Why You Should Hold Onto Eastman Chemical (EMN) Stock for Now

Eastman Chemical Company EMN is poised to benefit from its cost-management actions, innovation-driven growth model and synergies of acquisitions amid challenges including a difficult business environment.

Shares of the chemical maker are up 11% in the past year, outperforming the 14.7% decline of its industry.

Let’s delve deeper to find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Aiding the Stock?

Eastman Chemical's cost reduction actions and growth in high-margin innovation products are expected to contribute to its earnings. The company remains focused on growing new business revenues from innovations. It envisions new business revenues from innovation to increase to more than $400 million for full-year 2019. The company also remains on track to generate roughly $500 million of new business revenues in 2020.

The company is also focused on productivity and cost-cutting actions in the wake of the challenging environment. It is taking an aggressive approach to cost management to keep its manufacturing costs in control. The company is also taking actions to raise selling prices of its products amid an inflationary environment.

Eastman Chemical is also gaining from synergies of acquisitions. The buyout of Taminco Corporation has strengthened the company’s foothold in promising niche end-markets including food, feed and agriculture. The acquisition has also provided attractive cost and revenue synergy opportunities.

The company has also purchased the Marlotherm heat transfer fluids manufacturing assets in Germany and associated formulations, intellectual property and customer contracts from South Africa-based integrated energy and chemical company, Sasol. The buyout allows the company to boost its heat transfer fluids product offerings to customers globally.

The acquisition of Spain-based cellulosic yarn producer, INACSA will also boost the growth of the company’s textiles innovation products like Naia cellulosic yarn.

Moreover, Eastman Chemical remains committed to boost shareholder returns. It returned $583 million to shareholders through share repurchases and dividends during the first nine months of 2019.

The company’s board, last month, also declared a quarterly cash dividend on its common stock of 66 cents per share, reflecting a 6.5% increase from the prior payout of 62 cents per share. Notably, the company hiked its dividend for the tenth consecutive year. This is consistent with its focus on disciplined and balanced capital allocation, and shareholders’ returns.

Per the company, the dividend hike reflects its capacity to generate strong cash flow and deliver earnings growth. Eastman Chemical expects to generate solid free cash flow (of around $1.1 billion) for full-year 2019.

A Few Worries

Eastman Chemical is witnessing lower demand due to trade tensions, which is hurting its volumes. The company faced challenging global economic conditions in the third quarter of 2019 due to trade issues. Trade-related pressures impacted consumer discretionary markets such as transportation and consumer durables.

Eastman Chemical, in its third-quarter call, noted that it expects sales volumes and capacity utilization to decline in the fourth quarter due to the worsened global business environment resulting from trade uncertainties and other macro factors.

Moreover, the company is exposed to headwind from turnaround costs at its Longview manufacturing site in Texas. Higher plant shutdown costs and a local power disruption at Longview hurt margins in its Chemical Intermediates unit in the last reported quarter. The company expects similar headwind in the fourth quarter, which is likely to weigh on margins in this segment.

The company also faces currency headwinds due to a stronger U.S. dollar. It expects roughly 30 cents headwind associated with currency for full-year 2019. The company also anticipates pension-related headwind of around 20 cents for 2019.

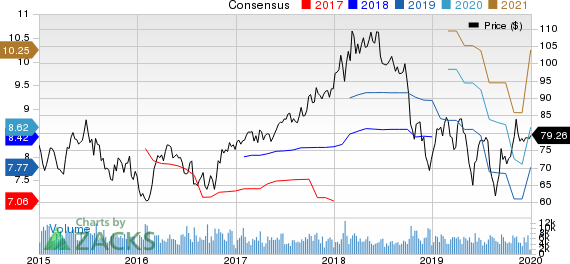

Eastman Chemical Company Price and Consensus

Eastman Chemical Company price-consensus-chart | Eastman Chemical Company Quote

Stocks to Consider

Some better-ranked stocks worth considering in the basic materials space include Kirkland Lake Gold Ltd. KL, Arconic Inc. ARNC and Franco-Nevada Corporation FNV, all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Kirkland Lake Gold has projected earnings growth rate of 15.4% for 2020. The company’s shares have surged around 65% over a year.

Arconic has a projected earnings growth rate of 13.6% for 2020. The company’s shares have rallied roughly 67% in a year’s time.

Franco-Nevada has estimated earnings growth rate of 25.4% for 2020. The company’s shares have shot up roughly 45% in a year’s time.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See 7 handpicked stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eastman Chemical Company (EMN) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Arconic Inc. (ARNC) : Free Stock Analysis Report

Kirkland Lake Gold Ltd. (KL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance