Why women pay 30% more for this insurance

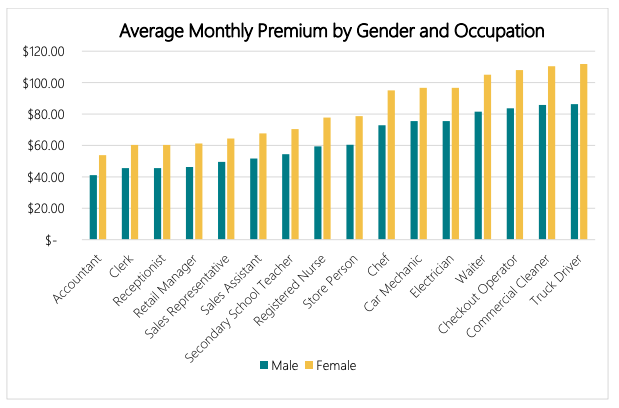

Australian women pay an average 30 per cent more for income protection insurance than their male counterparts, and it comes down to some major life decisions, new research has revealed.

Research from comparison service Canstar has found the average Australian woman with income protection insurance will pay premiums starting at $25 a month for her policy, while men will pay premiums starting at $17.

Income protection insurance is insurance that helps workers maintain an income while taking time away from work due to illness or injury. It’s generally 75 per cent of a worker’s salary.

Related story: ‘Fees will need to rise’ to cover super changes

Related story: Only 3 in 10 Australians can answer this basic health insurance question

Related story: Lost your job and received a payout? This is how you might be taxed

And while the premiums differ across industries – truck drivers pay substantially more than accountants – the gender gap is stubborn.

It’s something Canstar group manager of research, Mitch Watson finds interesting, especially given the current spotlight on gender equality.

The difference in premiums is likely due to the higher value of claims made by Australian women, Canstar said.

Women are more likely to make claims related to pregnancy and birth related problems, and are also more likely to be impacted by mental illnesses and cancers like breast cancer which hit at an earlier stage in women’s lives.

Additionally, women are more likely to develop musculoskeletal problems. According to the ABS, women make up 58 per cent of people with musculoskeletal disorders.

Breast cancer, musculoskeletal disorders and back issues are among the top five causes of illness and injury for 25-64-year-old women, the Australian Institute of Health and Welfare reports.

The Institute of Actuaries Australia’s 2002 Report of the Disability Committee found women were also 45 per cent more likely to claim four or more weeks off work under income protection insurance.

But, Watson noted, the higher premiums aren’t a reason to turn away from income protection insurance.

“Working Aussies with ongoing financial obligations should factor the monthly premium for income protection into their budget to ensure it’s affordable, as they do with their gym membership and car insurance, this way they’re safeguarded if put in a position where they’re unfit for work,” he said.

Australians spend an average $73 a month on their gym membership and another $83 on their insurance, but 67 per cent of Australians don’t have income protection insurance.

“Given the number of workplace accidents that occur, protecting you and your family in the event you’re not able to work should be a conversation families are having,” Watson said.

“While affordability may be seen as a barrier to entry for some, there may be others that don’t know what income protection insurance is and what it covers you for.”

But it’s crucial to shop around as fees and coverage varies.

“In some instances, women could be paying up to $1,414 more per year if they’re with an insurer that has higher premiums.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance