BABA Sep 2025 40.000 put

| Previous close | 0.8200 |

| Open | N/A |

| Bid | 0.0000 |

| Ask | 0.0000 |

| Strike | 40.00 |

| Expiry date | 2025-09-19 |

| Day's range | 0.8200 - 0.8200 |

| Contract range | N/A |

| Volume | |

| Open interest | 1 |

- South China Morning Post

Alibaba denies talks to sell Lazada's Thailand unit as it eyes continued global expansion

Southeast Asian online shopping giant Lazada Group has refuted a report that parent company Alibaba Group Holding is planning to sell its Thailand unit, as China's largest e-commerce conglomerate eyes overseas expansion amid a domestic economic slowdown. "Lazada Group is not considering any divestment of our business in Thailand and is not in discussion with any investors on this topic," the company said in a statement. "Any rumours stating otherwise are untrue." The Bangkok Post on Thursday rep

Bloomberg

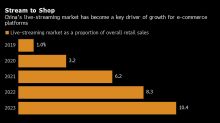

BloombergChina’s Ecommerce Giants Splash Out to Jolt Wary Shoppers

(Bloomberg) -- China’s shoppers are getting wooed this week like never before. Most Read from BloombergCar Dealerships Across US Halt Services After CyberattackWhat to Know About the Deadly Flesh-Eating Bacteria Spreading in JapanHedge Fund Talent Schools Are Looking for the Perfect TraderPutin’s Hybrid War Opens a Second Front on NATO’s Eastern BorderNvidia’s 591,078% Rally to Most Valuable Stock Came in WavesThe country’s biggest internet firms are pulling out all the stops during the annual “

South China Morning Post

South China Morning PostChina's 618 shopping festival ends with Alibaba, JD.com declaring victory amid 'waning' interest

Alibaba Group Holding and JD.com touted impressive growth trends but declined to reveal total gross merchandise value (GMV) figures for their midyear 618 shopping festival events, as China's major e-commerce players remain locked in a heated battle to get consumers to open their wallets amid the country's economic slowdown. Both e-commerce giants declared victory as they fend off competition from rivals Pinduoduo, operated by Temu owner PDD Holdings, and Douyin, the Chinese equivalent of TikTok