Why controversial ‘Sell in May’ investment strategy could make comeback

It’s a contentious investment strategy, but according to new research, there are some important lessons to be learnt around ‘Sell in May’ strategies.

The “Sell in May and go away, and come back on St Leger’s Day” investment strategy is promoted by a belief that the northern hemisphere’s warmer months (May-October) will deliver lower returns as millions head away on holidays.

The strategy sees investors sell off their holdings in May before re-establishing them come November.

But it’s not that simple, new research from CMC Markets reveals.

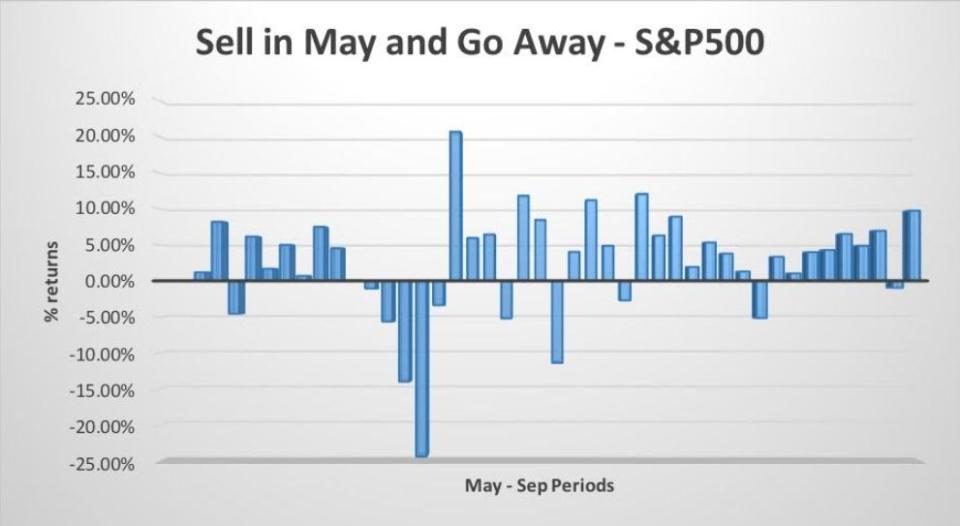

The firm analysed Australian and US stock market data from the last 15 years to see if ‘sell in May’ was a good idea for investors.

Here’s what they found

If you’re investing in the ASX… and you’re following the ‘Sell in May’ strategy, you would have seen a gain of almost 4 per cent compared to those subscribing to a ‘Buy in May’ belief.

But if you’re investing in the S&P500 … then it’s the opposite. Investors using a ‘Buy in May’ strategy on the S&P500 would have seen an incredible gain of 28 per cent compared to those using a ‘Sell in May’ strategy.

In the first two weeks of May 2019, the ASX has delivered returns of -1.4 per cent and -3.8 per cent on the S&P500.

What does this mean?

Don’t rush in.

“In the context of the Australian share market, the ‘Sell in May’ strategy has only been successful 47 per cent of the time over the last 15 years, so historically, it doesn’t prove to be a very successful strategy for investors,” CMC Markets head of sales trading Ashley Glover told Yahoo Finance.

“On the other hand, investors following a ‘Buy in May’ strategy would have seen a 53 per cent success rate and a cumulative return of 49 per cent, just by investing in the 4.5 month window from May to September.”

He said trade war rhetoric had dragged down the ASX and providing some encouragement for ‘Sell in May’ strategists in 2019.

But then the federal election boosted the Australian share market, delivering a 3 per cent return for for May – weakening the strength of a “Sell in May” strategy.

“Investors still have an ever escalating and unresolved trade war, a weakening Aussie dollar, Australian reporting season and the expectation of a Reserve Bank June rate cut to look forward to before we make it to St Leger’s Day!

“Our market is therefore poised on a knife’s edge for yet another test of the ‘Sell in May’ strategy.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance