‘Remain vigilant’: Westpac warns of scam spike

Westpac will roll out new scam detection technology as it urges the community to remain on guard against a fresh spike in scams.

Also read: This quiz shows how likely you are to fall for a scam

Also read: Australians bleeding cash from this scam since Covid-19

The combination of Australians applying for JobKeeper and JobSeeker payments and tax time has seen scammers step up their attempts to steal vulnerable people’s money, Westpac’s chief customer engagement officer Ross Miller said.

“With lots of people spending time in isolation and applying for government support through initiatives like JobKeeper, all against the backdrop of tax time, it’s never been more important to be educated against those looking to take advantage,” Miller said.

“Not only for customers to protect themselves, but also those around them who might be more vulnerable like older family members.”

The average person loses $12,000 when they’re scammed, Miller said, adding that the emotional toll can be much higher than that.

New technology

He said Westpac has rolled out new technology that sends branch employees real-time alerts when payments are being processed. These alerts indicate if there is a suspicious transaction which can then be investigated immediately.

The technology provides real-time analysis through the bank’s fraud team to determine if the transaction is high-risk, and if it fails this test, the system will ask a series of questions designed to help the banker determine whether to pause or decline the transaction.

Miller said this won’t stop every loss but will help catch high risk transactions.

“We’re also using people power to bolster this technology, including further training for our frontline bankers to help with monitoring transactions and supporting customers if there is cause for concern.”

Scam literacy a problem

More than four in 10 Australians don’t know the difference between a scam or fraud, and that knowledge gap has worsened since 2019.

Most Australians (77 per cent) are concerned about scammers targeting themselves or family and friends, while 76 per cent also agree they could be better educated.

“While we’re taking every step that we can to protect our customers against scammers, Australians must remain vigilant and be mindful of offers that seem suspicious or too good to be true,” Miller said.

“While it can feel embarrassing to talk about, remember you are not alone. The latest ACCC Targeting Scams Report found Australians reported more than 353,000 scams last year with a loss of over $634 million.”

The most common scams include fake texts and emails from people posing as well known government groups and businesses like AusPost, dating and romance scams and scams where people are tricked into sharing details over the phone or through texts and emails.

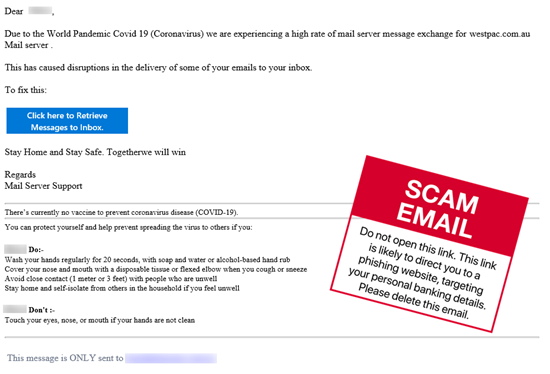

This scam asks victims to update their contact details, but takes them to a fake sign in page which will take their personal banking details.

This email scam makes victims believe that Westpac needs them to take action, but again contains a dangerous link asking them for personal information.

Westpac customers can contact 132 032 to seek assistance with a scam or to report suspicious activity or visit www.westpac.com.au/scams.

Yahoo Finance

Yahoo Finance