Wix.com (WIX) Tops Q3 Earnings Estimates, Updates '19 View

Wix.com Ltd. WIX reported third-quarter 2019 non-GAAP earnings of 41 cents per share beating the Zacks Consensus Estimate by 46.43%. Notably, the bottom line also improved 5.1% on a year-over-year basis.

Total revenues surged 26% year over year to $196.8 million. The top line lagged the Zacks Consensus Estimate by 0.48%. Nonetheless, figure came within management’s guided range of $196 million to $198 million.

The year-over-year increase in the top line can primarily be attributed to robust product offering and higher sales of complementary products. Further, growing user and premium subscription base were other positives.

Shares Down on Bleak Q4 View

Shares of Wix declined 7.7% on Nov 14, on bleak fourth-quarter revenue outlook. For the fourth quarter, the company anticipates revenues in the range of $204-$206 million, suggesting growth of 24-25% from the year-ago quarter. The guidance takes impact of foreign exchange rates into account. The Zacks Consensus Estimate for revenues is currently pegged at $207.15 million.

Notably, the stock has returned 38.6% year to date, outperforming the industry’s rally of 21.2%.

Key Metrics in Q3

Collections during the reported quarter came in at $205.9 million, up 26% year over year, attributable to expansion of new products, enhancement of existing products and improvement in pricing strategies. Management had projected collections in the range of $204-$206 million. Unfavorable foreign exchange movement limited growth. On a constant currency basis, collections would have been $207 million, up 27% year over year.

The company witnessed better-than-expected conversion and retention in user cohorts. The company added a total of 114,000 net premium subscriptions in the reported quarter, which came in at 4.4 million as of Sep 30, 2019 (up 15% year over year).

Wix added 5.5 million registered users during the reported quarter. Registered users as of Sep 30, 2019 came in at 160 million, up 17% year over year.

During the reported quarter, average revenue per subscription (ARPS) improved 8% year over year to $175. The surge can primarily be attributed to solid adoption of higher priced subscription packages.

In the first three quarters, collections from first quarter 2019 user cohort increased 10% year over year. The company anticipates future collections (over next eight years) from all existing cohorts to be roughly $6.1 billion, up 24% year over year.

Notably, Average Collections per Subscription (ACPS) of the latest annual subscriptions in the US improved 39% on a year-over-year basis and came in at $247 in the third quarter.

Noteworthy Developments

Corvid by Wix, designed to aid developers manage their workflow in a streamlined manner, is gaining adoption. Moreover, management is optimistic on growing penetration rate of Wix Payments.

During the reported quarter, the company launched Wix Fitness to aid studio owners and fitness instructors to manage business websites and leverage Wix App.

Wix is expanding Customer Solutions organization. The company has launched 24/7 global customer support in nine languages and is enhancing facilities to provide support to users.

Additionally, in the reported quarter, Wix partnered NTT Town Page to aid NTT enhance Wix platform based online business across Japan. The company also announced opening of a Customer Support Center in Tokyo in the second quarter. The center is aimed at improving the company’s international market reach, which favors growth prospects.

We believe that these product innovations and partnership deals bode well for Wix.

Moreover, incremental adoption of innovative digital services including Wix Editor, Wix ADI, Wix Logo Maker, Wix Answers, Ascend by Wix, Wix Turbo, Wix Payments, among others are other positives.

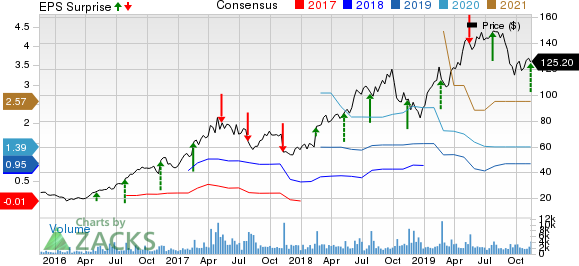

Wix.com Ltd. Price, Consensus and EPS Surprise

Wix.com Ltd. price-consensus-eps-surprise-chart | Wix.com Ltd. Quote

Operating Results

Non-GAAP gross profit advanced 17.2% from the year-ago quarter to $145.2 million. Nonetheless, non-GAAP gross margin contracted 600 bps to 74%, primarily owing to increasing investments in Wix Payments and Customer Solutions organization.

Non-GAAP Research and development expenses of $49.5 million, increased 28.2% year over year. Non-GAAP Selling and marketing expenses came in at $70.3 million, up almost 19% year over year. Non-GAAP General and administrative expenses surged 34.7% on a year-over-year basis to $13.2 million.

The company reported non-GAAP operating income of $12.3 million, down 24.6% year over year. As percentage of revenues non-GAAP operating margin contracted 420 bps to 6.3%.

Balance Sheet & Cash Flow

As on Sep 30, 2019, Wix had cash and cash equivalents of $283.2 million, compared with $351.5 million in the previous quarter. The company ended the quarter with $354.6 million in long-term debt compared with $349.3 million in the previous quarter.

Cash flow from operations came in at $36.1 million during the third quarter compared with $37.2 million reported in the previous quarter. Free cash flow was $29.2 million, compared with $30.8 million reported in the prior quarter.

Guidance

For the fourth quarter, Collections are projected to be in the range of $222-$225 million, indicating an improvement of 26-28% from the year-ago reported figure.

The company updated fiscal 2019 guidance. Management now anticipates revenues in the range of $761-$763 million, compared with prior guided range of $761-$765 million. This indicates an improvement of 26% from the year-ago reported figure. The Zacks Consensus Estimate for revenues is currently pegged at $764.53 million.

Collections are projected to be in the range of $828-$831 million, suggesting growth of 26% from the prior-year quarter, compared with previous predicted range of $825-$831 million. On a constant currency basis, Collections are projected to be in the range of $830-$833 million.

Moreover, the company anticipates free cash flow in the range of $124-$126 million, indicating an improvement of 22-24% from the year-ago quarter. Notably, the previously guided range was $123-$126 million. On a constant currency basis, free cash flow is projected to be in the range of $126-$128 million.

Zacks Rank and Key Picks

Wix carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector worth considering are Alteryx, Inc. AYX, Fortinet, Inc. FTNT and Perficient, Inc. PRFT. All the three stocks flaunt a Zacks Rank #1 (Strong buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Alteryx, Fortinet and Perficient is currently pegged at 39.85%, 14% and 11.75%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Perficient, Inc. (PRFT) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance