What's in Store for Simon Property's (SPG) Q1 Earnings?

Simon Property Group SPG is scheduled to report first-quarter 2020 earnings on May 11, after the market closes. The company’s quarterly results will likely display declines in both revenues and funds from operations (FFO) per share.

In the last reported quarter, this Indianapolis, IN-based retail real estate investment trust (REIT) delivered a positive surprise of 0.34% in terms of FFO per share. Results reflected increase in leasing spread per square foot at the company’s U.S. malls and Premium Outlets.

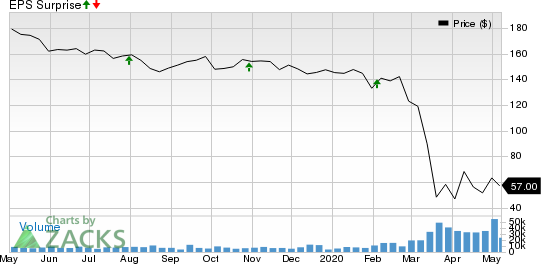

In addition, over the trailing four quarters, the company exceeded the Zacks Consensus Estimate on three occasions and met in the other, the average positive beat being 0.34%. This is depicted in the graph below:

Simon Property Group Inc Price and EPS Surprise

Simon Property Group Inc price-eps-surprise | Simon Property Group Inc Quote

Let’s see how things have shaped up for this announcement.

Factors at Play

Adoption of an omni-channel strategy and successful tie-ups with premium retailers has been a saving grace for Simon Property amid the retail apocalypse. The company has been focused on active restructuring of its portfolio, aiming at premium acquisitions and transformative redevelopments. It has been investing in billions for the past few years to transform its properties focused on creating value and drive footfall. The transformational plans include addition of hotels, restaurants, residences and luxury stores.

Additionally, the company has been undertaking strategic measures to help online retailers fortify their physical presence and its online retail platform, weaved with an omni-channel strategy, augurs well for growth.

During the first quarter, the company announced that it has agreed to acquire Taubman Centers TCO in a deal valued at $3.6 billion. Moreover, ABG, Simon Property and Brookfield Property Partners announced the acquisition of fast fashion retailer, Forever 21, which had filed for bankruptcy. The retail REIT also has a solid and improving balance sheet with ample liquidity. This trend is likely to have continued in the quarter under review as well.

Nevertheless, though the first quarter began on a positive note with a resilient economy and decent job-market strength, things got weary in the second half of the period thanks to the coronavirus pandemic.

Notably, the escalating number of coronavirus cases has forced several retailers to close stores. Some retailers have also reduced store hours, while many others are keeping their e-retail operations running as consumers are now increasingly opting for online purchases. As a result, retail REITs, which have already been battling store closure and bankruptcy issues, are feeling the brunt because consumers are avoiding gathering in large public spaces.

Simon Property, too, is not immune to move outs, store closures and retailer bankruptcies. The choppy retail real estate environment is likely to have curbed its growth momentum in the to-be-reported quarter to some extent, as secular industry headwinds keep dampening industry fundamentals.

Further, in an effort to reduce the spread of coronavirus in the company’s communities, on Mar 18, Simon Property decided to close all of its retail properties, including Malls, Premium Outlets and Mills in the United States till Mar 29.

Moreover, though the company has been striving to counter the challenging situation in the retail real estate market through various initiatives, implementation of such measures requires a decent upfront cost. Therefore, this is likely to have limited any robust growth in profit margins in the quarter to be reported.

The Zacks Consensus Estimate for first-quarter revenues is currently pinned at $1.41 billion, indicating a decrease of 3% year over year. Moreover, Simon Property’s activities during the January-March quarter were inadequate to gain analyst confidence. The Zacks Consensus Estimate for the FFO per share moved 2% south over the past two months and is currently pinned at $2.90. The figure also suggests a 4.6% decline from the year-ago quarter.

Here is what our quantitative model predicts:

Our proven model does not conclusively predict a positive surprise in terms of FFO per share for Simon Property this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Simon Property currently carries a Zacks Rank #4 (Sell) and has Earnings ESP of +0.23%.

Stocks That Warrant a Look

CBL Properties CBL, slated to release earnings results on May 18, has an Earnings ESP of +11.11% and currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

VEREIT, Inc. VER, set to report quarterly numbers on May 20, currently has an Earnings ESP of +5.15% and carries a Zacks Rank of 3.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Taubman Centers Inc (TCO) : Free Stock Analysis Report

Simon Property Group Inc (SPG) : Free Stock Analysis Report

CBL Associates Properties Inc (CBL) : Free Stock Analysis Report

VEREIT Inc (VER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance