Why You Might Be Interested In Glacier Bancorp, Inc. (NASDAQ:GBCI) For Its Upcoming Dividend

Glacier Bancorp, Inc. (NASDAQ:GBCI) is about to trade ex-dividend in the next 4 days. If you purchase the stock on or after the 7th of October, you won't be eligible to receive this dividend, when it is paid on the 17th of October.

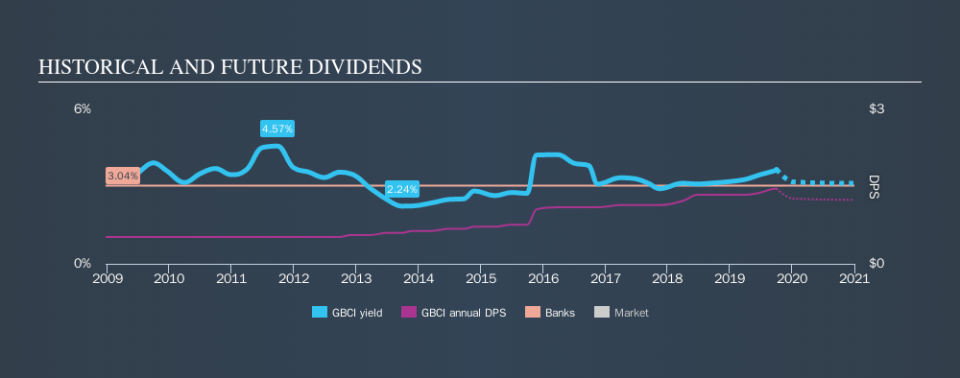

Glacier Bancorp's next dividend payment will be US$0.3 per share. Last year, in total, the company distributed US$1.4 to shareholders. Last year's total dividend payments show that Glacier Bancorp has a trailing yield of 3.7% on the current share price of $39.79. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Glacier Bancorp

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Fortunately Glacier Bancorp's payout ratio is modest, at just 44% of profit.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings fall far enough, the company could be forced to cut its dividend. For this reason, we're glad to see Glacier Bancorp's earnings per share have risen 13% per annum over the last five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Glacier Bancorp has delivered an average of 11% per year annual increase in its dividend, based on the past ten years of dividend payments. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

Is Glacier Bancorp an attractive dividend stock, or better left on the shelf? When companies are growing rapidly and retaining a majority of the profits within the business, it's usually a sign that reinvesting earnings creates more value than paying dividends to shareholders. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. Overall, Glacier Bancorp looks like a promising dividend stock in this analysis, and we think it would be worth investigating further.

Ever wonder what the future holds for Glacier Bancorp? See what the six analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance