Xi Pivot Fails to Stop Exodus by Big Investors in China Tech

(Bloomberg) -- Xi Jinping led a parade of officials this spring vowing to revive China’s economy, hoping to repair the damage wrought by years of Covid Zero and regulatory clampdowns. Some of the world’s biggest investors are selling anyway.

Most Read from Bloomberg

Worthless Degrees Are Creating an Unemployable Generation in India

Fox to Pay $787 Million to Settle Election Suit, Dominion Says

Apple's AR/VR Headset to Feature Sports, Gaming, iPad Apps and Workouts

One Tesla Deal Propels Little-Known Family to $800 Million Fortune

Apple, Goldman Sachs Debut Savings Account With 4.15% Annual Yield

Two pioneering financiers of China’s private sector — and hence the country’s economic miracle — have signaled in recent days their intentions to continue pulling back from marquee investments in the country. European internet powerhouse Prosus NV registered more than $4 billion of stock in Tencent Holdings Ltd. for potential sale in Hong Kong, while news emerged that SoftBank Group Corp. is preparing to hasten its exit from Alibaba Group Holding Ltd. — the e-commerce leader that made Masayoshi Son’s name.

Read more: SoftBank Prepares to Cash In on Long-Held Alibaba Stake

The moves accelerate the unwinding of some of the most lucrative bets in business history. While both Prosus and SoftBank declared their over-arching plans last year and are acting partly due to reasons outside their China outlook, the latest steps have dented investor optimism over a litany of recent promises from Beijing to welcome foreign capital and loosen its grip on the tech sector.

“Reported plans to lower exposure in Alibaba by SoftBank may reiterate the prevailing loss of confidence in Chinese tech firms by foreign investors, giving rise to concerns that more may do the same,” said Jun Rong Yeap, an analyst at IG Asia.

Tencent slid the most in over two months Wednesday in Hong Kong, while Alibaba wiped out as much as $13 billion of value on Thursday. In New York, Tencent’s US-listed shares rose 3.6% while Alibaba’s gained 2.2% in early trading, both outpacing a 1% gain in the tech-heavy Nasdaq 100 index. Morgan Stanley analyst Gary Wu said in a note Thursday he didn’t think SoftBank’s selling will have a “meaningful impact” on Alibaba’s financials or business.

The developments mark the latest challenge to China’s effort to mend its image as a country that’s increasingly isolating itself from the West and hostile to private capital. Xi again called on foreign investors to “seize opportunities” in China during a tour of southern Guangdong this week, during which he stopped by an LG Display Co. plant.

But beyond the tech crackdown of 2021 and 2022, years of clashes over the treatment of ethnic minorities in Xinjiang, the quashing of political dissent in Hong Kong, and the status of Taiwan have stoked skepticism in the US and Europe about Chinese intentions.

It’s a dramatic reversal from past decades, when an increasingly open China produced a succession of corporate successes thanks in part to foreign dealmakers.

Optimists counter that there may still be upside for companies like Alibaba.

“There will definitely be impact in the short term,” said Gong Jingjie, an analyst at Toyo Securities. “But in the longer run, we need to look at its fundamentals.”

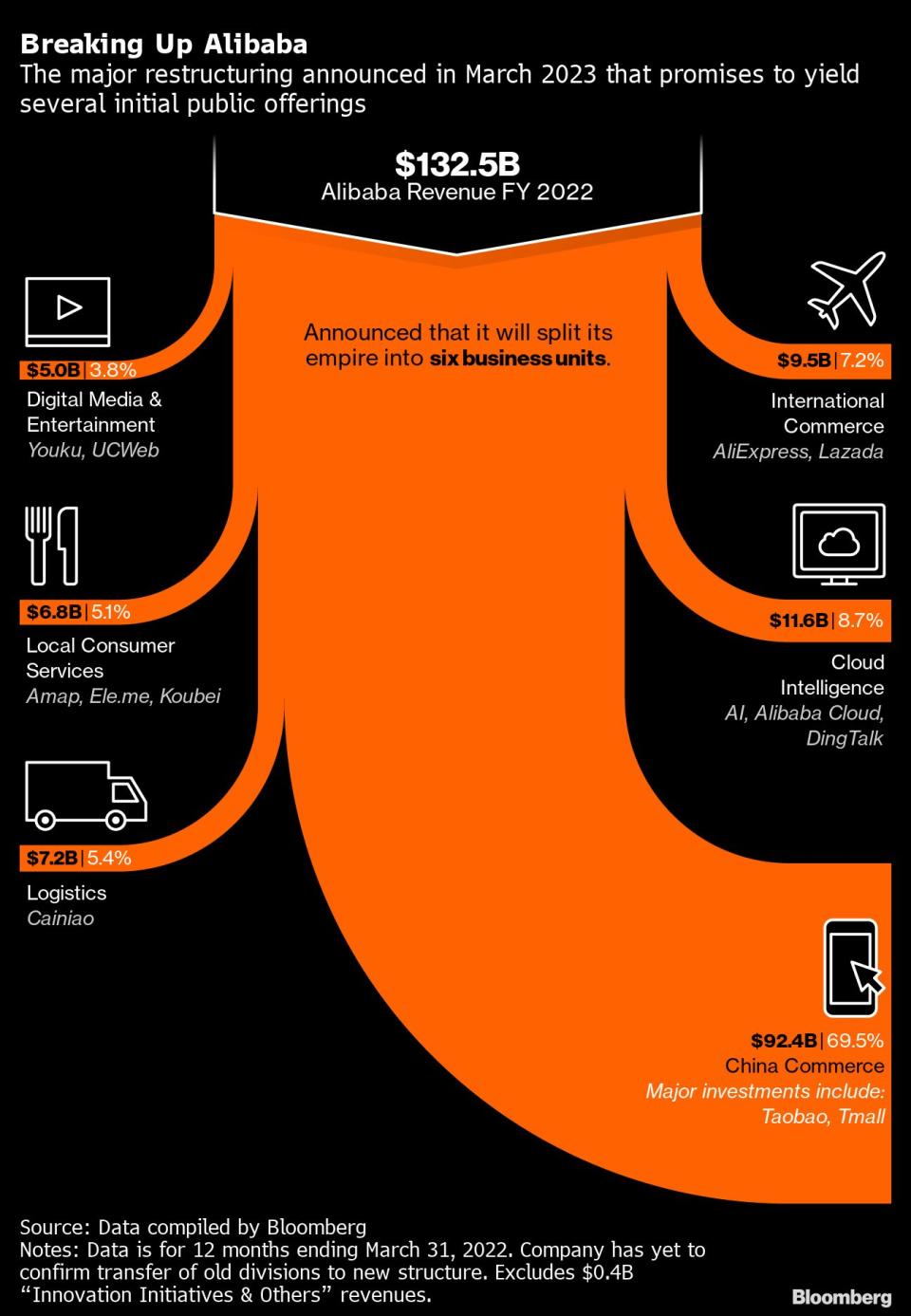

Alibaba recently announced a plan to unlock value by splitting itself into six separate companies — its most aggressive move since antitrust regulators slapped a record fine on the company in 2021. The company is also working on potentially game-changing initiatives such as investments in artificial intelligence.

Last month, billionaire Alibaba co-founder Jack Ma — one of the country’s best-known corporate figures — returned to China after an overseas jaunt lasting more than a year. That was taken as a sign that China, if not exactly back to business as usual, was moving in the right direction.

SoftBank founder Masayoshi Son famously invested about $20 million in Alibaba in 2000, holding on through the dot-com bust and the Chinese company’s IPO in 2014. Naspers, Prosus’ parent, invested in Tencent in 2001 — long before before smartphones and apps like WeChat became ubiquitous.

But prospects for both Chinese businesses have deteriorated markedly in the past two years. The companies reported their first revenue declines ever in 2022 and are now eking out single-digit gains every quarter — a far cry from their swashbuckling days of consistent double-digit expansion and constant flow of startup deals.

SoftBank’s selldown also partly reflects the precarious state of global markets. The company has been offloading some of its biggest holdings in part to shore up its balance sheet at a time when the failure of Silicon Valley Bank and rising interest rates have drained liquidity and added pressure on investment firms to reward jittery LPs. Prosus has said it will use proceeds from Tencent share sales to fund buybacks.

“After the global banking crisis and what happened to SVB in the US, it’s much harder to get loan financing in general,” said Steven Leung, executive director of UOB Kay Hian. “For those early investors in Chinese big tech firms, it might be the same case. So they have to accelerate cashing out from their existing holdings, before doing anything, including investing in new opportunities or buying back shares.”

--With assistance from Xiao Zibang, Adrian Leung and James Mayger.

(Updates with New York trading in fourth paragraph.)

Most Read from Bloomberg Businessweek

Americans Go Deeper Into Debt as They Use Buy Now, Pay Later Apps for Groceries

People Are Using AI for Therapy, Even Though ChatGPT Wasn’t Built for It

Banking Crises Are Preventable, But Human Nature Gets in the Way

©2023 Bloomberg L.P.

Yahoo Finance

Yahoo Finance