Youdao (NYSE:DAO) Shareholders Have Enjoyed A 45% Share Price Gain

The Youdao, Inc. (NYSE:DAO) share price has had a bad week, falling 12%. But that doesn't change the reality that over twelve months the stock has done really well. Looking at the full year, the company has easily bested an index fund by gaining 45%.

Check out our latest analysis for Youdao

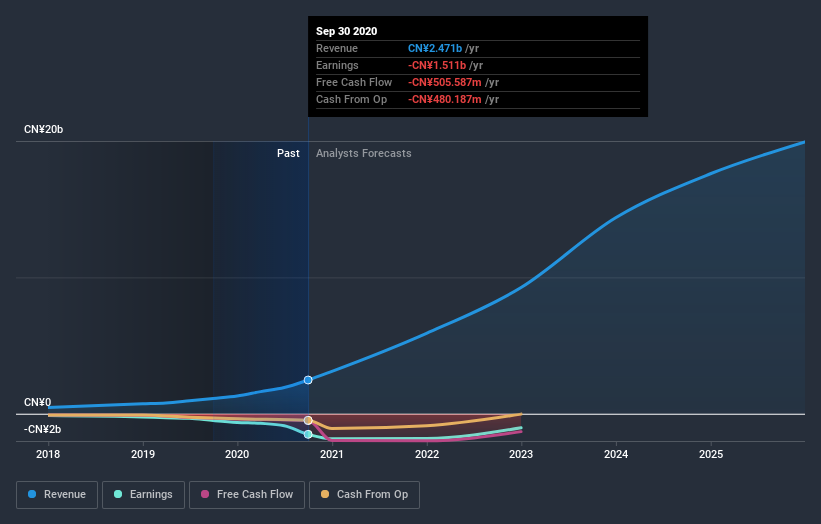

Given that Youdao didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Youdao grew its revenue by 119% last year. That's stonking growth even when compared to other loss-making stocks. The solid 45% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate Youdao in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Youdao stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Youdao shareholders should be happy with the total gain of 45% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 27% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Youdao is showing 4 warning signs in our investment analysis , and 2 of those are potentially serious...

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance