Why Bitauto Holdings Limited Fell 21.6% in January

What happened

Shares of Bitauto Holdings (NYSE: BITA) shed 21.6% of their value in January, according to data from S&P Global Market Intelligence. The stock climbed roughly 34% in December (a time when many other Chinese tech stocks were selling off), but it couldn't hold on to the gains as the outlook for the country's auto industry worsened.

The company's platform provides dealers with online-store creation tools, automobile advertising services, and financing options for customers. Discouraging data for China's auto industry appears to have shifted Bitauto stock into reverse, and shares currently trade in the neighborhood of five-year lows.

Image source: Getty Images.

So what

Bitauto stock has seen volatile swings as investors try to determine how to weigh the slowdown in the country's automotive market and broader economy against the long-term potential of automotive e-commerce in the Middle Kingdom. December auto sales in China fell 19% annually, and full-year sales for 2018 were down roughly 6%. While China's auto industry is seeing a rare downturn, the long-term outlook for the company's automotive e-commerce market is more enticing.

Now what

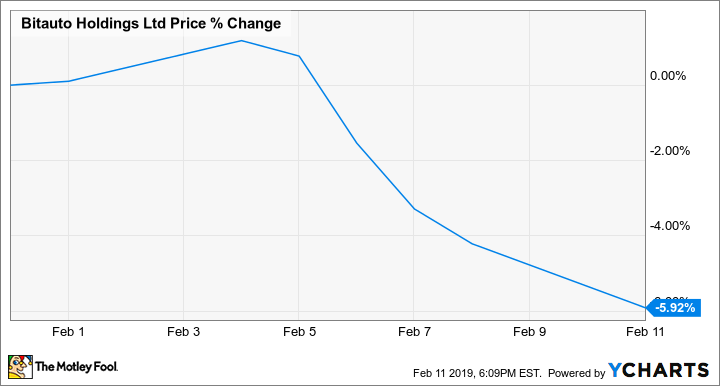

Bitauto stock has continued to move lower in February, with shares trading down roughly 5.9% in the month so far.

Shares have lost roughly a third of their value over the last year, and now trade at roughly 11 times this year's expected earnings and 0.75 times expected sales. Bitauto is slated to report fourth-quarter earnings next month and expects sales to come in between $425.5 million and $432.4 million, representing roughly 18% growth at the midpoint of the target.

More From The Motley Fool

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance