Is It Worth Considering ABM Industries Incorporated (NYSE:ABM) For Its Upcoming Dividend?

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that ABM Industries Incorporated (NYSE:ABM) is about to go ex-dividend in just 3 days. Ex-dividend means that investors that purchase the stock on or after the 2nd of October will not receive this dividend, which will be paid on the 4th of November.

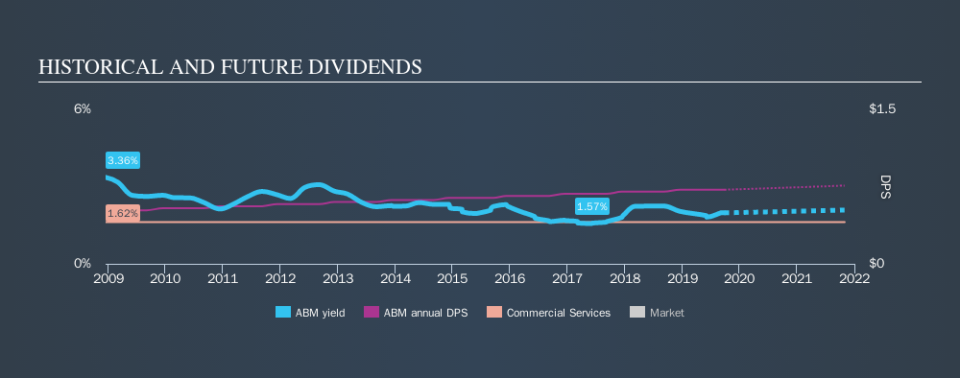

ABM Industries's next dividend payment will be US$0.2 per share. Last year, in total, the company distributed US$0.7 to shareholders. Calculating the last year's worth of payments shows that ABM Industries has a trailing yield of 2.0% on the current share price of $36.36. If you buy this business for its dividend, you should have an idea of whether ABM Industries's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for ABM Industries

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. ABM Industries paid out 54% of its earnings to investors last year, a normal payout level for most businesses. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Thankfully its dividend payments took up just 28% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that ABM Industries's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at ABM Industries, with earnings per share up 3.1% on average over the last five years. Earnings growth has been slim and the company is paying out more than half of its earnings. While there is some room to both increase the payout ratio and reinvest in the business, generally the higher a payout ratio goes, the lower a company's prospects for future growth.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the last ten years, ABM Industries has lifted its dividend by approximately 3.3% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Is ABM Industries worth buying for its dividend? While earnings per share growth has been modest, ABM Industries's dividend payouts are around an average level; without a sharp change in earnings we feel that the dividend is likely somewhat sustainable. Pleasingly the company paid out a conservatively low percentage of its free cash flow. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

Curious what other investors think of ABM Industries? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance