What's in Store for These 5 Technology Stocks in Q1 Earnings?

Technology stocks are on the brink of revealing robust first-quarter results, which are expected to be up 19.4% from the same period last year on 8.3% higher revenues, per the latest Earnings Preview.

The explosion of artificial intelligence (AI) in both production processes and final products has created tremendous opportunities for the overall technology space. The surge in demand for generative AI chips, essential for large language models, continued to bolster semiconductor companies' performance.

Sales data from the Semiconductor Industry Association reflects this trend, with semiconductor sales showing strong year-over-year growth of 16.3% and 15.2%, respectively, in February and January.

Several key factors have contributed to the positive outlook for technology stocks. The widespread adoption of Machine Learning, Augmented Reality/Virtual Reality devices, quantum computing and cloud computing has bolstered the performances of tech companies. Moreover, the escalating need for data centers, propelled by the surge in cloud capacity to accommodate AI-related workloads, has provided a significant tailwind for the sector.

Technical advancements in Internet infrastructure and the rapid deployment of 5G technology on a global scale have further fueled optimism among investors. Additionally, the proliferation of IoT-supported industrial automation, coupled with increasing demand for smart electric appliances, wearables, electric vehicles and drones, has acted as a catalyst for the growth of technology companies.

Despite these promising trends, the technology sector faces challenges on the geopolitical front. Escalating tensions between the United States and China, coupled with restrictions on China technology exports, have weighed on chipmakers. The sector's growth trajectory has also been hindered by ongoing conflicts in the Middle East and between Russia and Ukraine. Macroeconomic challenges such as high inflation and unfavorable currency fluctuations have also posed concerns.

Despite these obstacles, an uptick in PC shipments and signs of recovery in memory spending, particularly in NAND and DRAM, have contributed positively to the sector's momentum. After two years of decline, the worldwide traditional PC market returned to growth during the first quarter of 2024, with 59.8 million shipments, up 1.5% year over year, according to preliminary results from the International Data Corporation Worldwide Quarterly Personal Computing Device Tracker.

Overall, total S&P 500 earnings are now expected to be up 3.6% from the same period last year on 3.9% higher revenues. This follows the 6.8% earnings growth on 3.9% higher revenues in the fourth quarter of 2023. The “Magnificent 7” Tech players (Apple, Meta Platforms, Alphabet, Microsoft [MSFT], Tesla, NVIDIA, and Amazon) are expected to bring in 32.9% more earnings relative to the same period last year on 12.8% higher revenues.

Insight Into Key Releases

Here we discuss five stocks in the Zacks Computer and Technology sector, namely, Intel INTC, Check Point Software Technologies CHKP, STMicroelectronics STM, Fair Isaac FICO and Microsoft, which are scheduled to release their quarterly earnings on Apr 25.

Per the Zacks model, a company needs to have the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today's Zacks #1 Rank stocks here.

Intel Corporation: This semiconductor company is likely to have generated higher revenues year over year, driven by healthy demand trends in Data Center and AI Group. The introduction of cutting-edge AI-based products is also likely to have boosted revenues from the Client Computing Group. In the to-be-reported-quarter, Intel collaborated with DigitalBridge Group, Inc. to launch an independent AI-based software firm dubbed Articul8 AI, Inc. These are likely to have generated incremental revenues in the first quarter. (Read more: Will Healthy Revenue Growth Aid Intel's Q1 Earnings?)

The Zacks Consensus Estimate for INTC’s first-quarter 2024 earnings per share is pegged at 13 cents per share, unchanged over the past 30 days. The Zacks Consensus Estimate for total revenues is pegged at $12.76 billion, suggesting 8.93% growth from the year-ago quarter.

The stock’s combination of a Zacks Rank #3 and an Earnings ESP of 0.00% makes surprise prediction difficult. The company’s earnings beat estimates in the trailing four quarters, the average surprise being 154.49%.

Intel Corporation Price and EPS Surprise

Intel Corporation price-eps-surprise | Intel Corporation Quote

Check Point Software: The company’s quarterly performance is likely to have benefited from increased security subscriptions due to the solid demand for its CloudGuard, Harmony, Sandblast Zero-day threat prevention and Infinity solutions. Increased demand for network security gateways to support higher capacities has been aiding the adoption of the company’s remote access VPN solutions. Check Point has teamed up with Microsoft to enhance its Infinity AI Copilot using the latter’s Azure OpenAI service. This collaboration represents a big step forward in applying AI to cybersecurity. However, elevated investments in sales and marketing efforts might have clipped margins during the quarter to be reported.

The Zacks Consensus Estimate for CHKP’s first-quarter 2024 earnings per share is pegged at $2.01 per share, unchanged over the past 30 days. For the March quarter, the Zacks Consensus Estimate for total revenues is pegged at $595.28 million, suggesting 5.1% growth from the year-ago quarter.

The stock’s combination of a Zacks Rank #3 and an Earnings ESP of 0.00% makes surprise prediction difficult. The company’s earnings outpaced estimates in the trailing four quarters, the average surprise being 4.06%.

Check Point Software Technologies Ltd. Price and EPS Surprise

Check Point Software Technologies Ltd. price-eps-surprise | Check Point Software Technologies Ltd. Quote

STMicroelectronics: Growing demand in the automotive product group across all geographies, driven by increasing semiconductor pervasion and structural transformation, is likely to have aided STM’s performance in the to-be-reported quarter. Strength in embedded processing solutions, owing to its expanding STM32 portfolio, growing customer engagement for edge AI deployment and AI algorithm integration to existing microcontroller unit offerings, is likely to have boosted STM’s performance in the quarter under review. However, increasing inventory correction is expected to have impacted its prospects in the industrial end-market negatively in the quarter under discussion. (Read More: What's in Store for STMicroelectronics in Q1 Earnings?)

The Zacks Consensus Estimate for STM’s first-quarter 2024 earnings is pegged at 59 cents per share, unchanged over the past 30 days. The Zacks Consensus Estimate for revenues is pegged at $3.6 billion, suggesting a decline of 15.16% from the year-ago quarter’s reported figure.

The company has an Earnings ESP of 0.00% and carries a Zacks Rank #4 (Sell). The company’s earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 8.98%.

STMicroelectronics N.V. Price and EPS Surprise

STMicroelectronics N.V. price-eps-surprise | STMicroelectronics N.V. Quote

Fair Isaac: The company is expected to have benefited from the strong adoption of the FICO Platform and FICO Score. Its growing clientele has been a key catalyst, driving top-line growth. FICO’s analytics and digital decision-making technology are helping its clients fight financial crime. Globally, banks are recognizing the potency of Fair Isaac’s offerings to combat financial crime. Fair Isaac’s focus on strengthening the effectiveness of the FICO platform has been noteworthy. The company is benefiting from the strong adoption of its FICO Scores. Expanding usage of FICO Score 10 and 10T holds promise. (Read more: What's in the Cards for Fair Isaac's Q2 Earnings?)

The Zacks Consensus Estimate for FICO’s second-quarter fiscal 2024 earnings is pegged at $5.8 per share, unchanged over the past 30 days. The Zacks Consensus Estimate for revenues is pegged at $425.94 million, suggesting an increase of 12% from the year-ago quarter’s reported figure.

The company has an Earnings ESP of 0.00% and carries a Zacks Rank #4. The company’s earnings outpaced estimates in one of the trailing four quarters and missed the mark thrice, the average negative surprise being 1.25%.

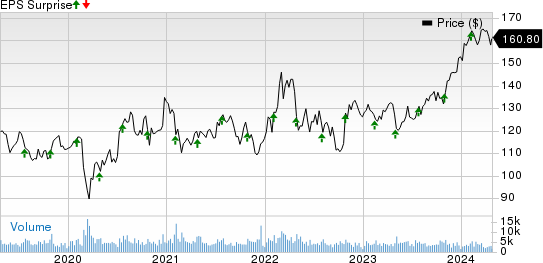

Fair Isaac Corporation Price and EPS Surprise

Fair Isaac Corporation price-eps-surprise | Fair Isaac Corporation Quote

Microsoft: Strength in Intelligent Cloud and Productivity and Business Processes, driven by growth in Azure, Office 365 suite and other cloud services, is expected to have aided top-line growth in the to-be-reported quarter. The strong adoption of Dynamics 365, MSFT's enterprise resource planning and customer relationship management platform, is also expected to have driven top-line growth. MSFT and OpenAI's shared commitment to building trustworthy and safe generative AI systems and products is a significant development in the AI space. Revenues from Windows are likely to have been driven by steady traction seen in Windows Commercial products and cloud services growth amid improving PC demand. (Read more: Assessing Your Microsoft Stake Ahead of Q3 Earnings)

The Zacks Consensus Estimate for MSFT’s third-quarter fiscal 2024 earnings has moved south by 1.1% to $2.81 per share over the past 30 days. The Zacks Consensus Estimate for revenues is pegged at $60.63 billion, indicating growth of 14.71% from the figure reported in the year-ago quarter.

The company has an Earnings ESP of -3.36% and it carries a Zacks Rank #4. Microsoft’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 8.82%.

Microsoft Corporation Price and EPS Surprise

Microsoft Corporation price-eps-surprise | Microsoft Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Check Point Software Technologies Ltd. (CHKP) : Free Stock Analysis Report

Fair Isaac Corporation (FICO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance