What's in Store for The TJX Companies (TJX) Q1 Earnings?

The TJX Companies, Inc. TJX is likely to register top-and bottom-line growth when it reports first-quarter fiscal 2023 earnings on May 18. The Zacks Consensus Estimate for revenues is pegged at $11,580 million, suggesting a rise of 14.8% from the prior-year quarter’s reported figure.

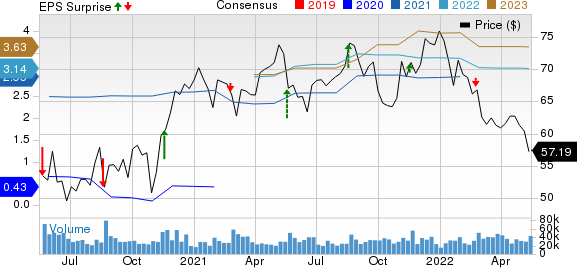

The Zacks Consensus Estimate for quarterly earnings is unchanged in the past 30 days at 60 cents per share, suggesting an increase of 36.4% from the figure reported in the prior-year quarter. The off-price apparel and home fashions retailer has a trailing four-quarter earnings surprise of 17.1%, on average. The TJX Companies reported a negative earnings surprise of 13.3% in the last reported quarter.

The TJX Companies, Inc. Price, Consensus and EPS Surprise

The TJX Companies, Inc. price-consensus-eps-surprise-chart | The TJX Companies, Inc. Quote

Things To Note

The TJX Companies is benefiting from its solid store and e-commerce growth efforts. In this regard, the company is undertaking several initiatives to boost online sales and strengthen its e-commerce business. Also, it is on track to expand its footprint and invest in distribution, network and infrastructure. Apart from this, The TJX Companies’ HomeGoods segment has been seeing robust demand for a while now.

Encouragingly, management expects U.S. comparable store sales growth of 1-3% in the first quarter of fiscal 2023. In its last earnings call, management highlighted that it is witnessing solid U.S. comp sales growth as consumer demand for apparel and home categories remains solid at the start of the fiscal first quarter. The company expects sales in the range of $11.5-$11.7 billion in the to-be-reported quarter. The company anticipates quarterly earnings per share of 58-61 cents compared with 44 cents reported in the year-ago quarter.

Yet, management highlighted that it anticipates the fiscal first quarter to be most pressured with incremental freight expenses. In addition, The TJX Companies expects escalated wage costs to have significantly affected the pretax margin in the quarter under review.

What the Zacks Model Unveils

Our proven model does not predict an earnings beat for The TJX Companies this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The TJX Companies currently carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%.

Stocks With the Favorable Combination

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat:

Costco Wholesale COST currently has an Earnings ESP of +1.90% and a Zacks Rank of 2. The company is likely to register an increase in the top line when it reports third-quarter fiscal 2022 numbers. The consensus mark for Costco's quarterly earnings has moved up a couple of cents in the last 30 days to $3.04 per share. The consensus estimate suggests 10.6% growth from the year-ago quarter’s reported number. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco's top line is expected to rise year over year. The Zacks Consensus Estimate for COST’s quarterly revenues is pegged at $51.8 billion, which suggests a rise of 14.3% from the figure reported in the prior-year quarter.

Ross Stores ROST currently has an Earnings ESP of +1.24% and a Zacks Rank of 2. The company will likely register an increase in the top line when it reports first-quarter fiscal 2022 results. The consensus mark for Ross Stores’ quarterly revenues is pegged at $4.5 billion, suggesting a rise of 0.5% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for ROST’s earnings has been unchanged at 99 cents per share in the past 30 days. However, the consensus estimate indicates a 26.1% decline from the $1.34 reported in the year-ago quarter.

Designer Brands DBI currently has an Earnings ESP of +4.35% and a Zacks Rank of 3. The company is likely to register top- and bottom-line growth when it reports first-quarter fiscal 2022 earnings. The consensus mark for Designer Brands’ quarterly revenues is pegged at $806.7 million, which suggests 14.7% growth from the figure reported in the prior-year quarter.

The consensus mark for quarterly earnings has moved up by a penny in the last 30 days to 23 cents per share. The consensus estimate for DBI suggests growth of 91.7% from the year-ago quarter’s levels.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance