What does health insurance have to do with EOFY?

It’s that time of year again when we dig up our old tax receipts, attend that obligatory office party, hunt for a bargain at the sales and eagerly await the arrival of our group certificate. Yep, it’s the End of Financial Year.

And while you’re probably starting to think about getting your finances in order, you may be forgetting to consider one important thing that you could save you money and extra tax in the next financial year. Private hospital cover.

You’re probably thinking, but what does Health Insurance have to do with EOFY? A lot actually. Whether you’re a policy holder or not, there a number of things to consider when it comes to health insurance at tax time.

Higher income earners & Medicare Levy Surcharge (MLS)

You’ve probably heard about the Medicare Levy Surcharge (MLS) before but, do you actually know how it works? iSelect’s research shows that most Aussies actually don’t really understand the levy and many confuse it with the Medicare Levy paid by all taxpayers. So here it is in plain English.

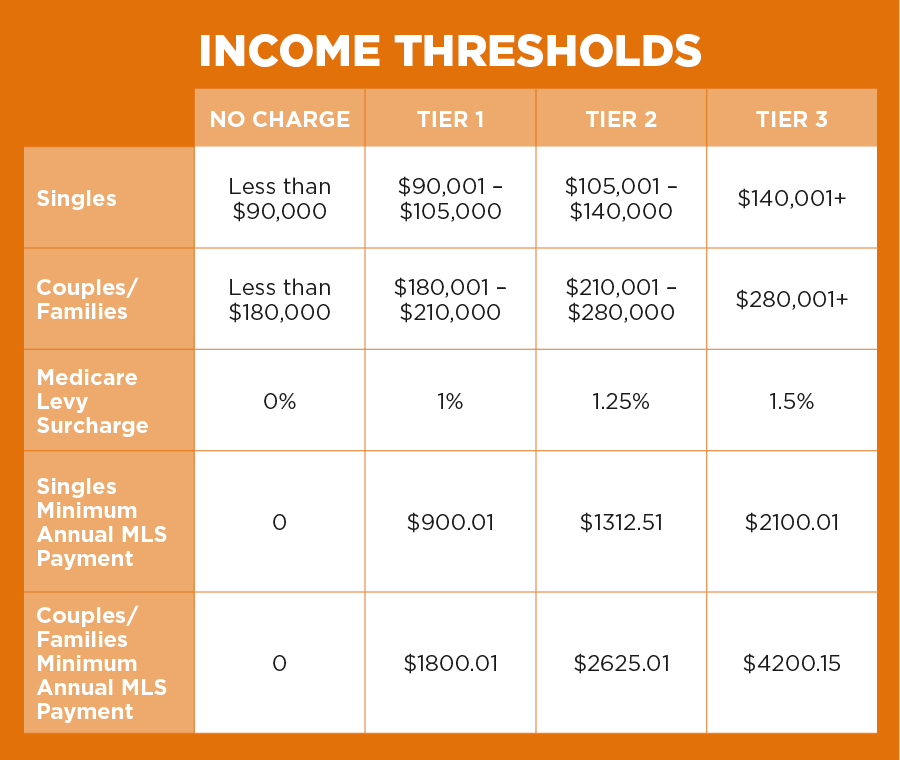

If you earn more than $90,000 a year (or $180,000 for families) and don’t have private hospital cover then you’ll have to pay at a minimum of $900 when tax time rolls around. That’s a lot of money down the drain for nothing in return except a big fat grin on the tax man’s face.

Because how much MLS you pay at tax time depends on how much you earn, if you earn above $95,000 then taking out a basic hospital policy will generally cost less than paying the MLS.

So if you’re earning above the MLS income threshold and don’t have private hospital cover, this June is the perfect time to consider taking out cover to avoid being slapped with extra tax next financial year.

Under 30s & Lifetime Health Cover (LHC) loading:

Are you 31 and don’t have hospital cover? We need to talk.

If you don’t have hospital cover by 1st July following your 31st birthday, you’ll pay more for your hospital premiums if you do decide to take it out down the track due to the Lifetime Health Cover (LHC) loading.

And we’re not talking just a few extra dollars, the loading will add 2 per cent extra to your premiums for every year you go without hospital cover and that can go up to a maximum loading of 70 per cent! And the loading will push up your premiums for 10 years.

The longer you wait to take out cover, the more expensive it can become. So if you turned 31 during the past year (or are about to) and don’t have private health insurance, now is the time to think about taking it out to avoid paying higher premiums later in life.

Don’t pay the ‘lazy tax’ on your health insurance

If you already have health insurance and are reading this with a smug smile on your face, you may be surprised to know that a lot of Aussies are paying more than they need to for their premiums. Why? Simply because they haven’t bothered to take the time to review their policy and shop around. This is what we call the ‘lazy tax’.

The end of financial year it’s a timely reminder to check you still have the right level of cover and are getting good value for money – if not, it’s time to shop around as funds are great offering deals and incentives to new customers such as months free, waiving waiting periods and cashback or gift cards.

Related article: 5 days to go: Why this week is the best time to buy these 10 things

Related article: 7 surprising things you didn’t know you could claim on tax

Related article: ‘Unfair’ tax deduction revoked by ATO

So this EOFY, while you’re crunching the numbers on your expected tax return, don’t forget to consider private health insurance. While it may seem tedious now, it’s well worth it if you could end up with some extra bucks in your pocket down in the next financial year.

If you’re feeling overwhelmed, there are services like iSelect that can help you understand how private hospital cover relates to tax and explain whether or not you’ll be impacted by either MLS or LHC. They can help you compare your options and select a suitable option from our range of available policies.

Jessie Petterd, iSelect spokeswoman.

Disclaimer

iSelect does not compare all health insurance providers or policies in the market. The availability of policies will change from time to time. Not all policies available from its providers are compared by iSelect and due to commercial arrangements, your stated needs and circumstances, not all policies compared by iSelect will be available to all customers. Some policies and special offers are available only from iSelect’s call centre and others are available only from iSelect’s website. Click here to view iSelect’s range of providers.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance