Yandex (YNDX) Q3 Earnings Miss, Revenues Beat Estimates

Yandex N.V. YNDX reported third-quarter 2019 adjusted earnings of 32 cents (RUB 13.85) per share missing the Zacks Consensus Estimate by 3 cents. Further, the figure has declined from the year-ago quarter figure of RUB 14.25.

Revenues of $698.8 million (RUB 45 billion) surpassed the Zacks Consensus Estimate of $672 million. The figure exhibited year-over-year growth of 38% in ruble terms.

The company’s growing advertising revenues, solid momentum in the Russian search market and robust performance by Taxi segment drove the top line during the reported quarter. Additionally, the company witnessed year-over-year growth of 22% in its paid clicks during the third quarter.

Further, well-performing Classifieds, Media Services and Experiments segments of the company contributed to the results.

However, increasing expenses hurt margin expansion during the reported quarter.

Coming to the price performance, shares of Yandex have gained 20% on a year-to-date basis, outperforming the industry’s growth of 6.4%.

We believe Yandex’s strong momentum across Taxi and ride sharing business remains a major positive. Moreover, the company has raised revenue outlook for 2019, which is likely to instill investor optimism.

Top Line Details

Total online advertising revenues amounted to RUB 31.23 billion (69.4% of total revenues), reflecting growth of 21% on a year-over-year basis.

This was primarily driven by robust performance of Yandex properties, which accounted for 79.7% of the total advertising revenues and exhibited year-over-year growth of 25%. This can be attributed to robust Zen, Geo services, Mail and others. Further, Advertising network revenues contributed 20.3% to advertising revenues and improved 6.3% from the year-ago quarter.

Taxi revenues of RUB 9.6 billion (21.4% of total revenues) surged 89% on a year-over-year basis, driven by increasing number of rides.

Other revenues of RUB 4.1 billion (9.2% of total revenues) soared 169% from the prior-year quarter. This can be attributed to the well-performing Yandex.Drive and Media Services. Further, strong IoT initiatives remain a positive.

Segments in Detail

Search and Portal: The segment generated RUB 31.2 billion revenues (69.2% of total revenues), up 21% year over year. The company’s strong position in the Russian search market remains a key catalyst. Notably, its market share reached 56.6% during the reported quarter, which went up 70 bps year over year. This can be attributed to expanding Yandex’s mobile search share which stood at 50.4% in the third quarter. Notably, mobile revenues accounted for 46.3% of the company's search revenues. Further, mobile search traffic accounted for 57.3% of the total search traffic. This was driven by Yandex’s search share on Android, which came in 52.8%, expanding 370 bps from the year-ago quarter.

Taxi: The segment generated RUB 9.6 billion revenues (21.4% of revenues), surging 89% from the year-ago quarter. Impressive year-over-year growth was driven by increasing number of rides that advanced 58% from the prior-year quarter, on the back of strengthening ridesharing business. Further, robust performance by corporate Taxi and food delivery business contributed to the segment’s results.

Classifieds: The segment generated revenues of RUB 1.4 billion (3% of revenues), advancing 39% year over year. Revenues from listing fees and value added service (VAS), which surged 88% year over year, drove the segment’s top line.

Media Services: The segment generated revenues of RUB 924 million (2% of revenues), climbing 123% from the year-ago quarter. This can be attributed to improving subscription services and video advertising revenues on the back of expanding Yandex.Plus and growth in content inventory of KinoPoisk. Further, well-performing Yandex.Music contributed to revenues.

Other Bets and Experiments: The segment yielded RUB 4.1 billion revenues (9% of total revenues), up 176% from the prior-year quarter. This was driven by robust performance of Yandex’s Zen, Yandex.Drive and Geo services.

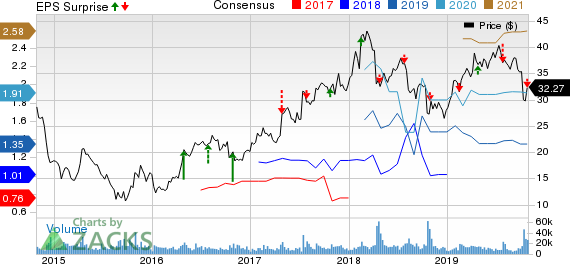

Yandex N.V. Price, Consensus and EPS Surprise

Yandex N.V. price-consensus-eps-surprise-chart | Yandex N.V. Quote

Operating Details

In third-quarter 2019, adjusted net income margin was 15.3%, contracting 360 bps from the year-ago quarter.

Per the company, its operating margin came in 16.5% in the third quarter, contracting 180 bps on a year-over-year basis.

Further, Adjusted EBITDA margin was 30.9%, which contracted 230 bps year over year.

Operating expenses as a percentage of revenue was 83.5%, expanding 180 bps from the year-ago quarter.

The company’s total traffic acquisition cost (TAC) came in RUB 5.8 billion, climbing 9% on a year-over-year basis.

Balance Sheet & Cash Flows

As of Sep 30, 2019, cash and cash equivalents were $675.7 million, up from $536 million as of Jun 30, 2019.

Accounts Receivables totaled $246.8 million, decreasing from $254.4 million in the previous quarter.

For the third quarter, cash flow from operations was $228 million, which surged from the previous-quarter figure of $167.1 million.

Guidance

For 2019, management raised guided range for revenue growth from 32-36% to 36-38% in ruble terms from 2018, excluding the Yandex.Market.

Further, the company expects revenue growth in Search and Portal in the range of 20-21% from 2018 in ruble terms.

Zacks Rank & Stocks to Consider

Currently, Yandex carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are NetEase, Inc. NTES, Itron, Inc. ITRI and Five9, Inc. FIVN. All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for NetEase, Itron and Five9 is currently pegged at 31.93%, 25 and 10%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yandex N.V. (YNDX) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

Five9, Inc. (FIVN) : Free Stock Analysis Report

Itron, Inc. (ITRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance