Xero (ASX:XRO) Shareholders Have Enjoyed A Whopping 388% Share Price Gain

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Xero Limited (ASX:XRO) share price. It's 388% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 22% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

See our latest analysis for Xero

While Xero made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years Xero saw its revenue grow at 33% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 37% per year in that time. It's never too late to start following a top notch stock like Xero, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

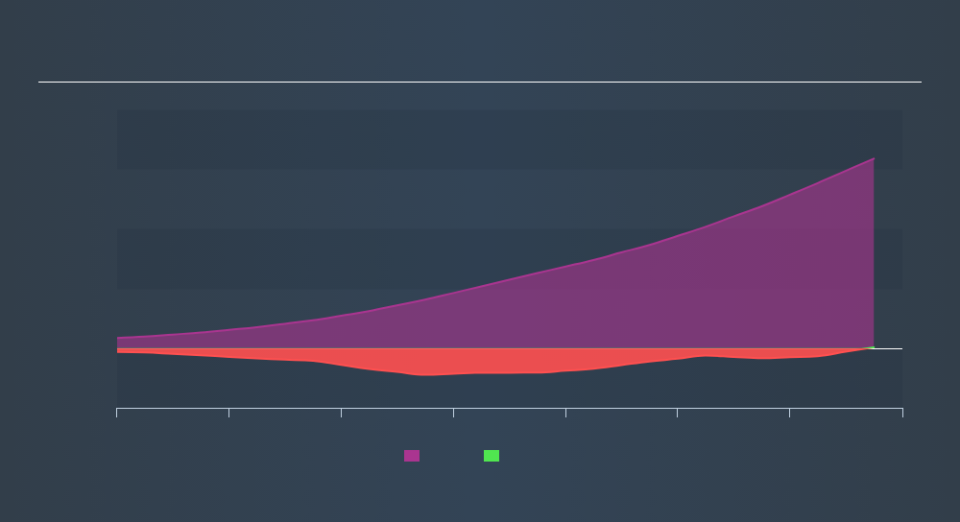

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Xero in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Xero shareholders have received a total shareholder return of 86% over the last year. That gain is better than the annual TSR over five years, which is 37%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance