

| Market cap | 3.639B |

| Beta (5Y monthly) | N/A |

| PE ratio (TTM) | N/A |

| EPS (TTM) | -6.90 |

| Earnings date | N/A |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | N/A |

| 1y target est | 58.22 |

PR Newswire

PR NewswireBiohaven Showcases Broad Innovative Portfolio and Pipeline Updates Across Multiple Therapeutic Areas including Immunology, Neuroscience, Metabolic Disorders and Oncology at Annual Investor R&D Day

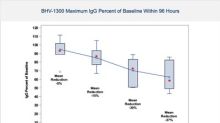

Biohaven Ltd. (NYSE: BHVN) (Biohaven or the Company), a global clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of life-changing therapies, provides an overview of its development and regulatory advances across multiple therapeutic areas, and highlights the progress of its innovative degrader pipeline at the Company's 2024 Investor R&D Day today, held concurrently with the Yale Innovation Summit in New Haven, Connecticut. Members of Biohaven's

PR Newswire

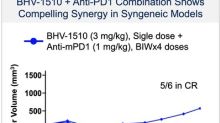

PR NewswireBiohaven Doses First Patient with its Novel Trop-2 Directed Antibody Drug Conjugate (ADC) BHV-1510 in Advanced or Metastatic Epithelial Tumors

Biohaven Ltd. (NYSE: BHVN) (Biohaven), a global clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of life-changing therapies to treat a broad range of rare and common diseases, announced the first patient has been dosed in a first-in-human Phase 1/2 study of BHV-1510, a highly differentiated Trophoblast Cell Surface Antigen-2 (Trop-2) directed Antibody Drug Conjugate (ADC), and the lead ADC program to advance into clinical trials in Biohaven's g

GuruFocus.com

GuruFocus.comDirector Gregory Bailey Acquires 15,000 Shares of Biohaven Ltd (BHVN)

On May 13, 2024, Gregory Bailey, Director of Biohaven Ltd (NYSE:BHVN), purchased 15,000 shares of the company.