Why It Might Not Make Sense To Buy Kodiak Gas Services, Inc. (NYSE:KGS) For Its Upcoming Dividend

Kodiak Gas Services, Inc. (NYSE:KGS) stock is about to trade ex-dividend in four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Therefore, if you purchase Kodiak Gas Services' shares on or after the 10th of May, you won't be eligible to receive the dividend, when it is paid on the 20th of May.

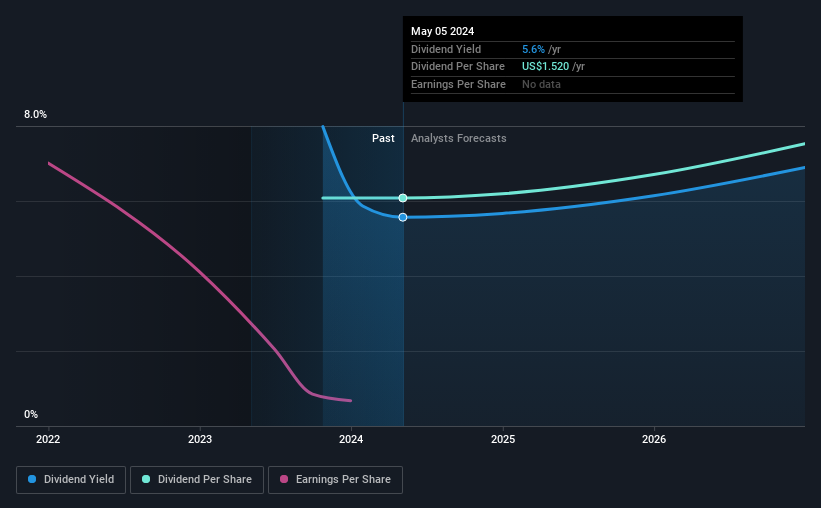

The company's upcoming dividend is US$0.38 a share, following on from the last 12 months, when the company distributed a total of US$1.52 per share to shareholders. Looking at the last 12 months of distributions, Kodiak Gas Services has a trailing yield of approximately 5.6% on its current stock price of US$27.30. If you buy this business for its dividend, you should have an idea of whether Kodiak Gas Services's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Kodiak Gas Services

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Kodiak Gas Services paid out a disturbingly high 258% of its profit as dividends last year, which makes us concerned there's something we don't fully understand in the business. A useful secondary check can be to evaluate whether Kodiak Gas Services generated enough free cash flow to afford its dividend. Kodiak Gas Services paid out more free cash flow than it generated - 155%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

Cash is slightly more important than profit from a dividend perspective, but given Kodiak Gas Services's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. From this perspective, we're disturbed to see earnings per share plunged 84% over the last 12 months, and we'd wonder if the company has had some kind of major event that has skewed the calculation.

We'd also point out that Kodiak Gas Services issued a meaningful number of new shares in the past year. It's hard to grow dividends per share when a company keeps creating new shares.

Given that Kodiak Gas Services has only been paying a dividend for a year, there's not much of a past history to draw insight from.

Final Takeaway

From a dividend perspective, should investors buy or avoid Kodiak Gas Services? It's looking like an unattractive opportunity, with its earnings per share declining, while, paying out an uncomfortably high percentage of both its profits (258%) and cash flow as dividends. Unless there are grounds to believe a turnaround is imminent, this is one of the least attractive dividend stocks under this analysis. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Kodiak Gas Services. To that end, you should learn about the 4 warning signs we've spotted with Kodiak Gas Services (including 2 which are potentially serious).

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance