Why hyperinflation is coming

The stage is being set for a central bank-fueled hyperinflation to take place in several years.

Our position has remained the since calling the next turn of hyperinflation in 2012. Here is our epic piece on Zero Hedge. And while we are at it, we fully matched it with our bond call, which is the first pre-requisite.

Yes, we are currently in deflation. I could not agree more, but this time it is different, as assets will fork at a juncture and move beyond the expected behavior—the results of a failed monetary transmission mechanism.

Recall the London whale. What have we learned from it? That unless you bought the whole market, the remaining 5% not owned could derail prices—a situation where the tail wags the dog.

The point is that unless central banks buy 100% of the government debts, they will still lose control of the fight.

What fight? The mismatch of debts to savings globally.

Gold must first go through a few related hoops and revert to a positive correlation with the US dollar. Meanwhile, cryptocurrencies may be one of the newest benefactors of the hyperinflationary wave. Bitcoin had a great run since we started our analysis at $300 (not unlike our analysis of gold, which coincidentally began when it was at $300).

And we expect this march to last well beyond the next two decades—finally ending in a massive bond crash and the subsequent flare-up of gold (as physical gold is default-free).

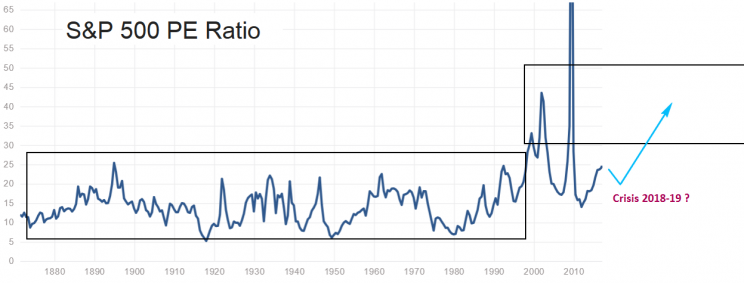

Source: Robert Shiller

Once the current correction passes, outflows of bonds will precipitate a sharp move up in stocks over the coming decade. And in a hyperinflationary environment, central banks will also be buying stocks. This will cause the supply of stocks to drop and P/E ratios to remain in a new elevated range of 25 to 50.

Prior articles:

Why the crisis of 2019 begins now

How to prepare for the next major selloff in stocks: trader

By Yves Lamoureux, January 16, 2017 ©Copyright, Lamoureux & Co.

This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product or service.This publication is proprietary and is intended for the use of the subscriber only. All information provided is impersonal and not tailored to the needs of any person, entity or group or persons. Lamoureux & Co. shall not be liable for any claims.

Yahoo Finance

Yahoo Finance